Answered step by step

Verified Expert Solution

Question

1 Approved Answer

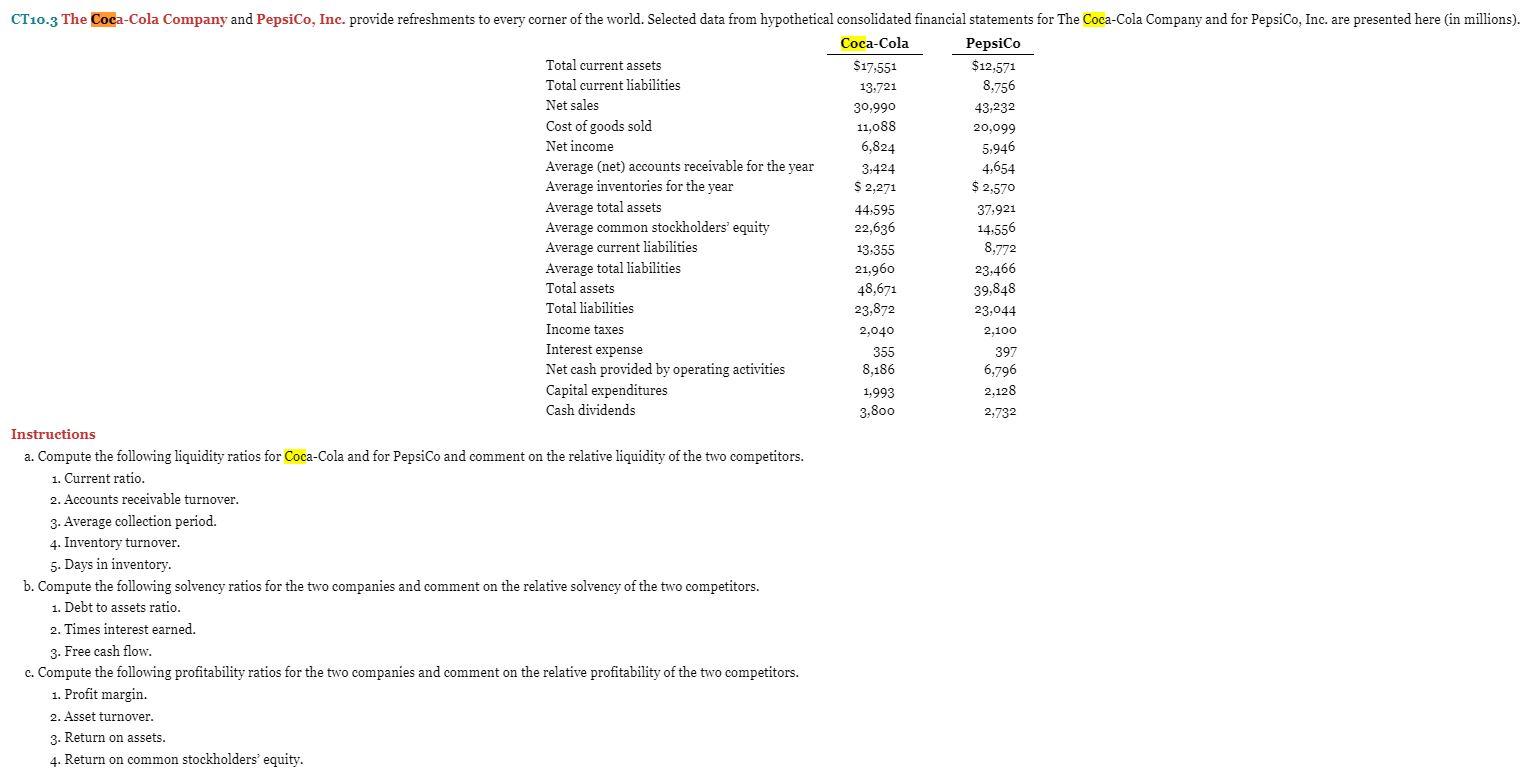

Based upon values, need recommendations on how companies can grow in the future. 8,772 39,848 CT10.3 The Coca-Cola Company and PepsiCo, Inc. provide refreshments to

Based upon values, need recommendations on how companies can grow in the future.

8,772 39,848 CT10.3 The Coca-Cola Company and PepsiCo, Inc. provide refreshments to every corner of the world. Selected data from hypothetical consolidated financial statements for The Coca-Cola Company and for PepsiCo, Inc. are presented here (in millions). Coca-Cola PepsiCo Total current assets $17.551 $12,571 Total current liabilities 13,721 8.756 Net sales 30,990 43,232 Cost of goods sold 11,088 20,099 Net income 6,824 5,946 Average (net) accounts receivable for the year 3,424 4.654 Average inventories for the year S 2,271 $ 2,570 Average total assets 44,595 37,921 Average common stockholders' equity 22,636 14,556 Average current liabilities 13,355 Average total liabilities 21,960 23,466 Total assets 48,671 Total liabilities 23,872 23,044 Income taxes 2,040 2,100 Interest expense 355 397 Net cash provided by operating activities 8,186 6,796 Capital expenditures 1,993 2,128 Cash dividends 3,800 2,732 Instructions a. Compute the following liquidity ratios for Coca-Cola and for PepsiCo and comment on the relative liquidity of the two competitors. 1. Current ratio. 2. Accounts receivable turnover. 3. Average collection period. 4. Inventory turnover. 5. Days in inventory. b. Compute the following solvency ratios for the two companies and comment on the relative solvency of the two competitors. 1. Debt to assets ratio. 2. Times interest earned. 3. Free cash flow. c. Compute the following profitability ratios for the two companies and comment on the relative profitability of the two competitors. 1. Profit margin. 2. Asset turnover. 3. Return on assets. 4. Return on common stockholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started