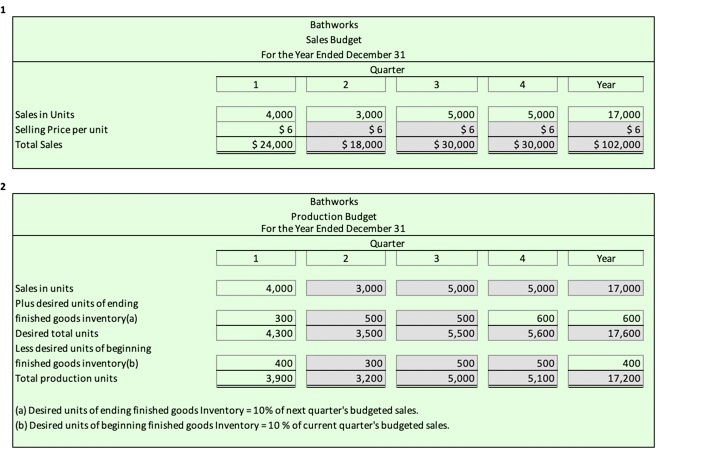

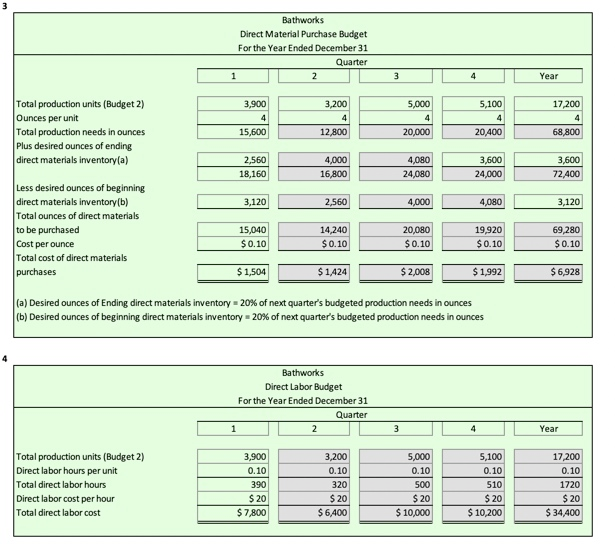

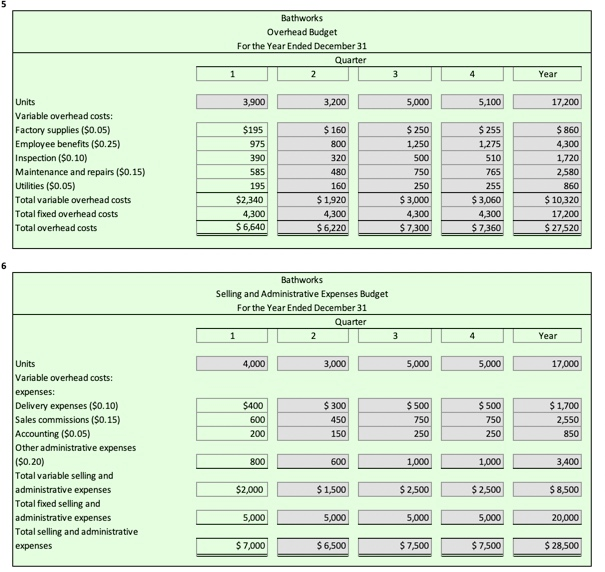

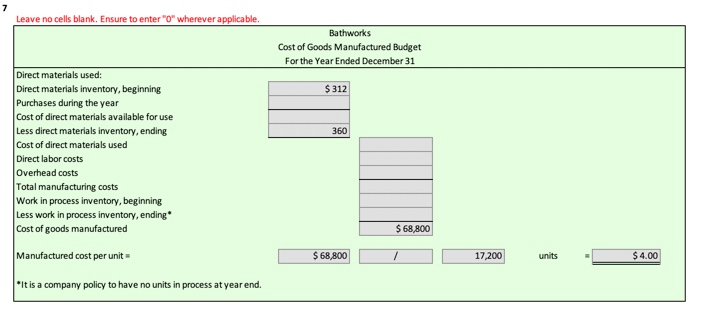

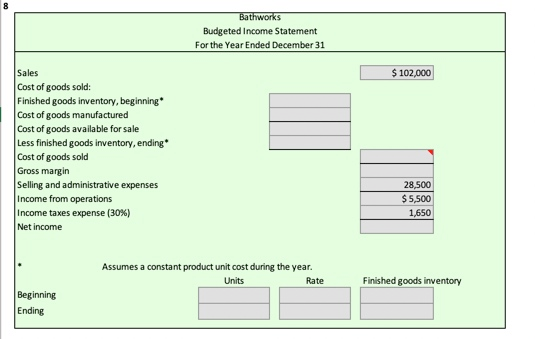

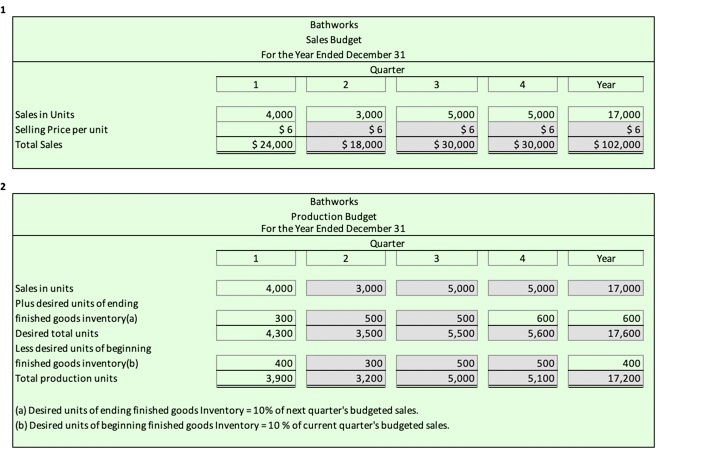

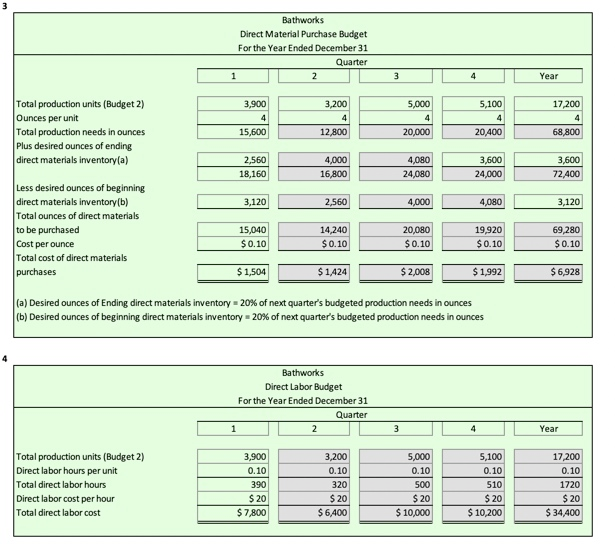

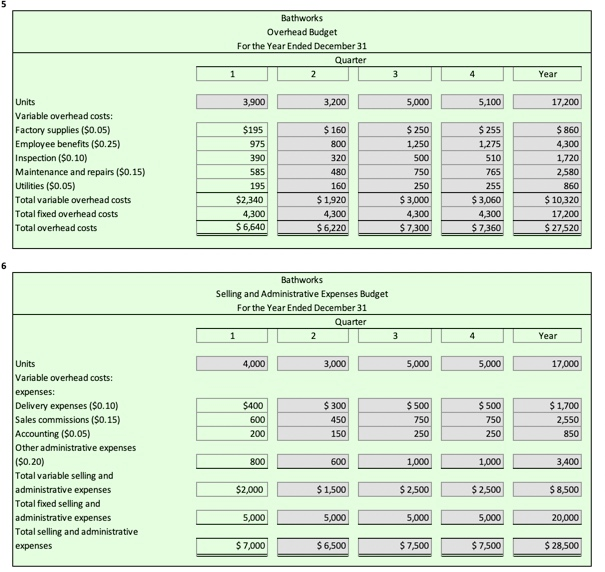

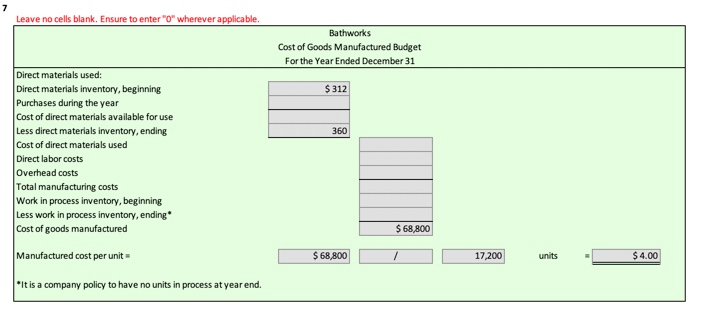

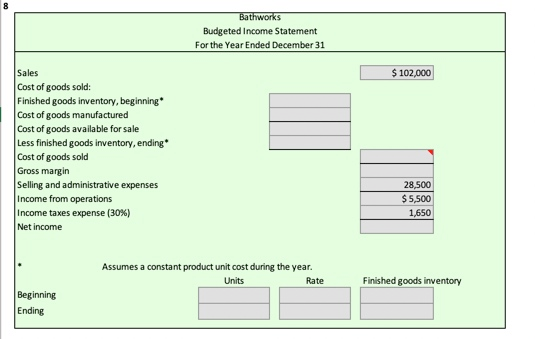

Bathworks Sales Budget For the Year Ended December 31 Quarter 1 2 3 4 Year Sales in Units Selling Price per unit Total Sales 4,000 $6 $ 24,000 3,000 $6 $ 18,000 5,000 $6 $ 30,000 5,000 $6 $ 30,000 17,000 $6 $ 102,000 2 Bathworks Production Budget For the Year Ended December 31 Quarter 1 2 3 4 Year 4,000 3,000 5,000 5,000 17,000 Sales in units Plus desired units of ending finished goods inventory(a) Desired total units Less desired units of beginning finished goods inventory(b) Total production units 300 4,300 500 3,500 500 5,500 600 5,600 600 17,600 400 3,900 300 3,200 500 5,000 500 5,100 400 17,200 (a) Desired units of ending finished goods Inventory = 10% of next quarter's budgeted sales. (6) Desired units of beginning finished goods Inventory = 10 % of current quarter's budgeted sales. Bathworks Direct Material Purchase Budget For the Year Ended December 31 Quarter 2 1 3 4 Year 3,200 5,000 3,900 4 15,600 4 Total production units (Budget 2) Ounces per unit Total production needs in ounces Plus desired ounces of ending direct materials inventory(a) 4 5,100 4 20,400 17,200 4 68,800 12,800 20,000 3,600 2,560 18,160 4,000 16,800 4,080 24,080 3,600 24,000 72.400 3,120 2,560 4,000 4,080 3,120 Less desired ounces of beginning direct materials inventory(b) Total ounces of direct materials to be purchased Cost per ounce Total cost of direct materials purchases 15,040 $ 0.10 14,240 $ 0.10 20,080 $0.10 19,920 $0.10 69,280 $0.10 $ 1,504 $ 1,424 $ 2,008 $ 1,992 $6,928 (a) Desired ounces of Ending direct materials inventory = 20% of next quarter's budgeted production needs in ounces (b) Desired Ounces of beginning direct materials inventory = 20% of next quarter's budgeted production needs in ounces Bathworks Direct Labor Budget For the Year Ended December 31 Quarter 2 1 3 Year 3,200 0.10 Total production units (Budget 2) Direct labor hours per unit Total direct labor hours Direct labor cost per hour Total direct labor cost 3,900 0.10 390 $20 $ 7,800 320 5,000 0.10 500 $20 $ 10,000 5,100 0.10 510 $20 $ 10,200 17,200 0.10 1720 $20 $ 34,400 $20 $6,400 Bathworks Overhead Budget For the Year Ended December 31 Quarter 2 1 3 4 Year 3,900 3,200 5,000 5,100 17,200 $ 160 800 Units Variable overhead costs: Factory supplies ($0.05) Employee benefits ($0.25) Inspection ($0.10) Maintenance and repairs ($0.15) Utilities ($0.05) Total variable overhead costs Total fixed overhead costs Total overhead costs $195 975 390 585 195 $2,340 4,300 $6,640 320 480 160 $ 1,920 4,300 $ 6,220 $250 1,250 500 750 250 $3,000 4,300 $ 7,300 $ 255 1,275 510 765 255 $ 3,060 4,300 $ 7,360 $860 4,300 1,720 2,580 860 $ 10,320 17,200 $ 27,520 6 Bathworks Selling and Administrative Expenses Budget For the Year Ended December 31 Quarter 1 2 3 4 Year 4,000 3,000 5,000 5,000 17,000 $ 1,700 $400 600 200 $ 300 450 $ 500 750 250 $ 500 750 250 2,550 150 850 Units Variable overhead costs: expenses: Delivery expenses ($0.10) Sales commissions ($0.15) Accounting ($0.05) Other administrative expenses ($0.20) Total variable selling and administrative expenses Total fixed selling and administrative expenses Total selling and administrative expenses 800 600 1,000 1,000 3,400 $2,000 $ 1,500 $ 2,500 $2,500 $ 8,500 5,000 5,000 5,000 5,000 20,000 $7,000 $ 6,500 $ 7,500 $7,500 $ 28,500 Leave no cells blank. Ensure to enter "0" wherever applicable. Bathworks Cost of Goods Manufactured Budget For the Year Ended December 31 $ 312 360 Direct materials used: Direct materials inventory, beginning Purchases during the year Cost of direct materials available for use Less direct materials inventory, ending Cost of direct materials used Direct labor costs Overhead costs Total manufacturing costs Work in process inventory, beginning Less work in process inventory, ending * Cost of goods manufactured $ 68,800 Manufactured cost per unit $ 68,800 / 17,200 units $4.00 "It is a company policy to have no units in process at year end. Bathworks Budgeted Income Statement For the Year Ended December 31 $ 102,000 Sales Cost of goods sold: Finished goods inventory, beginning Cost of goods manufactured Cost of goods available for sale Less finished goods inventory, ending Cost of goods sold Gross margin Selling and administrative expenses Income from operations Income taxes expense (30%) Net income 28,500 $5,500 1,650 Assumes a constant product unit cost during the year. Units Rate Finished goods inventory Beginning Ending