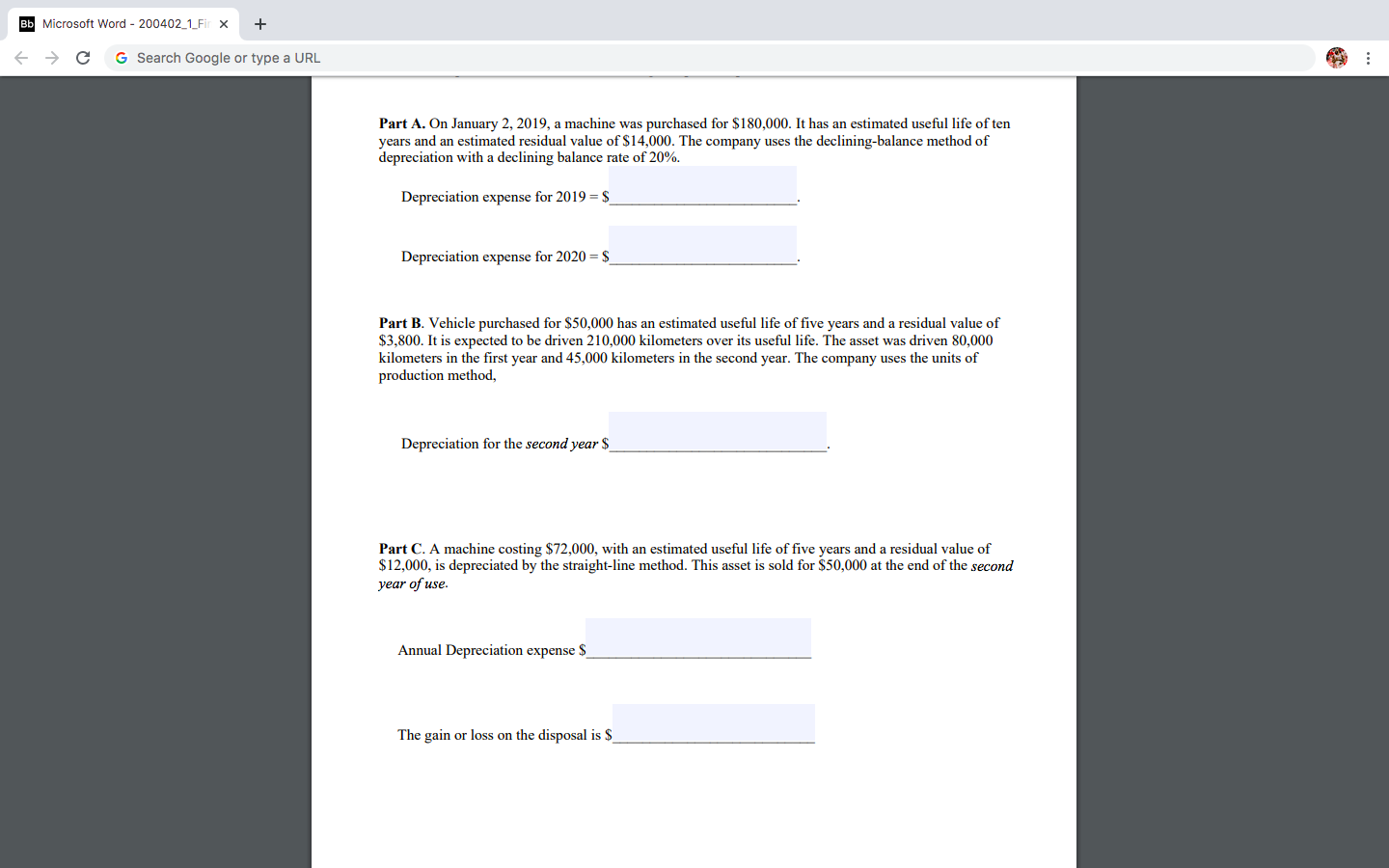

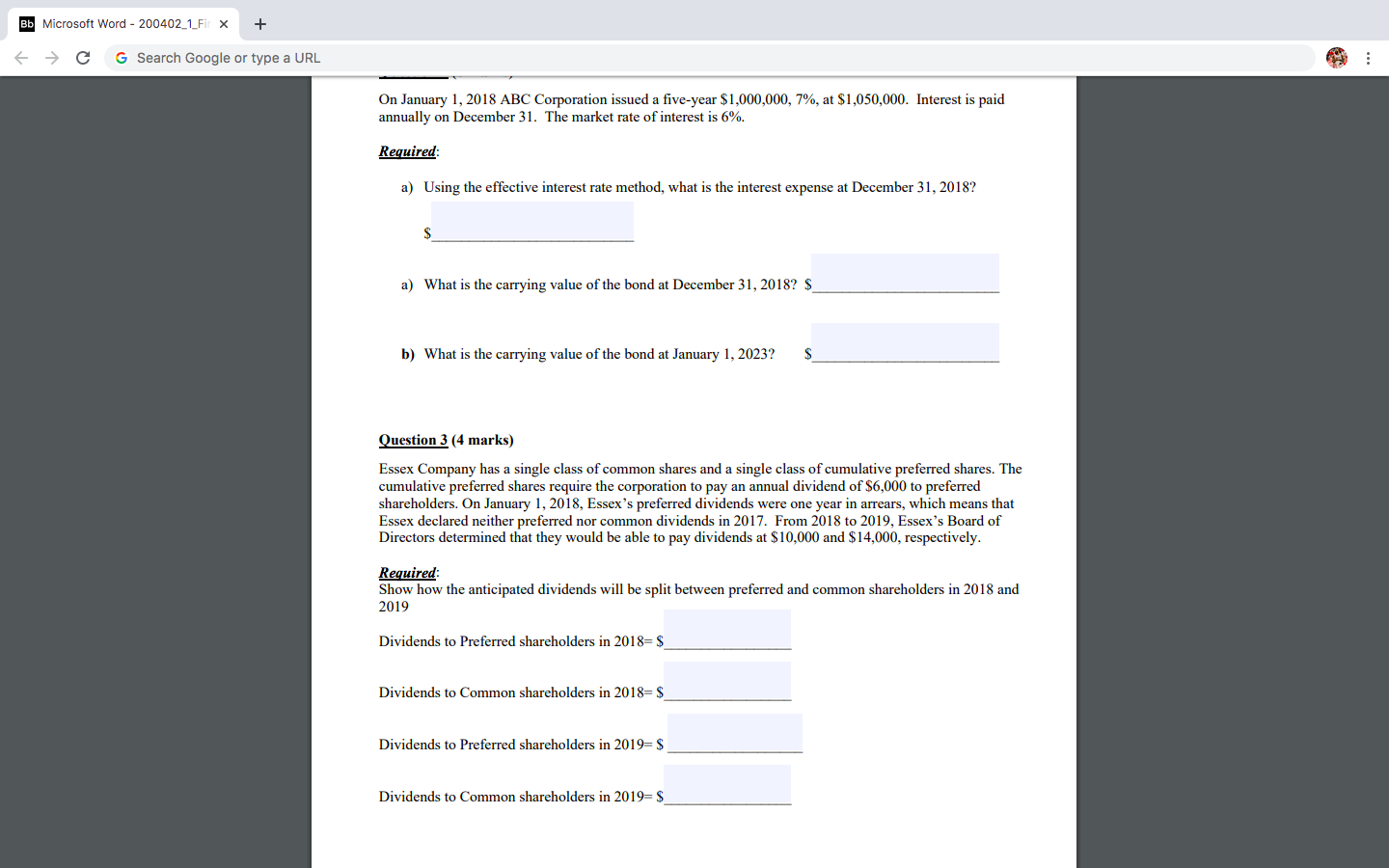

Bb Microsoft Word - 200402_1_Fix + + c G Search Google or type a URL Part A. On January 2, 2019, a machine was purchased for $180,000. It has an estimated useful life of ten years and an estimated residual value of $14,000. The company uses the declining-balance method of depreciation with a declining balance rate of 20%. Depreciation expense for 2019 = $ Depreciation expense for 2020 = $_ Part B. Vehicle purchased for $50,000 has an estimated useful life of five years and a residual value of $3,800. It is expected to be driven 210,000 kilometers over its useful life. The asset was driven 80,000 kilometers in the first year and 45,000 kilometers in the second year. The company uses the units of production method, Depreciation for the second year $ Part C. A machine costing $72,000, with an estimated useful life of five years and a residual value of $12,000, is depreciated by the straight-line method. This asset is sold for $50,000 at the end of the second year of use Annual Depreciation expense $ The gain or loss on the disposal is $ Bb Microsoft Word - 200402_1_Fix + C G Search Google or type a URL On January 1, 2018 ABC Corporation issued a five-year $1,000,000, 7%, at $1,050,000. Interest is paid annually on December 31. The market rate of interest is 6%. Required: a) Using the effective interest rate method, what is the interest expense at December 31, 2018? a) What is the carrying value of the bond at December 31, 2018? $ b) What is the carrying value of the bond at January 1, 2023? $ Question 3 (4 marks) Essex Company has a single class of common shares and a single class of cumulative preferred shares. The cumulative preferred shares require the corporation to pay an annual dividend of $6,000 to preferred shareholders. On January 1, 2018, Essex's preferred dividends were one year in arrears, which means that Essex declared neither preferred nor common dividends in 2017. From 2018 to 2019, Essex's Board of Directors determined that they would be able to pay dividends at $10,000 and $14,000, respectively. Required: Show how the anticipated dividends will be split between preferred and common shareholders in 2018 and 2019 Dividends to Preferred shareholders in 2018=$ Dividends to Common shareholders in 2018= $_ Dividends to Preferred shareholders in 2019=$ Dividends to Common shareholders in 2019=$