Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Batrisyia plans to buy a house but refuse to pay regular installments to the bank at the end of each year. Instead, she customized her

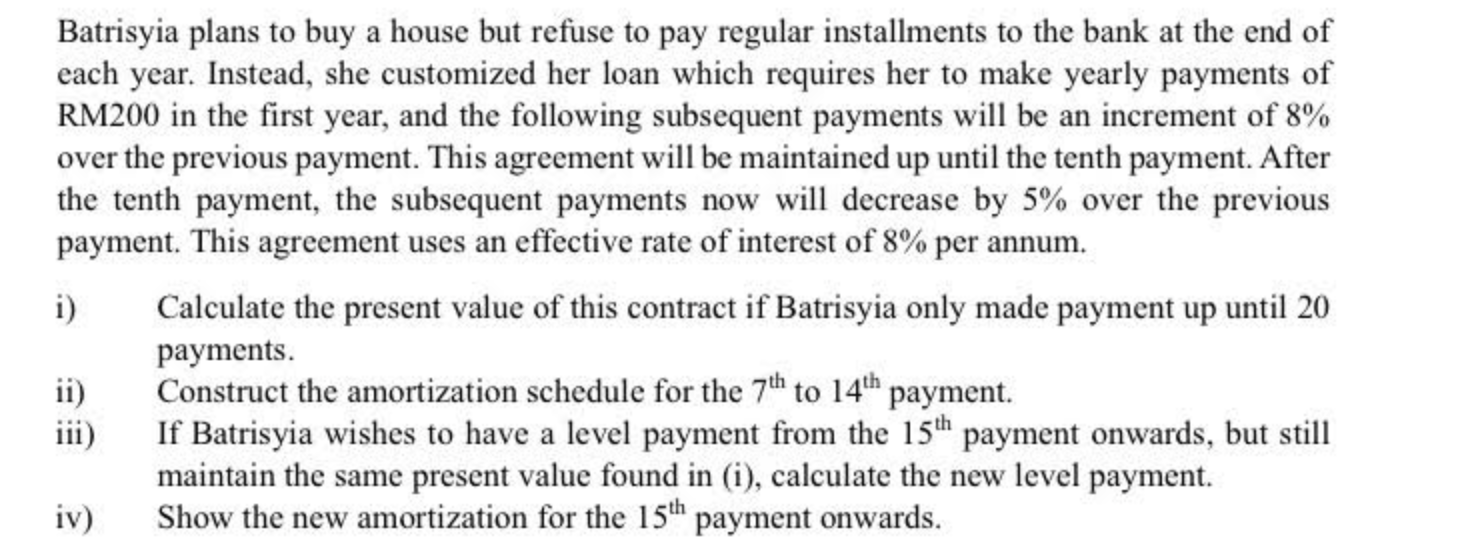

Batrisyia plans to buy a house but refuse to pay regular installments to the bank at the end of each year. Instead, she customized her loan which requires her to make yearly payments of RM200 in the first year, and the following subsequent payments will be an increment of 8% over the previous payment. This agreement will be maintained up until the tenth payment. After the tenth payment, the subsequent payments now will decrease by 5% over the previous payment. This agreement uses an effective rate of interest of 8% per annum. i) Calculate the present value of this contract if Batrisyia only made payment up until 20 payments. ii) Construct the amortization schedule for the 7th to 14th payment. iii) If Batrisyia wishes to have a level payment from the 15th payment onwards, but still maintain the same present value found in (i), calculate the new level payment. iv) Show the new amortization for the 15th payment onwards. Batrisyia plans to buy a house but refuse to pay regular installments to the bank at the end of each year. Instead, she customized her loan which requires her to make yearly payments of RM200 in the first year, and the following subsequent payments will be an increment of 8% over the previous payment. This agreement will be maintained up until the tenth payment. After the tenth payment, the subsequent payments now will decrease by 5% over the previous payment. This agreement uses an effective rate of interest of 8% per annum. i) Calculate the present value of this contract if Batrisyia only made payment up until 20 payments. ii) Construct the amortization schedule for the 7th to 14th payment. iii) If Batrisyia wishes to have a level payment from the 15th payment onwards, but still maintain the same present value found in (i), calculate the new level payment. iv) Show the new amortization for the 15th payment onwards

Batrisyia plans to buy a house but refuse to pay regular installments to the bank at the end of each year. Instead, she customized her loan which requires her to make yearly payments of RM200 in the first year, and the following subsequent payments will be an increment of 8% over the previous payment. This agreement will be maintained up until the tenth payment. After the tenth payment, the subsequent payments now will decrease by 5% over the previous payment. This agreement uses an effective rate of interest of 8% per annum. i) Calculate the present value of this contract if Batrisyia only made payment up until 20 payments. ii) Construct the amortization schedule for the 7th to 14th payment. iii) If Batrisyia wishes to have a level payment from the 15th payment onwards, but still maintain the same present value found in (i), calculate the new level payment. iv) Show the new amortization for the 15th payment onwards. Batrisyia plans to buy a house but refuse to pay regular installments to the bank at the end of each year. Instead, she customized her loan which requires her to make yearly payments of RM200 in the first year, and the following subsequent payments will be an increment of 8% over the previous payment. This agreement will be maintained up until the tenth payment. After the tenth payment, the subsequent payments now will decrease by 5% over the previous payment. This agreement uses an effective rate of interest of 8% per annum. i) Calculate the present value of this contract if Batrisyia only made payment up until 20 payments. ii) Construct the amortization schedule for the 7th to 14th payment. iii) If Batrisyia wishes to have a level payment from the 15th payment onwards, but still maintain the same present value found in (i), calculate the new level payment. iv) Show the new amortization for the 15th payment onwards Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started