Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 April 20X7 Pigeon entered into a five-year lease agreement for a machine with an estimated life of 7 years. Which of the

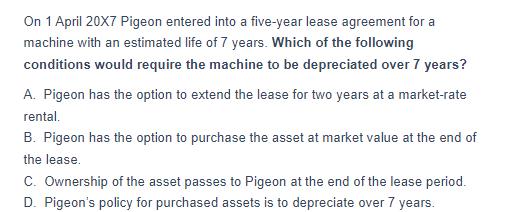

On 1 April 20X7 Pigeon entered into a five-year lease agreement for a machine with an estimated life of 7 years. Which of the following conditions would require the machine to be depreciated over 7 years? A. Pigeon has the option to extend the lease for two years at a market-rate rental. B. Pigeon has the option to purchase the asset at market value at the end of the lease. C. Ownership of the asset passes to Pigeon at the end of the lease period. D. Pigeon's policy for purchased assets is to depreciate over 7 years.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

C Ownership of the asset passes to Pigeon at the end of the lease period Explanation The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started