Answered step by step

Verified Expert Solution

Question

1 Approved Answer

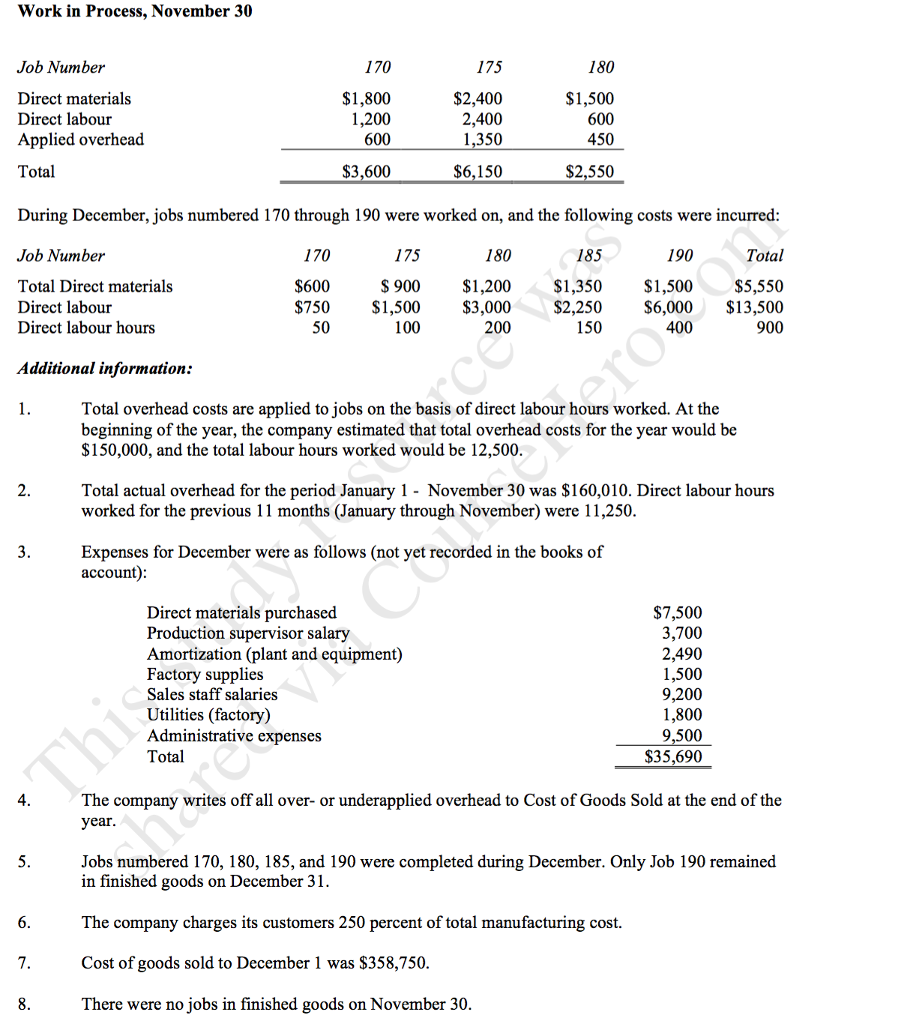

bases on this information calaculate the: a.predetermined overhead rate used to apply overhead to products b. the cost of ending work in process inventory c.

bases on this information calaculate the:

a.predetermined overhead rate used to apply overhead to products

b. the cost of ending work in process inventory

c. the cost of good manufactured in december

d. the unadjusted gross margin for december

Work in Process, November 30 170 175 180 Job Number Direct materials $1,800 $2,400 $1,500 Direct labour 1,200 2,400 600 Applied overhead 600 1,350 450 $3,600 $6,150 Total $2,550 During December, jobs numbered 170 through 190 were worked on, and the following costs were incurred: Total Job Number 170 180 185 190 Total Direct materials. $600 900 $1,200 $1,350 $1,500 $5,550 Direct labour $750 $1,500 $3,000 $2,250 $6,000 $13,500 Direct labour hours 50 100 200 150 400 9000 Additional information Total overhead costs are applied to jobs on the basis of direct labour hours worked. At the beginning of the year, the company estimated that total overhead costs for the year would be $150,000, and the total labour hours worked would be 12,500. Total actual overhead for the period January 1 November 30 was $160,010. Direct labour hours worked for the previous 11 months (January through November) were 11,250. Expenses for December were as follows (not yet recorded in the books of account) $7,500 Direct materials purchased Production supervisor salary 3,700 Amortization (plant and equipment) 2,490 Factory supplies 1,500 Sales staff salaries 9,200 Utilities (factory) 1,800 Administrative expenses 9,500 Total $35,690 The company writes off all over- or underapplied overhead to Cost of Goods Sold at the end of the year Jobs numbered 170, 180, 185, and 190 were completed during December. Only Job 190 remained in finished goods on December 31. The company charges its customers 250 percent of total manufacturing cost. Cost of goods sold to December 1 was $358,750. There were no jobs in finished goods on November 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started