Answered step by step

Verified Expert Solution

Question

1 Approved Answer

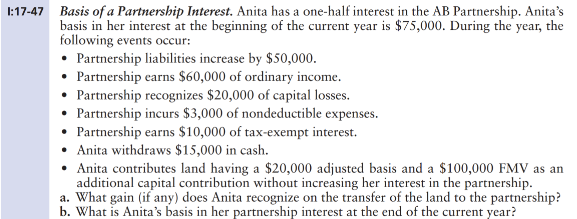

Basis of a Partnership Interest. Anita has a one-half interest in the AB Partnership. Anita's basis in her interest at the beginning of the current

Basis of a Partnership Interest. Anita has a one-half interest in the AB Partnership. Anita's basis in her interest at the beginning of the current year is $75,000. During the year, the following events occur: - Partnership liabilities increase by $50,000. - Partnership earns $60,000 of ordinary income. - Partnership recognizes $20,000 of capital losses. - Partnership incurs $3,000 of nondeductible expenses. - Partnership earns $10,000 of tax-exempt interest. - Anita withdraws $15,000 in cash. - Anita contributes land having a $20,000 adjusted basis and a $100,000 FMV as an additional capital contribution without increasing her interest in the partnership. a. What gain (if any) does Anita recognize on the transfer of the land to the partnership? b. What is Anita's basis in her partnership interest at the end of the current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started