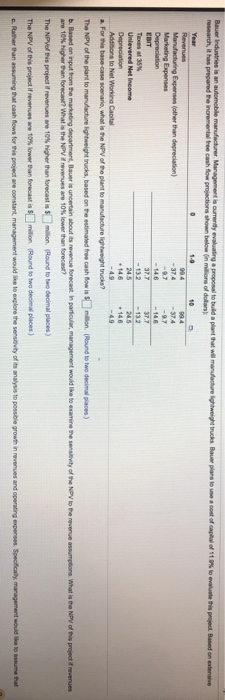

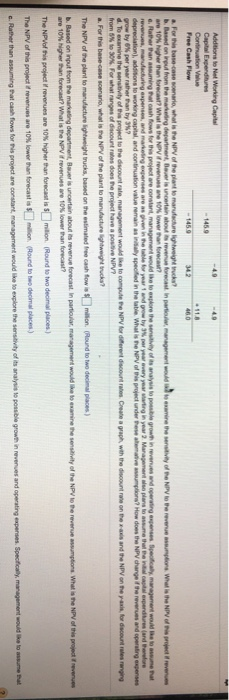

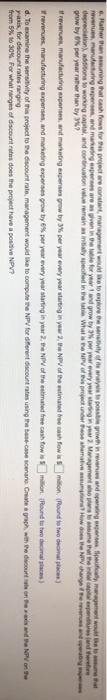

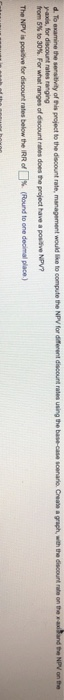

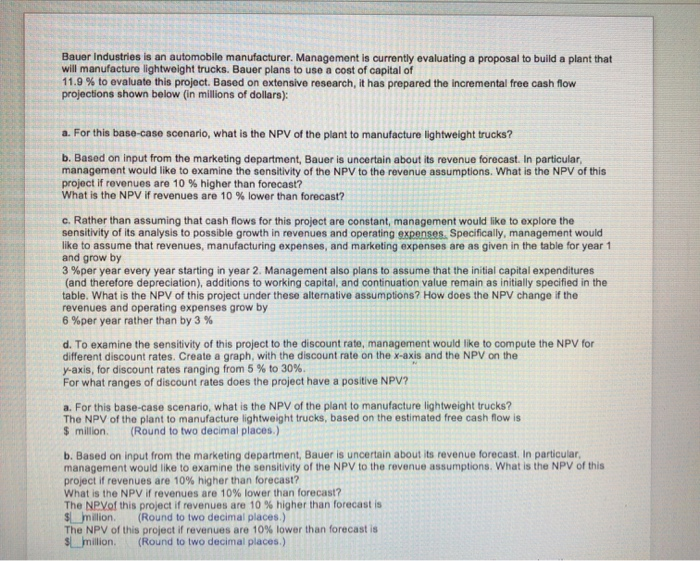

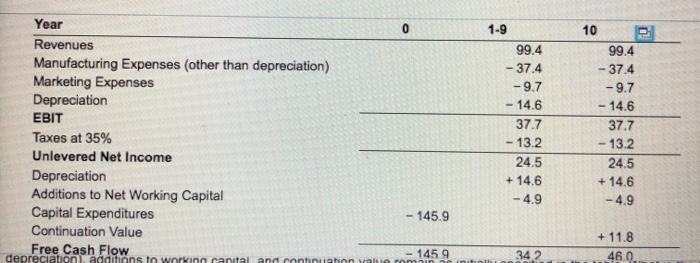

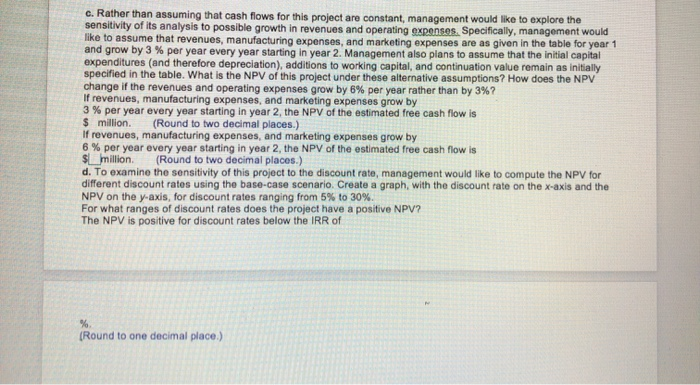

Bauer Industries is an automobile manufacturer Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks Bauer plans to use a cost of capital of 11 09 to research, it has prepared the incremental free cash flow projections shown below in millions of dollars this project Based on deve Manufacturing Expenses other than depreciation) Marketing Expenses Depreciation EDIT Taxes at Unilevered Net Income Depreciation Additions to Net Working Capital . For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is million Round to two deci b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular, management would like to examine the entity of the NPV to the revenue assumptions What is the NPV of this project if revenues are 10% higher than foreca What is the NPV revenues are 10% lower than forecast? The NPVof this project if revenues are 10% higher than forecast is milion. Round to two decimal places The NPV of this project if revenues are 10% lower than forecast is million Round to two decimal places) c. Rather than assuming that cash flows for this project are constant management would be to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to that Addition a l Working Capital Capital Expenditures Free Cash Flow Force where to marry perdures and are and the NPV on the forc e s ranging mancing expense and magne t fordr i nger Management plans grow by referranty To examine the entity of the project to the discount management would be computere NIV for rent countries C a r with the discounts on from Forwal range of discount es does the project have a postave NPV? a. For the base c a re what is the NPV of the plant to manufacture werk ? The NPV of the plant manufacture lightweight be on the estimated fr o m Pound towel s ) b. Based on out from mang department can b efore progra m Pe n tions where The P r evenues are 10% per anforce milion Round towe revenues are 10% lower than focal The NPV of this pro million Round o n es preses Specifically, management to that explore the sensitivity of its analyelo posee growth in revenues and operating c. Rather than a n g Palafows for this project are constant management would 6. Rather than assuming that cash flows for this project are constant management would lo esplore the set of its analysis to post growth in revenues and operating perses polymeragament del metal revenues, manufacturing expenses and marketing expers are given in the for year and grow by per year every year wing year 2 Management par l e thot the expenditure and therefore depreciation a n d to working capital and continuation value remains a specified in the table Whats NAV prendere mavesmo ? How does the NPV change the revenues and operating perces grow by 6% per year rather than by 5%? revenues, manufacturing expenses, and manating expenses grow by per year every year starting in year 2, the NPV of the estimated free cash flows on Round to two decimal places) revenues, manufacturing expenses, and manating expenses grow by 6% per year every year starting in year 2. the NPV of the estimated free cash flow is d. To examine the sensitivity of this project to the discount rate management would like to computer NPV for different countries using these cases y-axis, for discount rates ranging from 5% to 30%. For what ranges of contratos does the project have a positive NPV? million Round to two decimal places) Create a graph, with the discount rate on the roads and the NPV on the d. To examine the sentity of this project to the discount rate management would like to compute the NPV for different discount rates using the bese-case scenario Create a graph with the discounts on the road and the NPV on the yads, for discount rates ranging from 5% to 30%. For what range of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of Round to one decimal place) Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 11.9 % to evaluate this project. Based on extensive research, it has prepared the incremental free cash flow projections shown below (in millions of dollars): a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10 % higher than forecast? What is the NPV If revenues are 10 % lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3 %per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6 %per year rather than by 3% d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30% For what ranges of discount rates does the project have a positive NPV? a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is $ million. (Round to two decimal places.) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? The NPVof this project if revenues are 10% higher than forecast is $_million. (Round to two decimal places.) The NPV of this project if revenues are 10% lower than forecast is S million. (Round to two decimal places.) Year Revenues Manufacturing Expenses (other than depreciation) Marketing Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income Depreciation Additions to Net Working Capital Capital Expenditures Continuation Value Free Cash Flow 1-9 99.4 - 37.4 -9.7 - 14.6 37.7 - 13.2 24.5 +14.6 -4.9 99.4 - 37.4 -9.7 - 14.6 37.7 - 13.2 24.5 +14.6 -4.9 - 145.9 + 11.8 46.0 -1459 _342 one to natal and continu c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? If revenues, manufacturing expenses, and marketing expenses grow by 3% per year every year starting in year 2, the NPV of the estimated free cash flow is $ million. (Round to two decimal places.) If revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in year 2, the NPV of the estimated free cash flow is S million (Round to two decimal places.) d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates using the base-case scenario. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30% For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of (Round to one decimal place.) Bauer Industries is an automobile manufacturer Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks Bauer plans to use a cost of capital of 11 09 to research, it has prepared the incremental free cash flow projections shown below in millions of dollars this project Based on deve Manufacturing Expenses other than depreciation) Marketing Expenses Depreciation EDIT Taxes at Unilevered Net Income Depreciation Additions to Net Working Capital . For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is million Round to two deci b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast in particular, management would like to examine the entity of the NPV to the revenue assumptions What is the NPV of this project if revenues are 10% higher than foreca What is the NPV revenues are 10% lower than forecast? The NPVof this project if revenues are 10% higher than forecast is milion. Round to two decimal places The NPV of this project if revenues are 10% lower than forecast is million Round to two decimal places) c. Rather than assuming that cash flows for this project are constant management would be to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically management would like to that Addition a l Working Capital Capital Expenditures Free Cash Flow Force where to marry perdures and are and the NPV on the forc e s ranging mancing expense and magne t fordr i nger Management plans grow by referranty To examine the entity of the project to the discount management would be computere NIV for rent countries C a r with the discounts on from Forwal range of discount es does the project have a postave NPV? a. For the base c a re what is the NPV of the plant to manufacture werk ? The NPV of the plant manufacture lightweight be on the estimated fr o m Pound towel s ) b. Based on out from mang department can b efore progra m Pe n tions where The P r evenues are 10% per anforce milion Round towe revenues are 10% lower than focal The NPV of this pro million Round o n es preses Specifically, management to that explore the sensitivity of its analyelo posee growth in revenues and operating c. Rather than a n g Palafows for this project are constant management would 6. Rather than assuming that cash flows for this project are constant management would lo esplore the set of its analysis to post growth in revenues and operating perses polymeragament del metal revenues, manufacturing expenses and marketing expers are given in the for year and grow by per year every year wing year 2 Management par l e thot the expenditure and therefore depreciation a n d to working capital and continuation value remains a specified in the table Whats NAV prendere mavesmo ? How does the NPV change the revenues and operating perces grow by 6% per year rather than by 5%? revenues, manufacturing expenses, and manating expenses grow by per year every year starting in year 2, the NPV of the estimated free cash flows on Round to two decimal places) revenues, manufacturing expenses, and manating expenses grow by 6% per year every year starting in year 2. the NPV of the estimated free cash flow is d. To examine the sensitivity of this project to the discount rate management would like to computer NPV for different countries using these cases y-axis, for discount rates ranging from 5% to 30%. For what ranges of contratos does the project have a positive NPV? million Round to two decimal places) Create a graph, with the discount rate on the roads and the NPV on the d. To examine the sentity of this project to the discount rate management would like to compute the NPV for different discount rates using the bese-case scenario Create a graph with the discounts on the road and the NPV on the yads, for discount rates ranging from 5% to 30%. For what range of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of Round to one decimal place) Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 11.9 % to evaluate this project. Based on extensive research, it has prepared the incremental free cash flow projections shown below (in millions of dollars): a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10 % higher than forecast? What is the NPV If revenues are 10 % lower than forecast? c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3 %per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6 %per year rather than by 3% d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30% For what ranges of discount rates does the project have a positive NPV? a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks? The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is $ million. (Round to two decimal places.) b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast? The NPVof this project if revenues are 10% higher than forecast is $_million. (Round to two decimal places.) The NPV of this project if revenues are 10% lower than forecast is S million. (Round to two decimal places.) Year Revenues Manufacturing Expenses (other than depreciation) Marketing Expenses Depreciation EBIT Taxes at 35% Unlevered Net Income Depreciation Additions to Net Working Capital Capital Expenditures Continuation Value Free Cash Flow 1-9 99.4 - 37.4 -9.7 - 14.6 37.7 - 13.2 24.5 +14.6 -4.9 99.4 - 37.4 -9.7 - 14.6 37.7 - 13.2 24.5 +14.6 -4.9 - 145.9 + 11.8 46.0 -1459 _342 one to natal and continu c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? If revenues, manufacturing expenses, and marketing expenses grow by 3% per year every year starting in year 2, the NPV of the estimated free cash flow is $ million. (Round to two decimal places.) If revenues, manufacturing expenses, and marketing expenses grow by 6% per year every year starting in year 2, the NPV of the estimated free cash flow is S million (Round to two decimal places.) d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates using the base-case scenario. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30% For what ranges of discount rates does the project have a positive NPV? The NPV is positive for discount rates below the IRR of (Round to one decimal place.)