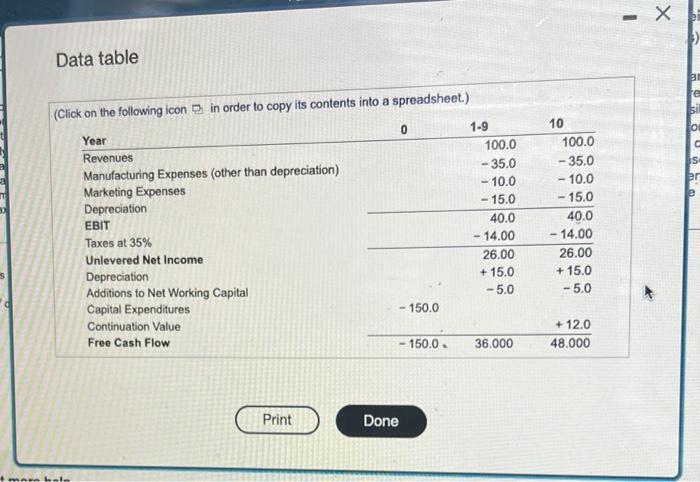

Baver industrios is an nutemobile manutacturer. Management is currently evaluating a proposal to buld a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12% to evaluate this projoct. Based on extensive research, th has prepared the following incremental free cash flow projoctions (n millions of toliars) a. For this base-case scenario, what is the NPV of the plant to manufacture lightiveight trucks? b. Based on input from the marketing department, Baver is uncertain about iss revenue forecast. in particular, management would tike to examine the sensitivity of the NPV to tho revenue assumptions. What in the NPV of this project if revenues are 10\% higher than forecast? What is the NPV if revenues are 10% lower than forecast? e. Rathet than assuming that cash flows for this project are constant, management would like to explore the senstivity of its analysis to possible growth in revenues and operating expenses. Specifcally, management would like to assume that revenses, manufacturing cespenses, and marketing expenses are as given in the table for year 1 and grow by 2% per ynar every year starthg in year 2. Management wiso plans to asweume that the initial copital expendthes (and therefore depreciation), additions to working capital, and continuation value remain as initialy specified in the tatio. What is the NPV of this pereject under these allernative assumptions? How does the NPY change if the revenues and operating expenses grow by 5% per year rather than by 2%. d. To nxareine the sensitivity of this (base-case scenarie) peoject to the discount rate, manasement would like to compute the NPV for different dscount rales. Create a graph, with the discount nte on the x-axis and the NPV on the y-axis, for dscount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV/? a. For this base-case sconario, what is the Npp of the plant to manufachare lightiteight tricks? The NPV of the estimated free cash flow is 5 mution. (Round to tao decimal places). Data table (Glirk an tha following icon in order to copy its contents into a spreadsheet.)