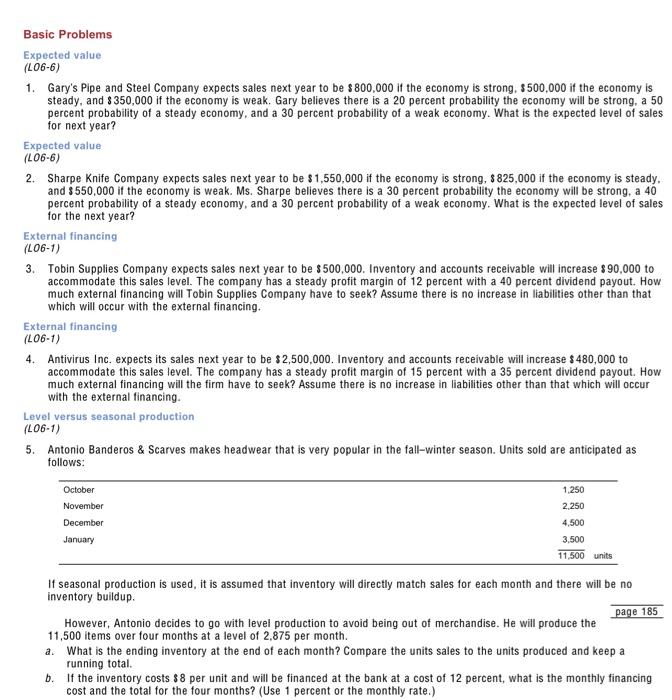

Basic Problems Expected value (L06-6) 1. Gary's Pipe and Steel Company expects sales next year to be $800,000 if the economy is strong, $500,000 if the economy is steady, and $350,000 if the economy is weak. Gary believes there is a 20 percent probability the economy will be strong, a 50 percent probability of a steady economy, and a 30 percent probability of a weak economy. What is the expected level of sales for next year? Expected value (L06-6) 2. Sharpe Knife Company expects sales next year to be $1,550,000 if the economy is strong, $ 825,000 if the economy is steady, and $550,000 if the economy is weak. Ms. Sharpe believes there is a 30 percent probability the economy will be strong, a 40 percent probability of a steady economy, and a 30 percent probability of a weak economy. What is the expected level of sales for the next year? External financing (L06-1) 3. Tobin Supplies Company expects sales next year to be $500,000. Inventory and accounts receivable will increase $90,000 to accommodate this sales level. The company has a steady profit margin of 12 percent with a 40 percent dividend payout. How much external financing will Tobin Supplies Company have to seek? Assume there is no increase in liabilities other than that which will occur with the external financing. External financing (L06-1) 4. Antivirus Inc. expects its sales next year to be $2,500,000. Inventory and accounts receivable will increase $ 480,000 to accommodate this sales level. The company has a steady profit margin of 15 percent with a 35 percent dividend payout. How much external financing will the firm have to seek? Assume there is no increase in liabilities other than that which will occur with the external financing. Level versus seasonal production (L06-1) 5. Antonio Banderos & Scarves makes headwear that is very popular in the fall-winter season. Units sold are anticipated as follows: 1.250 2.250 October November December January 4,500 3.500 11,500 units If seasonal production is used, it is assumed that inventory will directly match sales for each month and there will be no inventory buildup. However, Antonio decides to go with level production to avoid being out of merchandise. He will produce the page 185 11,500 items over four months at a level of 2,875 per month. What is the ending inventory at the end of each month? Compare the units sales to the units produced and keep a running total. b. If the inventory costs $8 per unit and will be financed at the bank at a cost of 12 percent, what is the monthly financing cost and the total for the four months? (Use 1 percent or the monthly rate.)