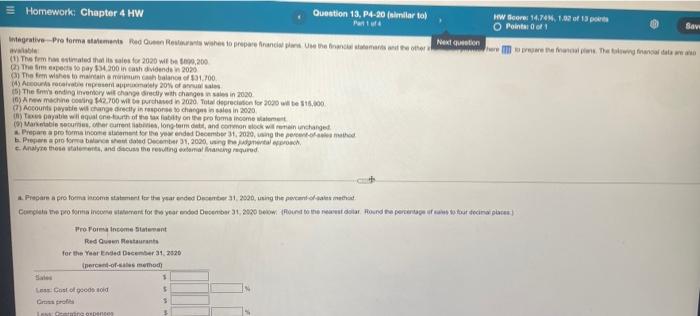

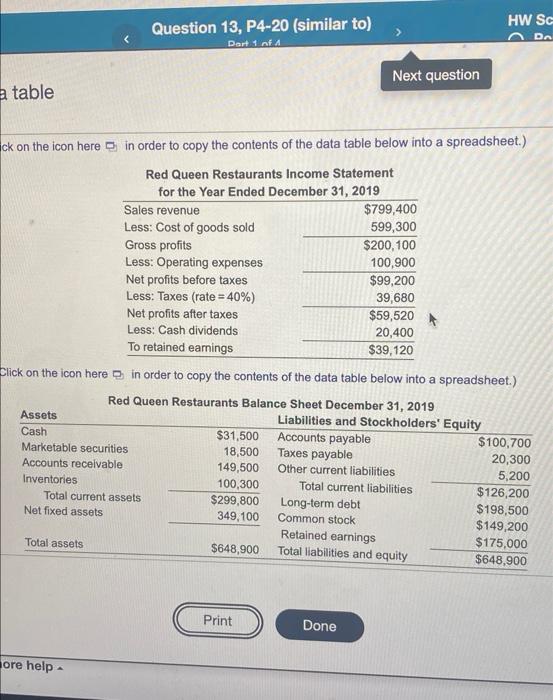

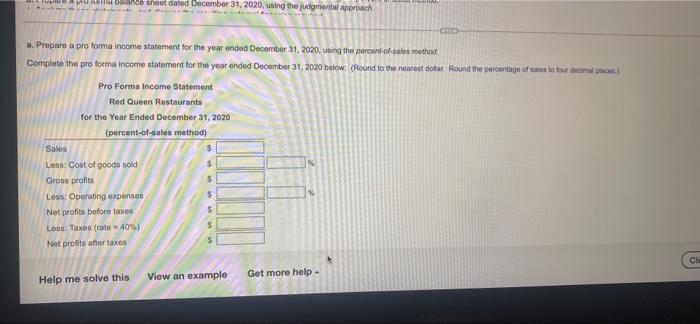

Bave W Bor 14.76 1.92 of 13 O Points of we found. The blowing franca Next quotion = Homework: Chapter 4 HW Question 13, P4-20 (similar to Integrativo - Fra forma statemente poder Rowinno whes to prepare and we are ones with (1) The tema estimated this sales for 2020 with 200 The Imports to pay $34.300 in cathoden 2020 The firm wishes to maintain momma 1.700 Amours rocal present owl 20% A machine coming $2.700 win te schased in 2000 Tot depreciation for 2000 will be 116.000 The founding my wit change met with changes in 2000 (7) Accounts payah we in 2020 Toyote ilegal or fourth Income wat Warseloto come other current , long termand cook will remain unchanged Prepare a proforma incontra owned December 2020, wing the per me Pre proformated Dec 31, 2000, Analyse these and custo rewing external linger Prepare a pro forma constant for the year anded Dec 31, 2000, sing the percent of mechat Complete proforma incora starred for tw year ended December 31, 2020 w Rocess to the retour Round the percentage fast four decina plates) ProForms Income Sant Red Queen Restaurants for the Year December 31, 2020 percando method 1 Cost of good old $ Grote e open 5 3 Question 13, P4-20 (similar to) HW SC DA Dart 1 of Next question a table ck on the icon here in order to copy the contents of the data table below into a spreadsheet.) Red Queen Restaurants Income Statement for the Year Ended December 31, 2019 Sales revenue $799,400 Less: Cost of goods sold 599,300 Gross profits $200,100 Less: Operating expenses 100,900 Net profits before taxes $99,200 Less: Taxes (rate = 40%) 39,680 Net profits after taxes $59,520 Less: Cash dividends 20,400 To retained earnings $39,120 Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Red Queen Restaurants Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $31,500 Accounts payable $100,700 Marketable securities 18,500 Taxes payable 20,300 Accounts receivable 149,500 Other current liabilities 5,200 Inventories 100,300 Total current liabilities $126,200 Total current assets $299,800 Long-term debt $198,500 Net fixed assets 349,100 Common stock $149,200 Retained earnings $175,000 Total assets $648,900 Total liabilities and equity $648,900 Print Done ore help U shoot dated December 31, 2020, using the judgmental approach a. Prepare a pro forma income statement for the year anded December 31, 2020, using the percent-of-sales method Complete the proforma income statement for the year ended December 31, 2020 below: (Round to the nearest dotat. Round the percentage of sales to four decimal poss Pro Forma Income Statement Red Queen Restaurants for the Year Ended December 31, 2020 (percent-of-sales method Sales Less: Cost of goods sold Gross profits $ Less: Operating expenses $ Net profits before taxes $ Los: Taxes (rate 40%) 5 Net profits after taxes 5 Cle Help me solve this View an example Get more help Bave W Bor 14.76 1.92 of 13 O Points of we found. The blowing franca Next quotion = Homework: Chapter 4 HW Question 13, P4-20 (similar to Integrativo - Fra forma statemente poder Rowinno whes to prepare and we are ones with (1) The tema estimated this sales for 2020 with 200 The Imports to pay $34.300 in cathoden 2020 The firm wishes to maintain momma 1.700 Amours rocal present owl 20% A machine coming $2.700 win te schased in 2000 Tot depreciation for 2000 will be 116.000 The founding my wit change met with changes in 2000 (7) Accounts payah we in 2020 Toyote ilegal or fourth Income wat Warseloto come other current , long termand cook will remain unchanged Prepare a proforma incontra owned December 2020, wing the per me Pre proformated Dec 31, 2000, Analyse these and custo rewing external linger Prepare a pro forma constant for the year anded Dec 31, 2000, sing the percent of mechat Complete proforma incora starred for tw year ended December 31, 2020 w Rocess to the retour Round the percentage fast four decina plates) ProForms Income Sant Red Queen Restaurants for the Year December 31, 2020 percando method 1 Cost of good old $ Grote e open 5 3 Question 13, P4-20 (similar to) HW SC DA Dart 1 of Next question a table ck on the icon here in order to copy the contents of the data table below into a spreadsheet.) Red Queen Restaurants Income Statement for the Year Ended December 31, 2019 Sales revenue $799,400 Less: Cost of goods sold 599,300 Gross profits $200,100 Less: Operating expenses 100,900 Net profits before taxes $99,200 Less: Taxes (rate = 40%) 39,680 Net profits after taxes $59,520 Less: Cash dividends 20,400 To retained earnings $39,120 Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Red Queen Restaurants Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $31,500 Accounts payable $100,700 Marketable securities 18,500 Taxes payable 20,300 Accounts receivable 149,500 Other current liabilities 5,200 Inventories 100,300 Total current liabilities $126,200 Total current assets $299,800 Long-term debt $198,500 Net fixed assets 349,100 Common stock $149,200 Retained earnings $175,000 Total assets $648,900 Total liabilities and equity $648,900 Print Done ore help U shoot dated December 31, 2020, using the judgmental approach a. Prepare a pro forma income statement for the year anded December 31, 2020, using the percent-of-sales method Complete the proforma income statement for the year ended December 31, 2020 below: (Round to the nearest dotat. Round the percentage of sales to four decimal poss Pro Forma Income Statement Red Queen Restaurants for the Year Ended December 31, 2020 (percent-of-sales method Sales Less: Cost of goods sold Gross profits $ Less: Operating expenses $ Net profits before taxes $ Los: Taxes (rate 40%) 5 Net profits after taxes 5 Cle Help me solve this View an example Get more help