Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bb Group Assignment - BAF2005 x 4508499 C 4484133 MAS Holdings (82) Pogiren - Mugen Rao MG X + Q learn-ap-southeast-1-prod-fleet03-xythos.s3.ap-southeast-1.amazonaws.com/5dfa89a209d71/4508499?response-cache-control-private%2C%20max-age%3D216... H Type here

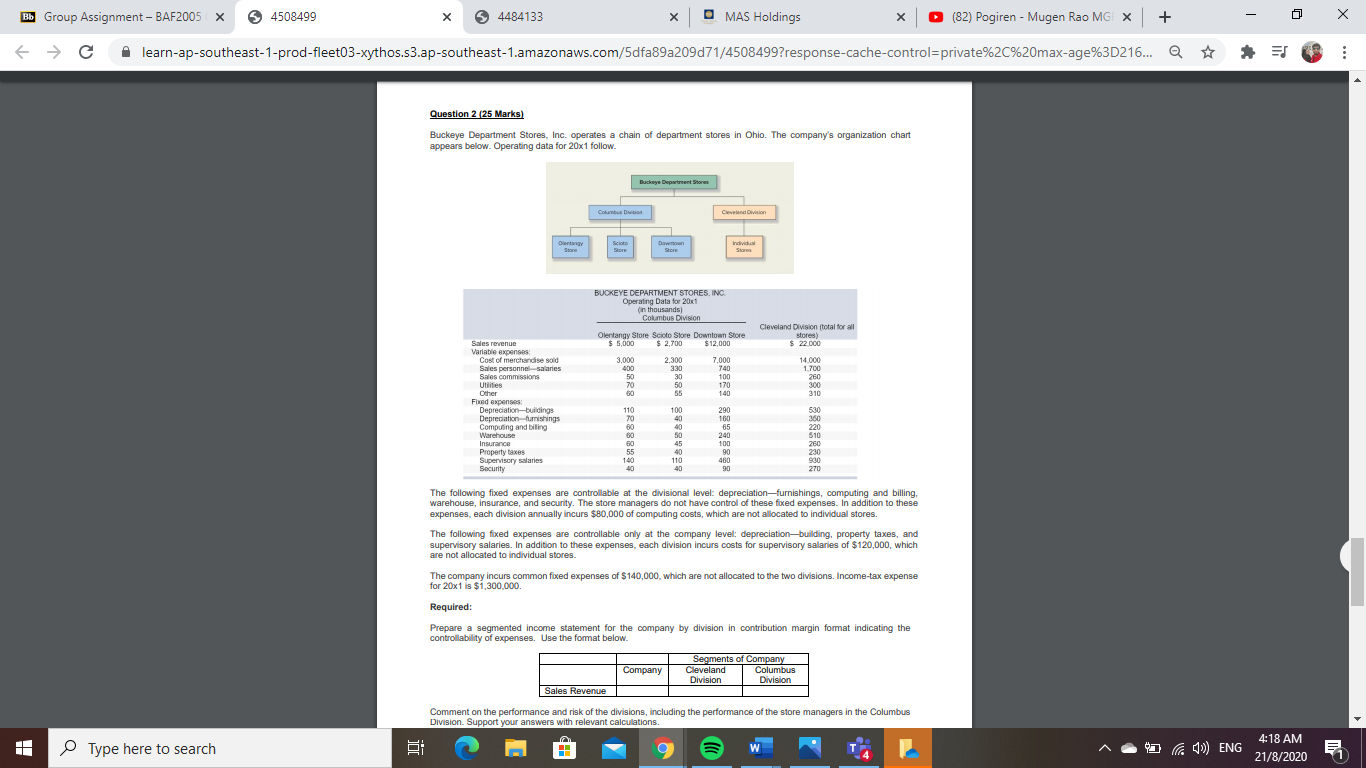

Bb Group Assignment - BAF2005 x 4508499 C 4484133 MAS Holdings (82) Pogiren - Mugen Rao MG X + Q learn-ap-southeast-1-prod-fleet03-xythos.s3.ap-southeast-1.amazonaws.com/5dfa89a209d71/4508499?response-cache-control-private%2C%20max-age%3D216... H Type here to search Question 2 (25 Marks) Buckeye Department Stores, Inc. operates a chain of department stores in Ohio. The company's organization chart appears below. Operating data for 20x1 follow. Buckeye Department Stores Columbus Division Cleveland Division Olentangy Store Scioto Store Downtown Store Individual Stores BUCKEYE DEPARTMENT STORES, INC. Operating Data for 20x1 (in thousands) Columbus Division Olentangy Store Scioto Store Downtown Store Cleveland Division (total for all stores) Sales revenue Variable expenses $ 2,700 $12,000 Cost of merchandise sold 3,000 7,000 $ 22,000 14,000 Sales personnel-salaries 400 330 740 1,700 Sales commissions 50 30 100 260 Utilities 50 170 300 Other 60 55 140 310 Fixed expenses: Depreciation-buildings 110 100 290 Depreciation-furnishings 70 40 160 350 Computing and billing 60 40 65 220 Warehouse 60 50 240 510 Insurance 60 45 100 Property taxes 40 90 Supervisory salaries 460 Security 40 40 270 The following fixed expenses are controllable at the divisional level: depreciation-furnishings, computing and billing, warehouse, insurance, and security. The store managers do not have control of these fixed expenses. In addition to these expenses, each division annually incurs $80,000 of computing costs, which are not allocated to individual stores. The following fixed expenses are controllable only at the company level: depreciation-building, property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $120,000, which are not allocated to individual stores. The company incurs common fixed expenses of $140,000, which are not allocated to the two divisions. Income-tax expense for 20x1 is $1,300,000. Required: Prepare a segmented income statement for the company by division in contribution margin format indicating the controllability of expenses. Use the format below. Company Segments of Company Cleveland Division Columbus Division Sales Revenue Comment on the performance and risk of the divisions, including the performance of the store managers in the Columbus Division. Support your answers with relevant calculations. S= * 4) ENG 4:18 AM 21/8/2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started