Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BAX6223 Taxation II Trimester 2, 2023/2024 MINING ALLOWANCE Question 1 Daya Tahan Sdn Bhd commenced its mining business on 1 April 2021 and incurred

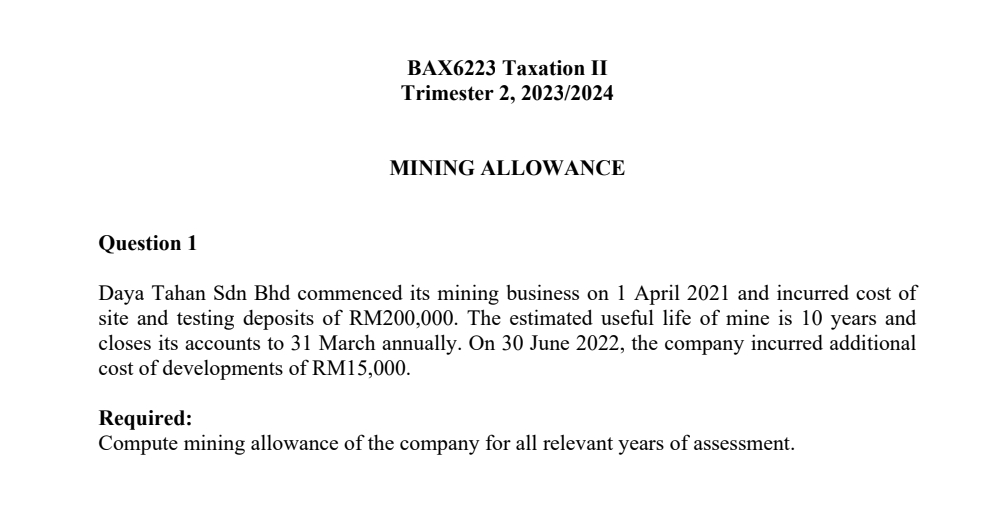

BAX6223 Taxation II Trimester 2, 2023/2024 MINING ALLOWANCE Question 1 Daya Tahan Sdn Bhd commenced its mining business on 1 April 2021 and incurred cost of site and testing deposits of RM200,000. The estimated useful life of mine is 10 years and closes its accounts to 31 March annually. On 30 June 2022, the company incurred additional cost of developments of RM15,000. Required: Compute mining allowance of the company for all relevant years of assessment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the mining allowance for Daya Tahan Sdn Bhd we first need to determine the allowable expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started