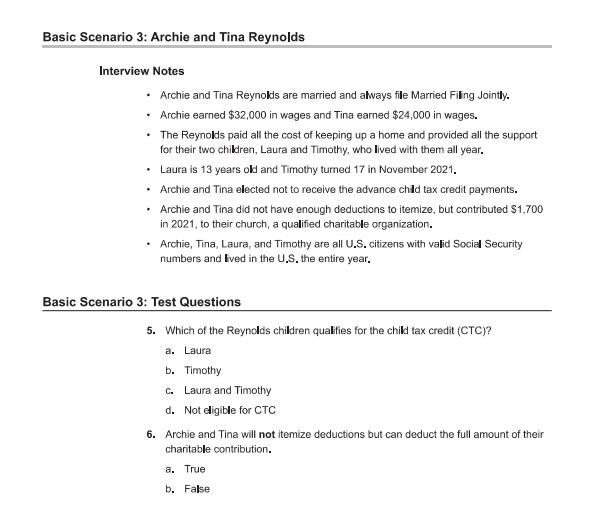

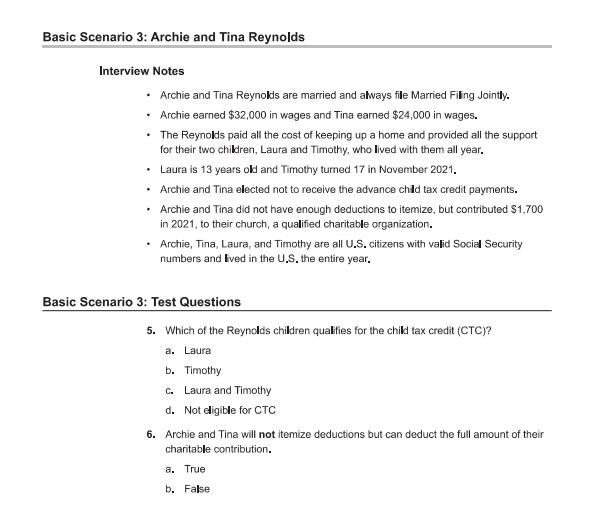

Basic Scenario 3: Archie and Tina Reynolds Interview Notes Archie and Tina Reynolds are married and always file Married Filing Jointly. Archie earned $32,000 in wages and Tina earned $24,000 in wages. The Reynolds paid all the cost of keeping up a home and provided all the support for their two children, Laura and Timothy, who lived with them all year. Laura is 13 years old and Timothy turned 17 in November 2021. Archie and Tina elected not to receive the advance child tax credit payments. Archie and Tina did not have enough deductions to itemize, but contributed $1,700 in 2021, to their church, a qualified charitable organization. Archie, Tina, Laura, and Timothy are all U.S. citizens with valid Social Security numbers and lived in the U.S. the entire year. Basic Scenario 3: Test Questions 5. Which of the Reynolds children qualifies for the child tax credit (CTC)? a. Laura b. Timothy C. Laura and Timothy d. Not eligible for CTC 6. Archie and Tina will not itemize deductions but can deduct the full amount of their charitable contribution. a. True b. False Basic Scenario 3: Archie and Tina Reynolds Interview Notes Archie and Tina Reynolds are married and always file Married Filing Jointly. Archie earned $32,000 in wages and Tina earned $24,000 in wages. The Reynolds paid all the cost of keeping up a home and provided all the support for their two children, Laura and Timothy, who lived with them all year. Laura is 13 years old and Timothy turned 17 in November 2021. Archie and Tina elected not to receive the advance child tax credit payments. Archie and Tina did not have enough deductions to itemize, but contributed $1,700 in 2021, to their church, a qualified charitable organization. Archie, Tina, Laura, and Timothy are all U.S. citizens with valid Social Security numbers and lived in the U.S. the entire year. Basic Scenario 3: Test Questions 5. Which of the Reynolds children qualifies for the child tax credit (CTC)? a. Laura b. Timothy C. Laura and Timothy d. Not eligible for CTC 6. Archie and Tina will not itemize deductions but can deduct the full amount of their charitable contribution. a. True b. False