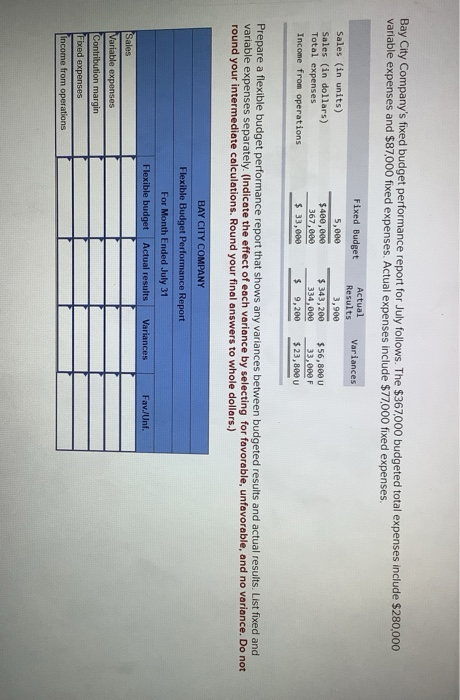

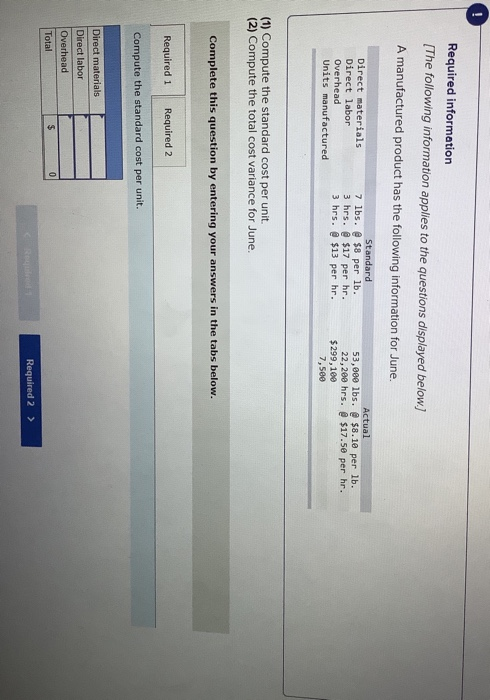

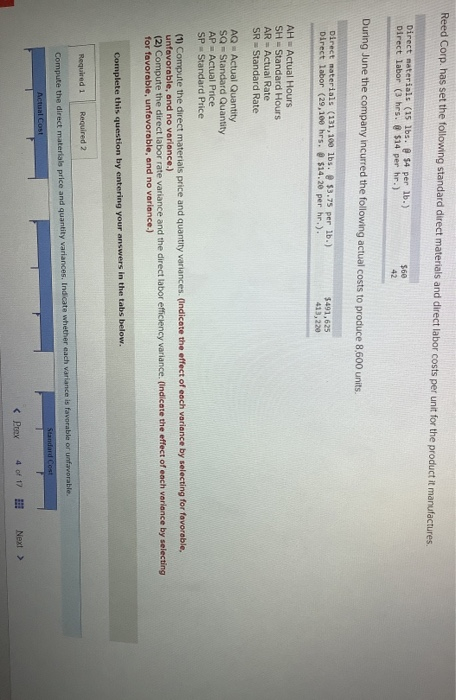

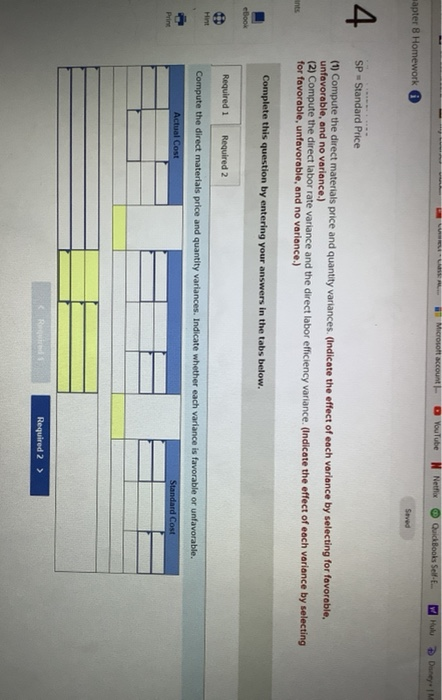

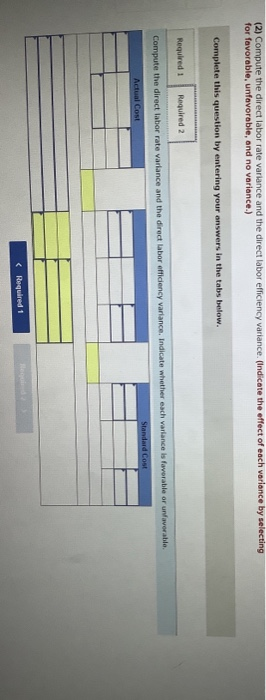

Bay City Company's fixed budget performance report for July follows. The $367,000 budgeted total expenses include $280,000 variable expenses and $87,000 fixed expenses. Actual expenses include $77,000 fixed expenses. Variances Sales (in units) Sales (in dollars) Total expenses Income from operations Fixed Budget 5,000 $400,000 367,000 $ 33,000 Actual Results 3,900 $ 343,200 334,000 $ 9,200 $ 56,800 U 33,000 F $ 23,800 U Prepare a flexible budget performance report that shows any variances between budgeted results and actual results. List fixed and variable expenses separately. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Do not round your intermediate calculations. Round your final answers to whole dollars.) BAY CITY COMPANY Flexible Budget Performance Report For Month Ended July 31 Flexible budget Actual results Variances Fav./Unf. Sales Variable expenses Contribution margin Fbed expenses Income from operations Required information [The following information applies to the questions displayed below.) A manufactured product has the following information for June Direct materials Direct labor Overhead Units manufactured Standard 7 lbs. @ $8 per lb. 3 hrs. @ $17 per hr. 3 hrs. $13 per hr. Actual 53,000 lbs. @ $8.10 per lb. 22,200 hrs. @ $17.50 per hr. $299, 100 7,500 (1) Compute the standard cost per unit (2) Compute the total cost variance for June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the standard cost per unit. Direct materials Direct labor Overhead Total $ 0 Required 2 > Reed Corp. has set the following standard direct materials and direct labor costs per unit for the product it manufactures Direct materials (15 lbs. $4 per lb.) Direct labor (3 hrs. @ $14 per hr.) 560 42 During June the company incurred the following actual costs to produce 8,600 units. Direct materials (131, 100 lbs. $3.75 per lb.) Direct labor (29,100 hrs. $14.20 per hr.). $491,625 41), 220 AH - Actual Hours SH - Standard Hours AR - Actual Rate SR Standard Rate AQ - Actual Quantity SQ - Standard Quantity AP Actual Price SP Standard Price (1) Compute the direct materials price and quantity variances. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) (2) Compute the direct labor rate variance and the direct labor efficiency variance. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the direct materials price and quantity variances. Indicate whether each variance is favorable or unfavorable. Standard Cost Actual Cost Microsoft account O YouTube Nettia @ QuickBooks Self apter 8 Homework Seved 4 SP - Standard Price (1) Compute the direct materials price and quantity variances. (Indicate the effect of each variance by selecting for favorable, (2) Compute the direct labor rate variance and the direct labor efficiency variance. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) Complete this question by entering your answers in the tabs below. ebook Required 1 Required 2 Hint Compute the direct materials price and quantity variances. Indicate whether each variance is favorable or unfavorable. Actual Cost Standard Cost Red Required 2 > (2) Compute the direct labor rate variance and the direct labor efficiency variance. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) Complete this question by entering your answers in the tabs below. Required: Required 2 Compute the direct labor rate variance and the direct labor efficiency variance Indicate whether each variance is favorable or unfavorable Standard Cost Actual Cost