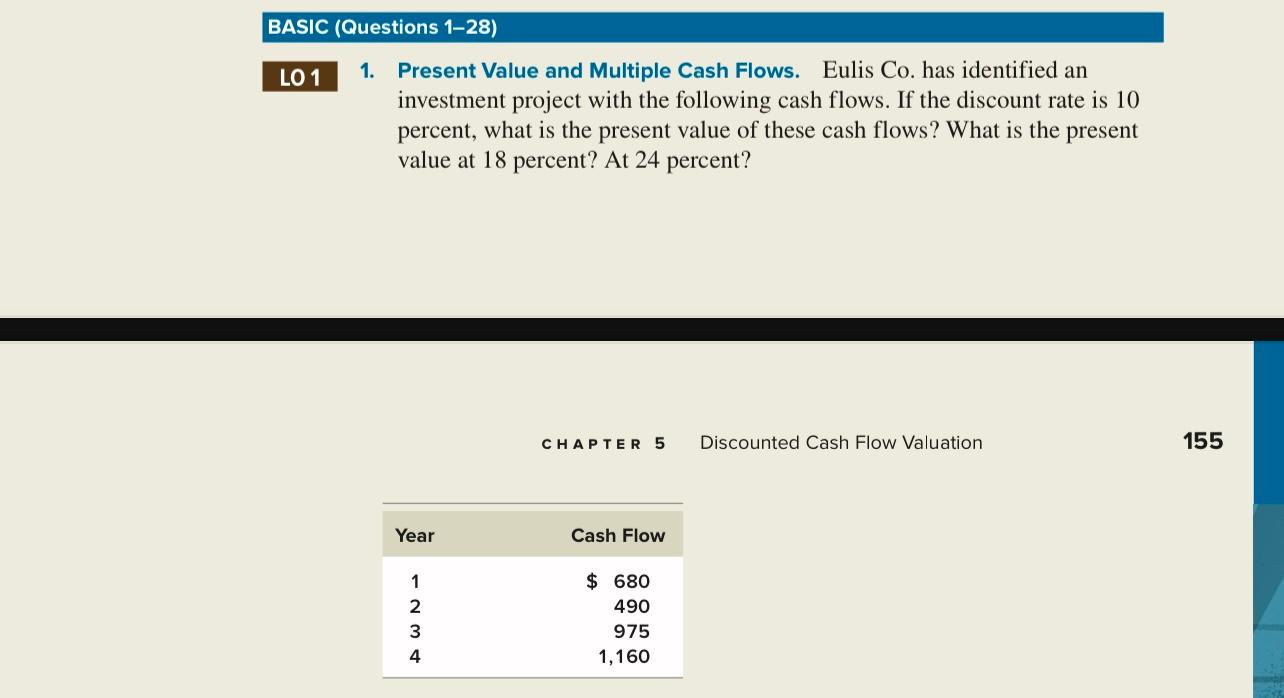

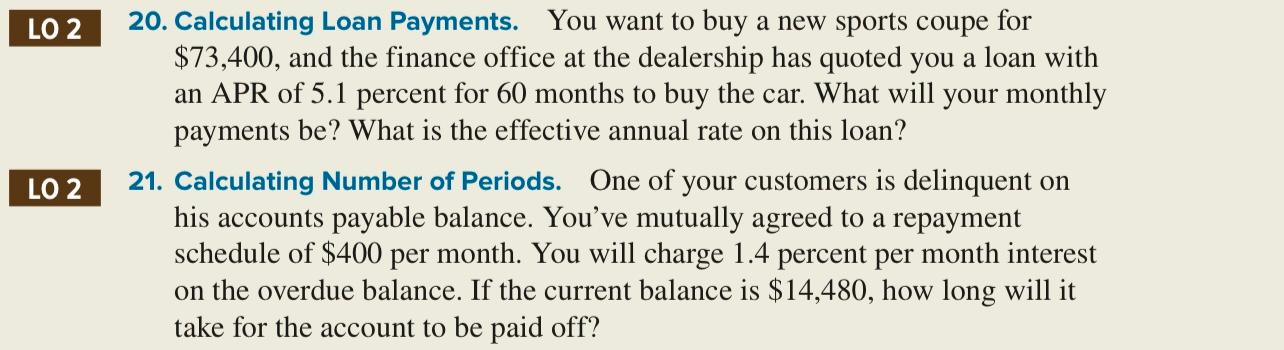

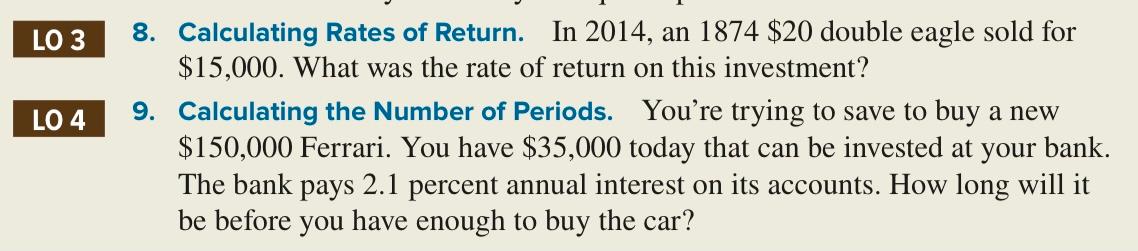

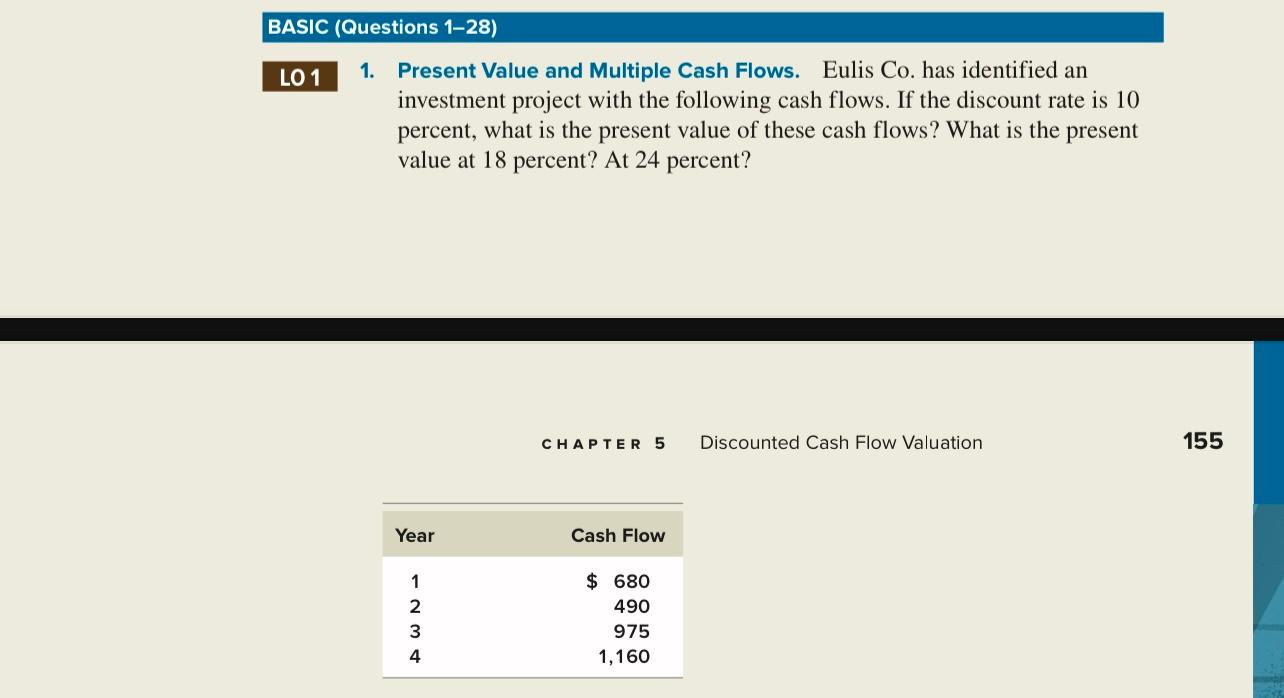

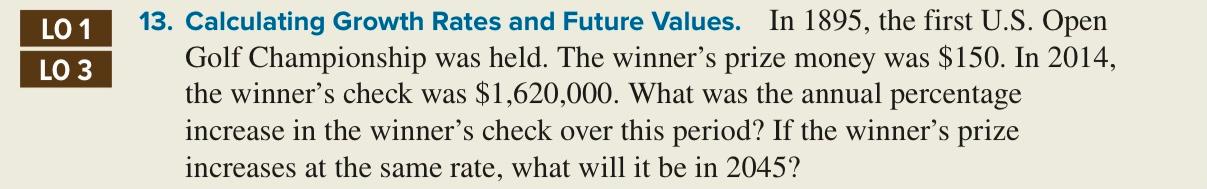

BASIC (Questions 1-28) LO1 1. Present Value and Multiple Cash Flows. Eulis Co. has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? What is the present value at 18 percent? At 24 percent? CHAPTER 5 Discounted Cash Flow Valuation 155 Year Cash Flow 1 $ 680 490 AWN- 975 1,160 LO 1 LO 3 13. Calculating Growth Rates and Future Values. In 1895, the first U.S. Open Golf Championship was held. The winner's prize money was $150. In 2014, the winner's check was $1,620,000. What was the annual percentage increase in the winner's check over this period? If the winner's prize increases at the same rate, what will it be in 2045? LO 1 9. Calculating Annuity Values. If you deposit $5,000 at the end of each year for the next 20 years into an account paying 9.6 percent interest, how much money will you have in the account in 20 years? How much will you have if you make deposits for 40 years? LO 2 11. Calculating Present Values. You have just received notification that you have won the $1 million first prize in the Centennial Lottery. However, the prize will be awarded on your 100th birthday (assuming you're around to collect), 80 years from now. What is the present value of your windfall if the appropriate discount rate is 7.25 percent? LO 2 20. Calculating Loan Payments. You want to buy a new sports coupe for $73,400, and the finance office at the dealership has quoted you a loan with an APR of 5.1 percent for 60 months to buy the car. What will your monthly payments be? What is the effective annual rate on this loan? LO 2 21. Calculating Number of Periods. One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $400 per month. You will charge 1.4 percent per month interest on the overdue balance. If the current balance is $14,480, how long will it take for the account to be paid off? LO 3 LO 4 8. Calculating Rates of Return. In 2014, an 1874 $20 double eagle sold for $15,000. What was the rate of return on this investment? 9. Calculating the Number of Periods. You're trying to save to buy a new $150,000 Ferrari. You have $35,000 today that can be invested at your bank. The bank pays 2.1 percent annual interest on its accounts. How long will it be before you have enough to buy the car