Answered step by step

Verified Expert Solution

Question

1 Approved Answer

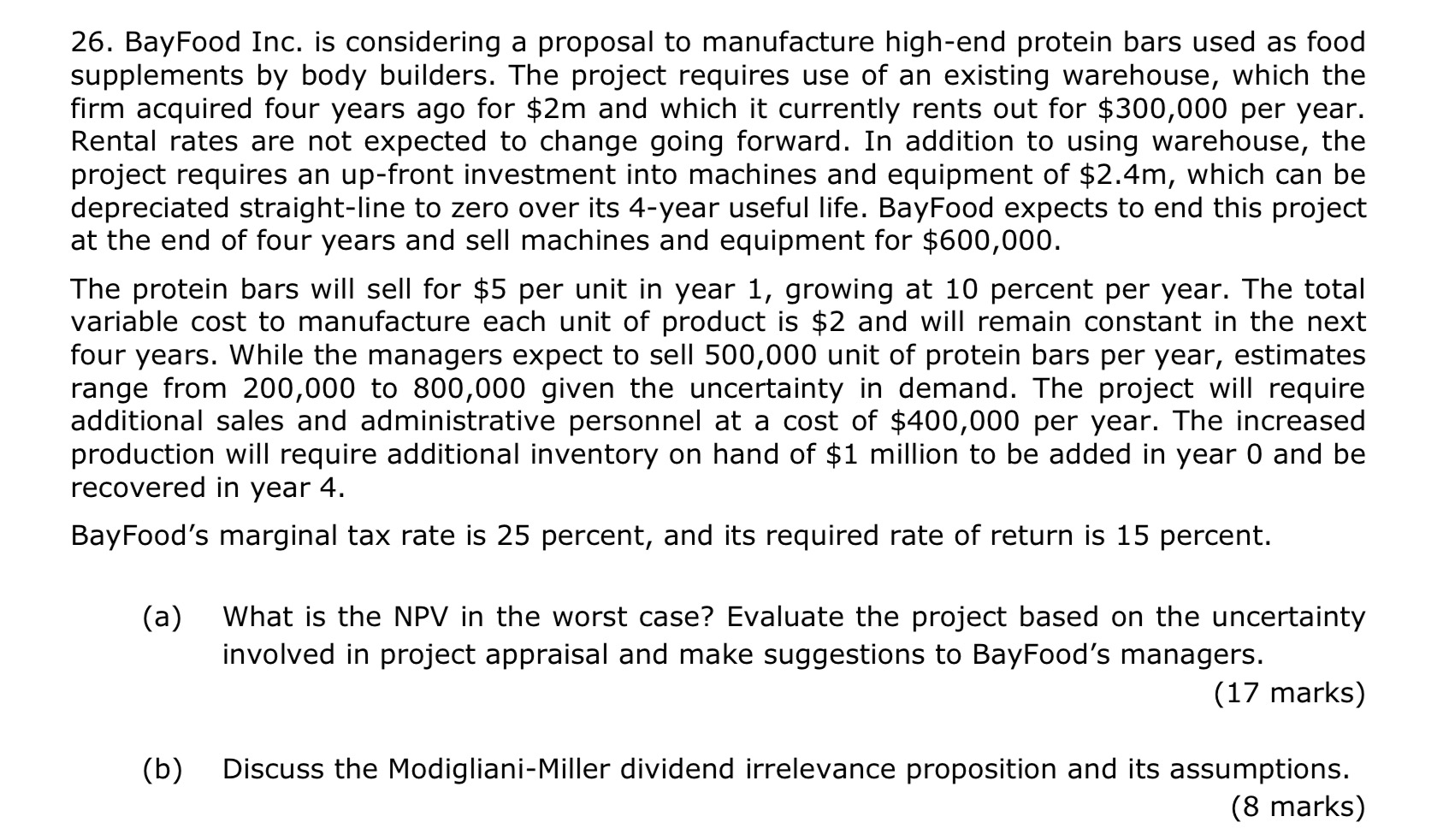

BayFood Inc. is considering a proposal to manufacture high - end protein bars used as food supplements by body builders. The project requires use of

BayFood Inc. is considering a proposal to manufacture highend protein bars used as food

supplements by body builders. The project requires use of an existing warehouse, which the

firm acquired four years ago for $ and which it currently rents out for $ per year.

Rental rates are not expected to change going forward. In addition to using warehouse, the

project requires an upfront investment into machines and equipment of $ which can be

depreciated straightline to zero over its year useful life. BayFood expects to end this project

at the end of four years and sell machines and equipment for $

The protein bars will sell for $ per unit in year growing at percent per year. The total

variable cost to manufacture each unit of product is $ and will remain constant in the next

four years. While the managers expect to sell unit of protein bars per year, estimates

range from to given the uncertainty in demand. The project will require

additional sales and administrative personnel at a cost of $ per year. The increased

production will require additional inventory on hand of $ million to be added in year and be

recovered in year

BayFood's marginal tax rate is percent, and its required rate of return is percent.

a What is the NPV in the worst case? Evaluate the project based on the uncertainty

involved in project appraisal and make suggestions to BayFood's managers.

marks

b Discuss the ModiglianiMiller dividend irrelevance proposition and its assumptions.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started