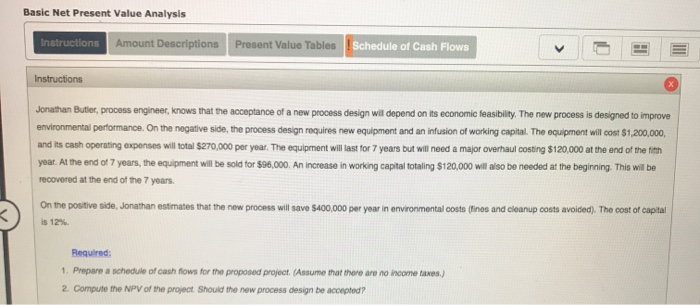

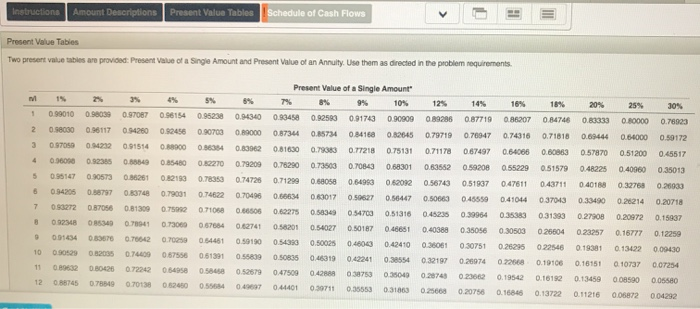

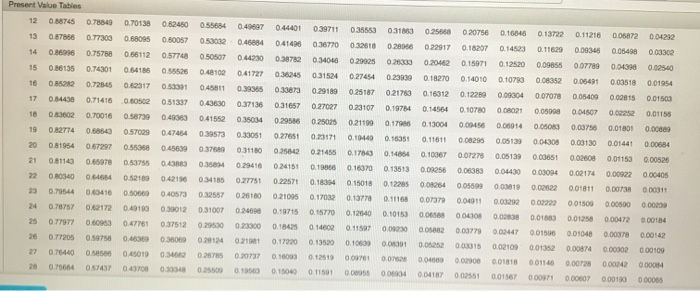

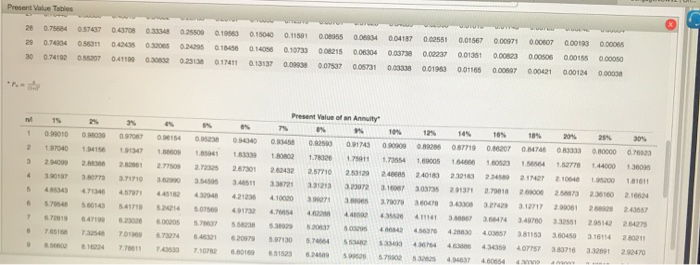

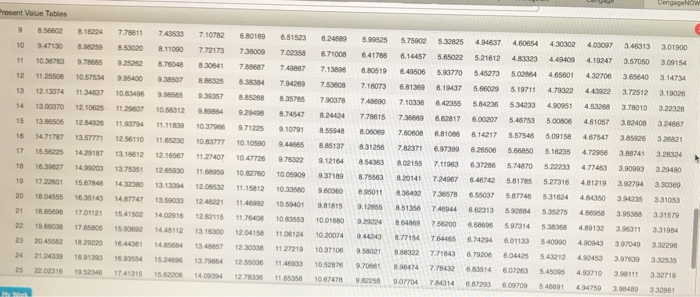

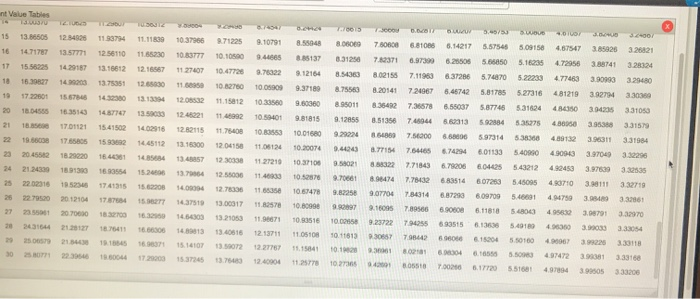

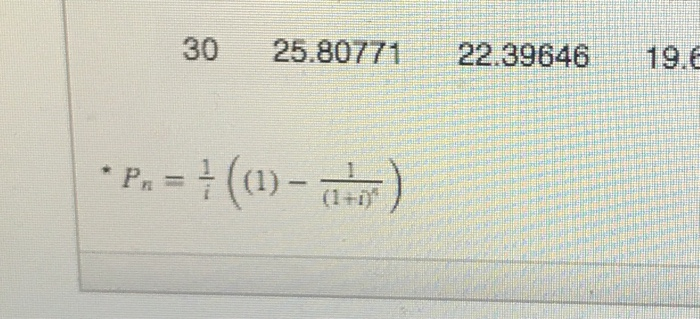

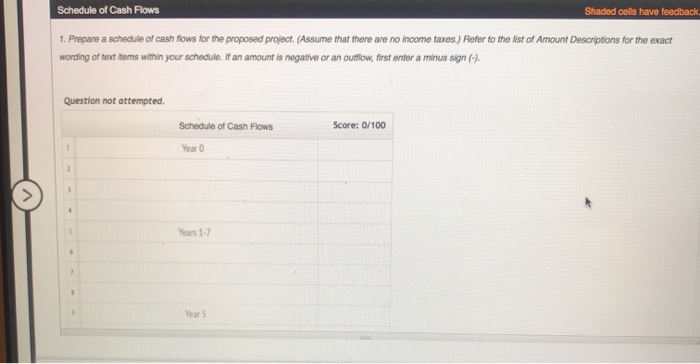

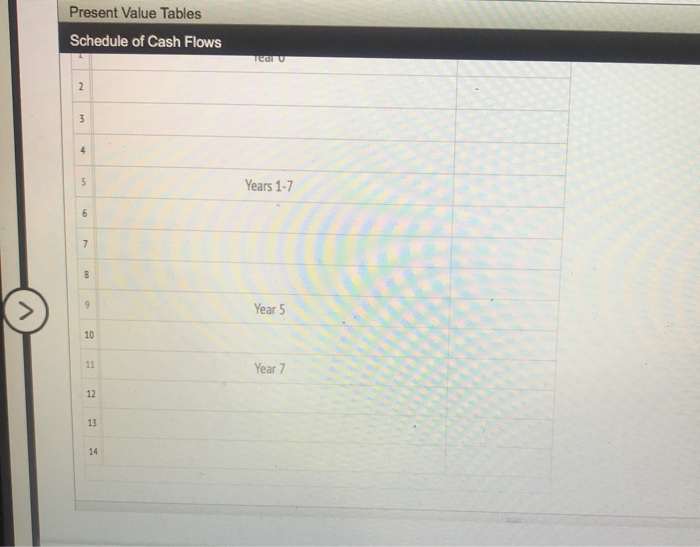

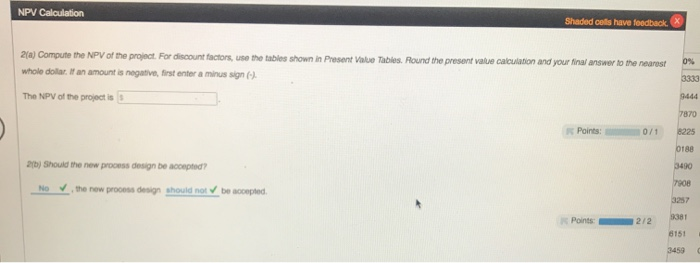

Basic Net Present Value Analysis Instructions Amount Descriptions Present Value Tables Schedule of Cash Flows Instructions Jonathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process is designed to improve environmental performance. On the negative side, the process design requires new equipment and an infusion of working capital. The equipment will cost $1,200,000, and its cash operating expenses will total $270,000 per year. The equipment will last for 7 years but will need a major overhaul costing $120,000 at the end of the fifth year. At the end of 7 years, the equipment will be sold for $96,000. An increase in working capital totaling $120,000 will also be needed at the beginning. This will be recovered at the end of the 7 years. On the positive side, Jonathan estimates that the new process will save $400,000 per year in environmental costs fines and cleanup costs avoided). The cost of capital Required: 1. Prepare a schedule of cash flows for the proposed project. Assume that there are no income taxes.) 2. Compute the NPV of the project should the new process design be accepted? Instructions Amount Descriptions en Refer to the list below for the exact wording of an amount description within your schedule. sibility. The new process ig capital. The equipment erhaul costing $120,000 also be needed at the beg Amount Descriptions Equipment Equipment operating costs Cost savings and cleanup costs avoidet Overhaul Recovery of working capital Salvage value Total Working capital Instructions Amount Descriptions Present Value Tables Schedule of Cash Flows Present Value Tables Two present value tables are provided: Present Value of a Single Amount and Present Value of an Annuity. Use them as directed in the problem requirements Present Value of a Single Amount 5 % % % % % 8% 9% 10% 12% 10% 10% 10% 20% 25% 30% 0901009803907087 096154 0.0528 1340033458 950 00100 30000 O MSORT719 016207 0 MT460 .83333 0.000 0.78923 08030 0.96117 04200 2456 ODOTU 0.000 0.8734 015734 0 M168 012645 0.79719 070047 0.74316 0.71818 0.69444 0.64000 0.59172 3 OSO O 22091514 0.000 0. 00 0.0002 0.81630 0.78383 0.77218 0.75131 0.71178 0.67497 0.64006 0.00363 0.57870 0.51200 0.45517 4 0.0600 0.92385 084 085430 0122700.79209 0.7820073503 0.70843 0.68301 0.83682 0.50208 0.552290.51579 0.48225 0.409600.35013 505147 00573 082133 0 0 7472507120968058 0.64993 0620120.56743 051907 0.47611 0.43711040158 0.32768 0.26833 50 7 0 1 2 070405 0 0017 050627 06 05 0455 041044 037043033490 0.26214 0.20718 7 2017056 0.813000 0 0.66505 0.0275 0834 0.54703 0.51316 0.45235 0.39954 0.35383 0.31393 027908 0.20972 015937 3 MB DASS D041 0730690676 0 2761 05201 0.54027 0.50187 046651 0.40388 035058 030503025804 0.23257 0.16777 0.12259 9 001434 083676 076420 7259 054461 050190 0543 0.50025 046043 0.42410 0.36061 0.30751 0.26296 022546019381 0.134.22 0.00430 10 09 082055 040 0.675560513010 0 SOBS 0.68319 02224 0 4 030197 20402268 0.19106016151 010737 07254 1 DS 722 09790090 0.38753 0.30 0.28743 0.23002 0.1056 0.16132 0.13459 000 005580 12 0 7701 0 00 00 055553 031 03566820756 0.16 0.137220 .11216 02004292 Prost Value Tables 12 0.66745 0.78849 0.70138 0.52450055614 0.49007 0.44401 0.39711 0.35553 0.313 0.20 0.20756 0.160460137220.11216 0.06872 0.04292 13 0.87866 0.77309 0.68095 0.50057 0.53032 0.46804041496 0.36770 0.32010020006 022917 0.162070.14523 0.11629 0.08346 0.05498 0.03302 14 0600 0.75788 0.5611205770805007 0442300372 0.34048 02900502633 0.2042 015071 0.12520 0.00055 0.077890.04398002540 15 0.86135 0.74301 0.64186056526 0.481020.41727 0.36245 0.315244 0.27454 0.23039 0.18270 0.14010 0.10790 0.00352 0.06491 0.03518 0.01954 16 0152072545 0.62317 058301045811 03 0387302911 025187 02173 01691201228002304 07078 0.0540900215 0.01509 17 0.14438 0.71416 0.0502051397 0.43630 0.37136 0.31657 0.27027 028107 0.19784 0.14564 0.10780008021 0.00098 0.04507 0.00252 0.01155 18 083602 070016 0587390.4933 0.415520.350340295 025035 021109 0.19 0.13004009458 08014 00 00180 000 190.2774 0.68643 0.570290.47454 0.39573 0.33051 0.27051 0.23171 0.10400.16351 0.11611 0.00205 0.05139 0.04308 0.00130 0.01441 0.00684 20 0.81954 067297 0.55068 0.45639 03760 031180020 021435 0.1786 0.140040.10067 0.07278 0.05139 0.0005 0.02608001159 000528 21 081143 0.05078 0.537550 S 004 02416 0.26151 0.19006 0.1637 0213513 0.00256 0. 0 0 044 0 03004 0.02174 0.00022 0.00405 22 0.03406461 052100 0.42136 034185 027751 0.22571 0.10 0.15018 0.125 0.0254 00589 0.0019 0.002 00181 00738 000311 23 065416 05 040573 57 025180021005 0.17032 13778 0.1116 003 004 0222 0015 050 000239 0.15770 0.12040 0.10153 0 0. 0 0.00472 00184 11 000 007 000142 24 078757 25 77977 25 77205 27 076400 02172 0.10 0.39012 0.1007 0.2498 019715 0.0093 0.4771 37512 0295 020 018425 0 0 0 3069 021240100 0.17220 0.450190 0257 020737 016003 0 0 150 04308 0.02838 0.01 0.01258 000 001 01048 05 0.02109 0.01352000874 0.018180116 00028 0 0.13520 0.1009 0. 001 0.125100 0.00 0. 0 0. 0 0 0 BOP000109 000 000054 2 115 0 0 0 0 0 0 0000 0 0000 Present Value Tables 28 0.75684 0.57437 0.43708 0.33348025500010563 0.15040 0.11501 0.00065 0.06034 0.04187 29 0.74904 05601 0.00 0 32065 0. 2 0.18450 0.14058 0.10733 008215006304 003739 30 0.7492052070411090.30002020159017411 0.131370.0008 0.07537 0.05731 0.33 0.09551 0.01567 0.00971 0.00607 0.00193 0.00065 0.00237 00135 00023 0.00506 0.0015500000 0.0196001165 0.00007000421000124 0.00038 10010 7040 2 039 0907 0 34156 047 1.000 2.7709 3 10 3.6 4 10 5 104 S Present Value of an Annuity 104 12 14 18% 10% 20% 29 8 0.040 058 050 091743 090909089288 08779 01207 0.7680 3300 0000000023 1.05041 75011 17:54 180005 1 1.603 78 44000 36036 2725 267301 20129 240 24130 2:13 2 10640 0 0 6161 3.500 3.46511 2302310303735 2013 2018 2680062 2160 216 379 380 330 3 31271 2001 2 2 1 732 4111 35 36 34700332561 2061422275 3 5 .5 563 423 0387 381153 3.50450 316114 28021 20879 5.97130 571 30 4164 4 4 34859 07757 378 3. 260470 79 8016 50 4 4 0654 104 560143 5.41 S14 S 800205 76517 77 1 77 78 sont Value Tables 9 660 1624 7.78811 7.4353 7.10782 6.80100 8.515238 .2460 5.2525 S 75002 532825404637 4.60654 4.30302 4.03097 3.46313 3.01900 10 9.47130 6 250 772173 73000 7.00358 871008 8.41756 14457 565022 521512 000 290 4.19247 357050 3.69154 11 10 673 97585 925252 3750 8.30541 7.49087 6.80519 40506 533770 5.45273 5.02854 4.65801 432700 365640 3.1473 191T 56802919711 4.40922 3.72512 3.19026 453258 3.78010322328 710335 6.42355 5.34235 5.34233 490951 3666966817 800207 54674350008 82 4.61057 MB 324867 614217 5.57545 5.0915 467547 385925 3.26821 12 11.25508 10.57534 9.95400 9.38507 8.885 7.29 753608 716073 13 12 1174 11 437 10 53405 8.3575 700378 14 13.008701210625 11.29807 10.5812 8.74547 15 13.165051234823 11 9794 10791 16 14 717 13 577 256110 11.85230 10 BTT 10.105004 S 885137 17 15 22 1429187 13.16612 12. 165671127407 1047721 2 12164 18 10 37 12650 111510 1005009 93718.75563 191722601 15.678461432380 1813394120852 11.1581210 9 60060 0801 2005 613 4 3 120822 11 10 0 8 1 21 18.500 170112115.415021402916122115 11.76408 10.053 10 160 M2 22168038 17 15 12 13 16 12.048 11 06124 1020014 23 20.455821821220 16.666145613. 45 2.303381127219 10.3710858021 24 21.243391801330 1603554 15 246 13 7 12 55000 71.46033 10 52876 25 2016 2015 2014 2 11 06 058 8.87399628506 .6650516235 4.72956 388741 328324 7.1196337236 S1470 23 309 329490 8.20141724067 .46742 5.81785 5.27316 481219 32794330369 42 858037 587748 531624 OO 34235 331053 51356 740044 .62313582884535275 498 395388 3.31579 609 56200 660606 07314 383684.00132 3311 3.31984 54 S 01133 0 990 410943 397049 332295 322 771843 67020880425 54321242453 3976393.32535 374 77 3 545095 40710 39111332719 74 754314 887233 00700 46001 M 3.489 332861 Value Tables BORD 706 1086 5.142175.57545 5.09158 4.67547 35825 32621 1 7371 673 0.9730 82506 .2306 5.66450 5.16295 4.72956 388741 32 853 8.62155 7.11963 6.3726 5.76370 522233 477483 390 32900 875563 20141 7 67 5.667425.81705 27316 481219392733 8.95011835492 7 78 8.55037 5.87746531624 4 3 331053 212855 351358 74 39 3 33159 5 13.50 12.345 1.38794 11 19 10 37866 271225 16 14.71787 13.57771 12.56110 1185230 10 TTT 10.100 BA5137 17 15562251429187 13.16612 1218557 112T 1047720 2002 18 16 14 375351 100 100 9.37180 10 17200 1 14.2580 1813394120832 11 1012 10 3500 .60360 2018. 1635163 47 3.5012021 102 10 401 981815 0 54150218 2015 1 0 10.01580 22 19 1780 15882 14.451121316300 12 041581100124 10.20074 23 20.4512182020 164 13 12 1127210 10 31100 34 210 5 4 25 226251 1852 1741515 15.6.2008 2 1 1.63358 1067478 327900 20 12104 177 5 14 13 00017 158 10 9 2 1889 7.000 5.00 5.97314 538368460132 3.6311 67420601133540000 400003 304 3.31984 30296 8.045 543212 4453 396 394 807253 5.45095 40 3 111 3.32719 7.34914 6.872306.097095.48691 4.94759 3.0 3326 5.B 11818 0 4 3 91 397 201641 641 666305 13 13 0616 7 55 8.93515 6.13535 5.431394 39000 333054 12.137111105108 6.9600 815204 .100 4107 32 330118 277 11.15841 2 021 0 55 72 393 200418 017713 25 21 11 67 15 17 3 2 30 25.80771 22.39646 19. * P. = + ((1) - cor) Schedule of Cash Flows Shaded colls have feedback 1. Prepare a schedule of cash flows for the proposed project. (Assume that there are no income taxes) Refer to the list of Amount Descriptions for the exact wording of text toms within your schedule an amount is negative or an outflow, first enter a minus sign (-). Question not attempted. Score: 0/100 Schedule of Cash Flows Year 0 Wears Present Value Tables Schedule of Cash Flows NPV Calculation Shaded calls have feedback. X 2(a) Compute the NPV of the project. For discount factors, use the tables shown in Present Value Tables Round the present value calculation and your final answer to the nearest whole dolar. If an amount is negative, first enter a minus sign The NPV of the project is Points: 0/1 2 Should the new process design become No the new process design should not be accepted Points