Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Basic Math Functions: 16 SUM Function: 17 SLN Function: 18 19 19 Allow you to use the basic math symbols to perform mathematical functions. You

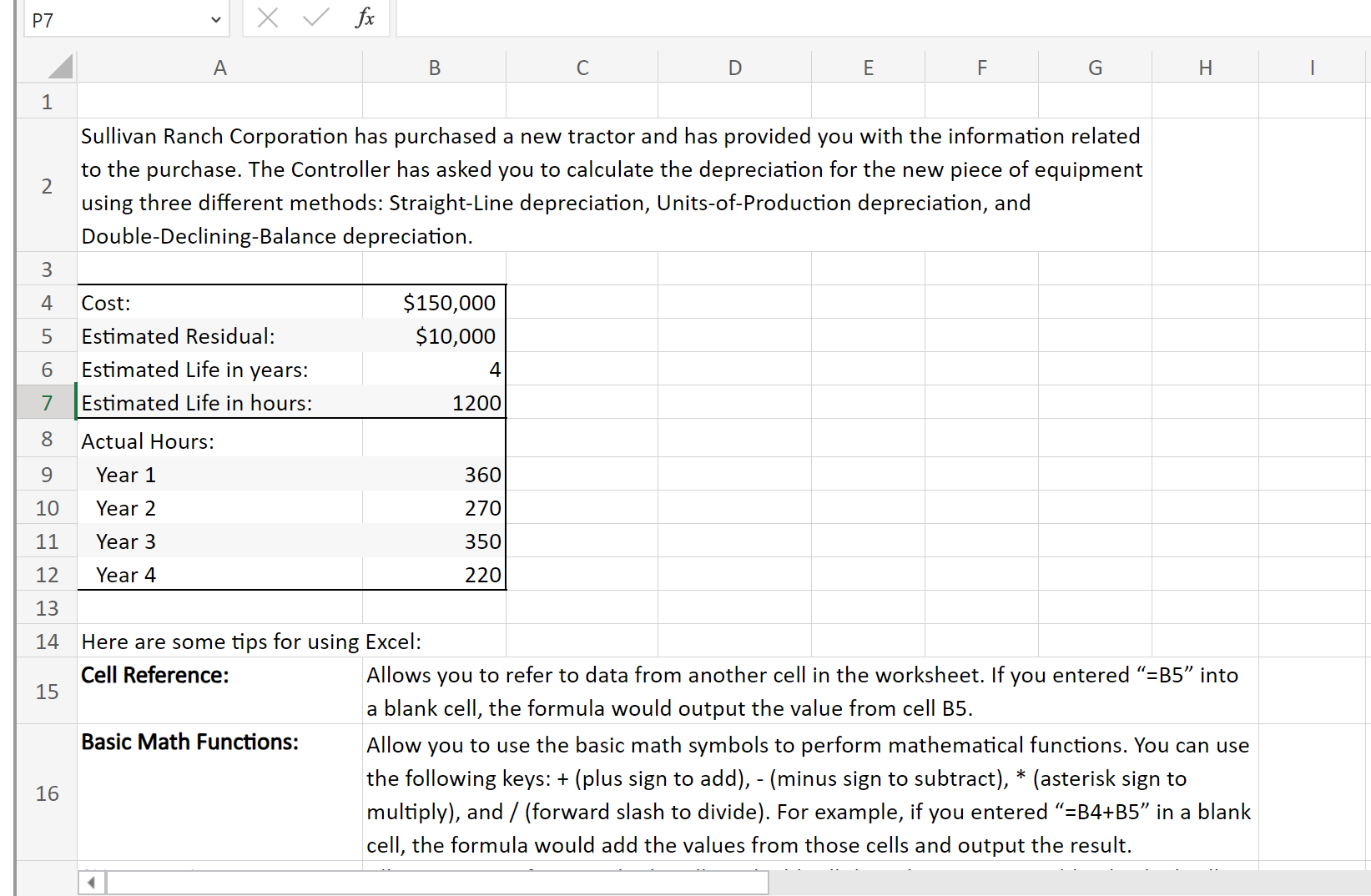

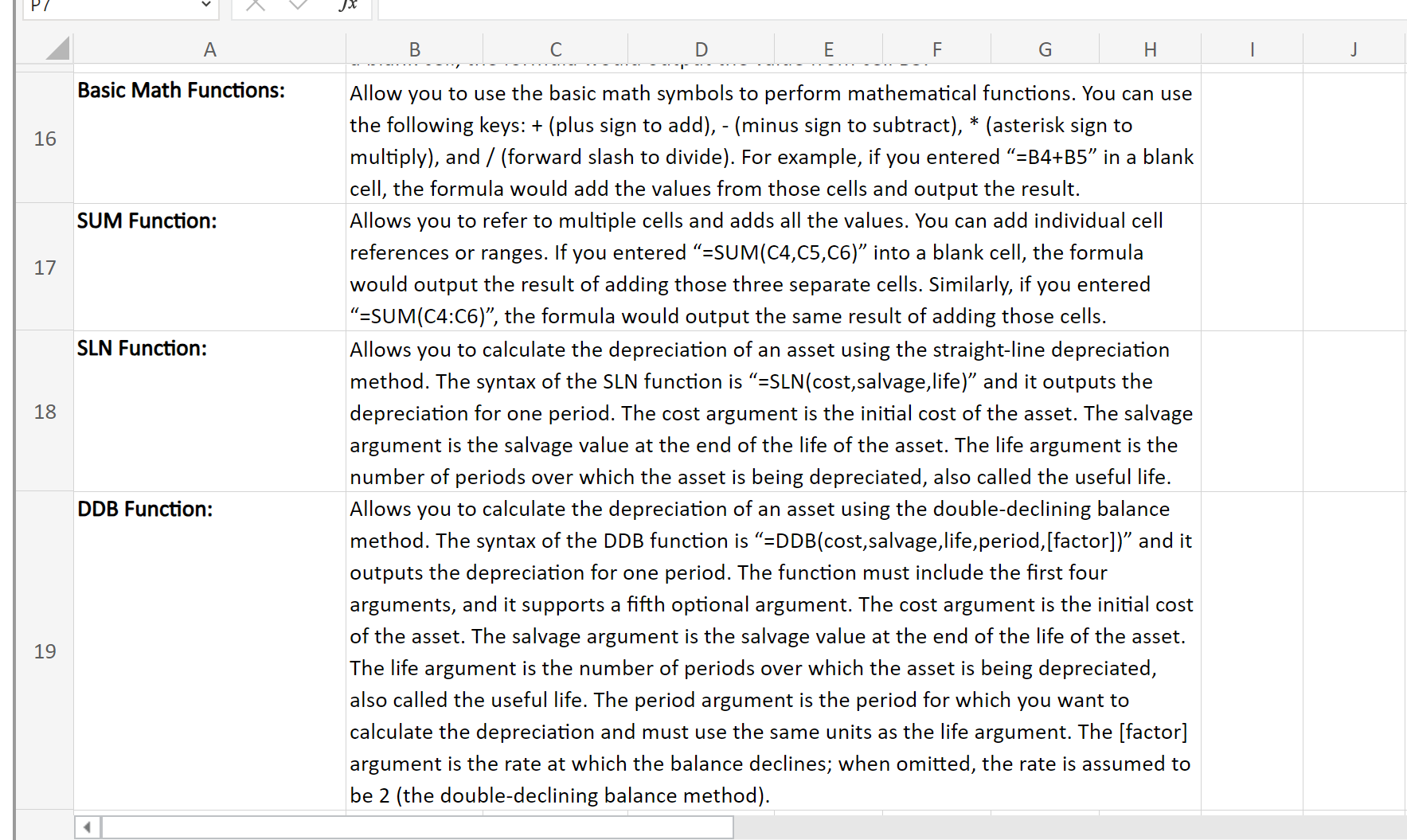

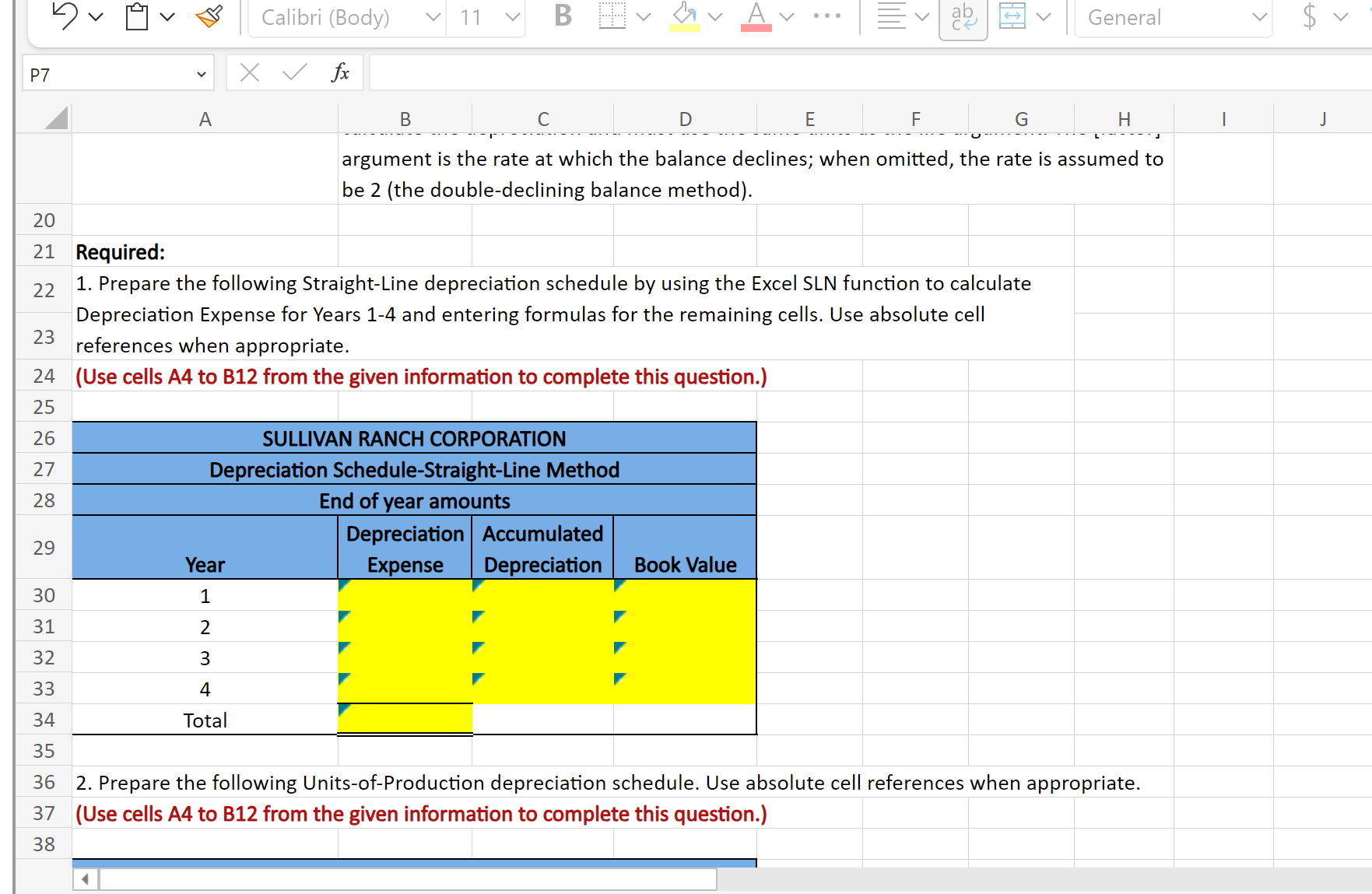

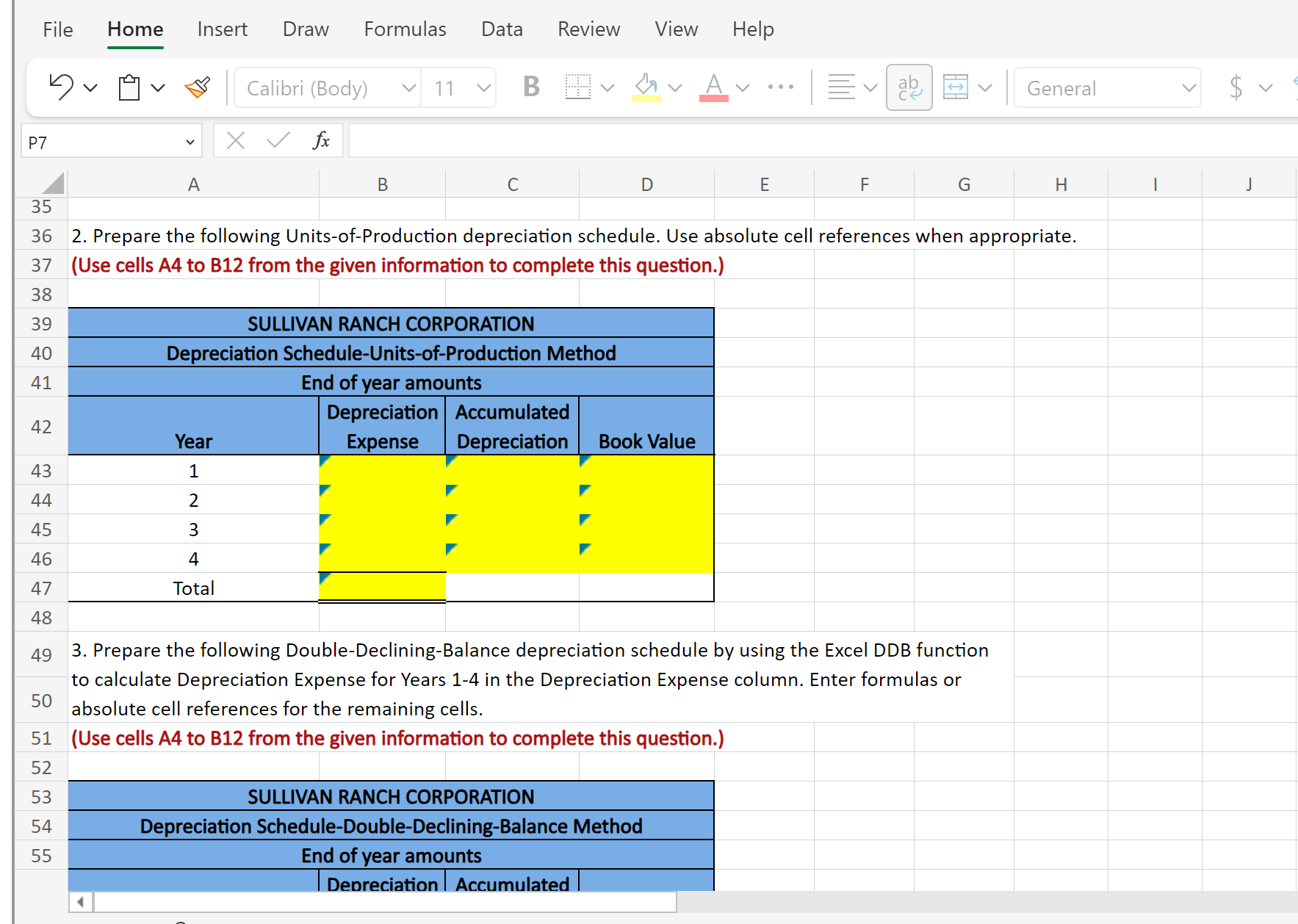

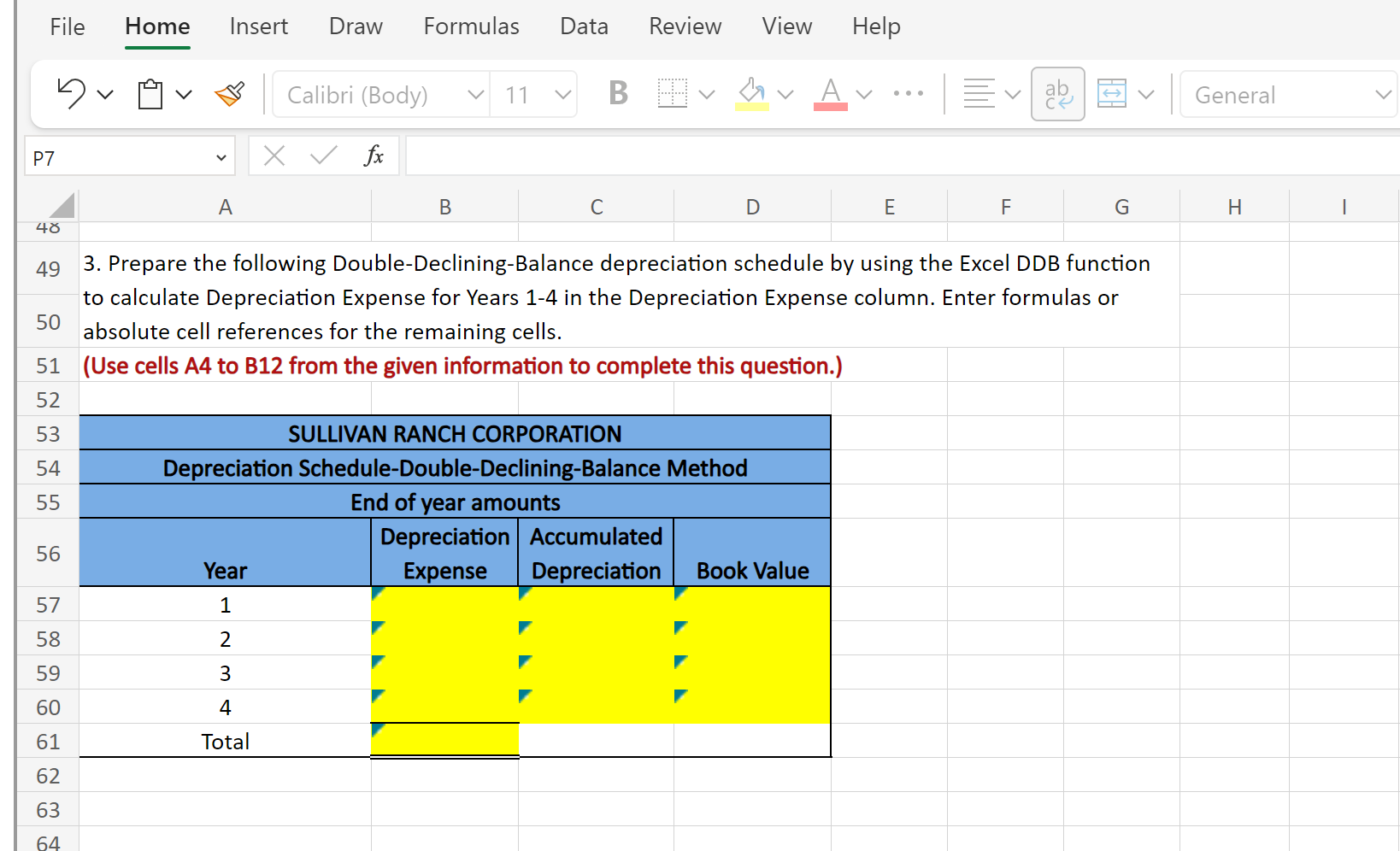

Basic Math Functions: 16 SUM Function: 17 SLN Function: 18 19 19 Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered "=B4+B5" in a blank cell, the formula would add the values from those cells and output the result. Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered " =SUM(C4,C5,C6) " into a blank cell, the formula would output the result of adding those three separate cells. Similarly, if you entered "=SUM(C4:C6)", the formula would output the same result of adding those cells. Allows you to calculate the depreciation of an asset using the straight-line depreciation method. The syntax of the SLN function is "=SLN(cost, salvage,life)" and it outputs the depreciation for one period. The cost argument is the initial cost of the asset. The salvage argument is the salvage value at the end of the life of the asset. The life argument is the number of periods over which the asset is being depreciated, also called the useful life. Allows you to calculate the depreciation of an asset using the double-declining balance method. The syntax of the DDB function is "=DDB(cost, salvage,life, period, [factor])" and it outputs the depreciation for one period. The function must include the first four arguments, and it supports a fifth optional argument. The cost argument is the initial cost of the asset. The salvage argument is the salvage value at the end of the life of the asset. The life argument is the number of periods over which the asset is being depreciated, also called the useful life. The period argument is the period for which you want to calculate the depreciation and must use the same units as the life argument. The [factor] argument is the rate at which the balance declines; when omitted, the rate is assumed to be 2 (the double-declining balance method). 1. Prepare the following Straight-Line depreciation schedule by using the Excel SLN function to calculate Depreciation Expense for Years 1-4 and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) 2. Prepare the following Units-of-Production depreciation schedule. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) 2. Prepare the following Units-of-Production depreciation schedule. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) 3. Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB function to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 3. Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB function to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. (Use cells A4 to B12 from the given information to complete this question.)

Basic Math Functions: 16 SUM Function: 17 SLN Function: 18 19 19 Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered "=B4+B5" in a blank cell, the formula would add the values from those cells and output the result. Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered " =SUM(C4,C5,C6) " into a blank cell, the formula would output the result of adding those three separate cells. Similarly, if you entered "=SUM(C4:C6)", the formula would output the same result of adding those cells. Allows you to calculate the depreciation of an asset using the straight-line depreciation method. The syntax of the SLN function is "=SLN(cost, salvage,life)" and it outputs the depreciation for one period. The cost argument is the initial cost of the asset. The salvage argument is the salvage value at the end of the life of the asset. The life argument is the number of periods over which the asset is being depreciated, also called the useful life. Allows you to calculate the depreciation of an asset using the double-declining balance method. The syntax of the DDB function is "=DDB(cost, salvage,life, period, [factor])" and it outputs the depreciation for one period. The function must include the first four arguments, and it supports a fifth optional argument. The cost argument is the initial cost of the asset. The salvage argument is the salvage value at the end of the life of the asset. The life argument is the number of periods over which the asset is being depreciated, also called the useful life. The period argument is the period for which you want to calculate the depreciation and must use the same units as the life argument. The [factor] argument is the rate at which the balance declines; when omitted, the rate is assumed to be 2 (the double-declining balance method). 1. Prepare the following Straight-Line depreciation schedule by using the Excel SLN function to calculate Depreciation Expense for Years 1-4 and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) 2. Prepare the following Units-of-Production depreciation schedule. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) 2. Prepare the following Units-of-Production depreciation schedule. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) 3. Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB function to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 3. Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB function to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. (Use cells A4 to B12 from the given information to complete this question.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started