Answered step by step

Verified Expert Solution

Question

1 Approved Answer

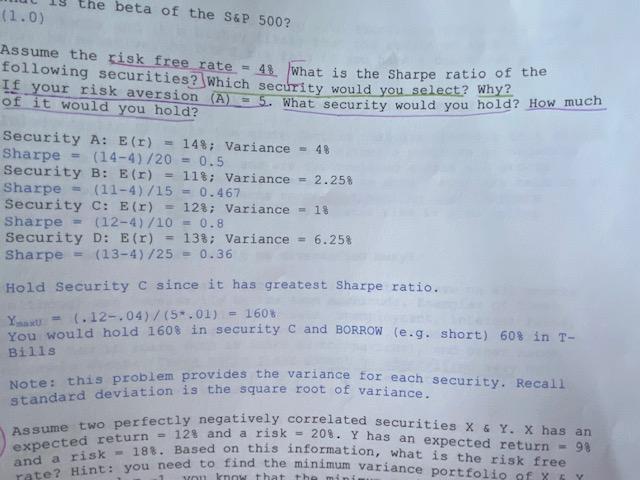

I am having a hard time understanding where the 20, 15, 10 and 25 came from to find the sharpe ratio. thanks! the beta of

I am having a hard time understanding where the 20, 15, 10 and 25 came from to find the sharpe ratio.

I am having a hard time understanding where the 20, 15, 10 and 25 came from to find the sharpe ratio.

thanks!

the beta of the S&P 500? (1.0) Assume the risk free rate - 48. What is the Sharpe ratio of the following securities? Which security would you select? why? f your risk aversion (A) = 5. What security would you hold? How much of it would you hold? Security A: E(r) = 148; Variance = 48 Sharpe (14-4)/20 0.5 Security B: E(r) 118; Variance = 2.25% Sharpe (11-4)/15 = 0.467 Security C: E(r) 128; Variance = 1% Sharpe (12-4)/10 = 0.8 Security D: E(r) 138; Variance = 6.25% Sharpe (13-4)/25 - 0.36 Hold Security C since it has greatest Sharpe ratio. = 1608 Y = 1.12-.04)/(5.01) - You would hold 1608 in security C and BORROW (e.g. short) 60% in T- Bilis Note: this problem provides the variance for each security. Recall standard deviation is the square root of variance. Assume two perfectly negatively correlated securities X & Y. X has an expected return = 12$ and a risk - 208. Y has an expected return 98 and a risk - 188. Based on this information, what is the risk free rate? Hint: you need to find the minimum variance portfolio of XY You know that the miniStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started