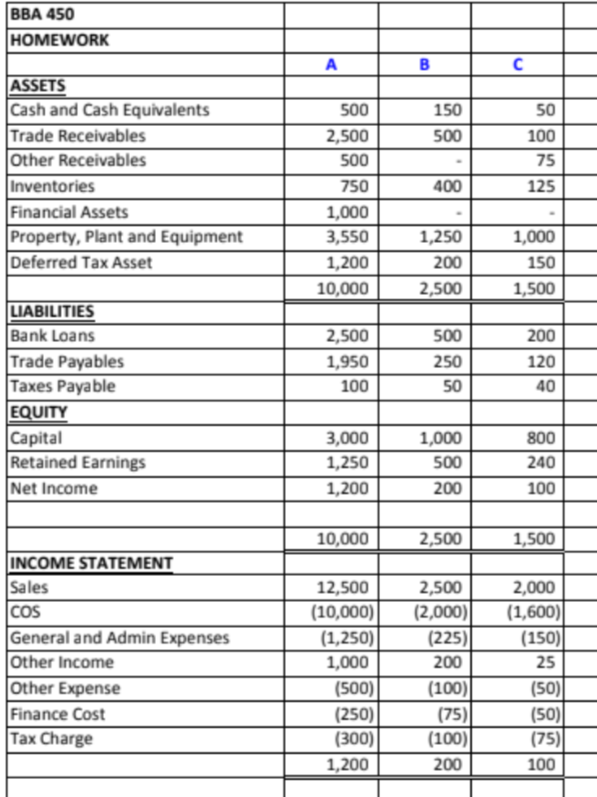

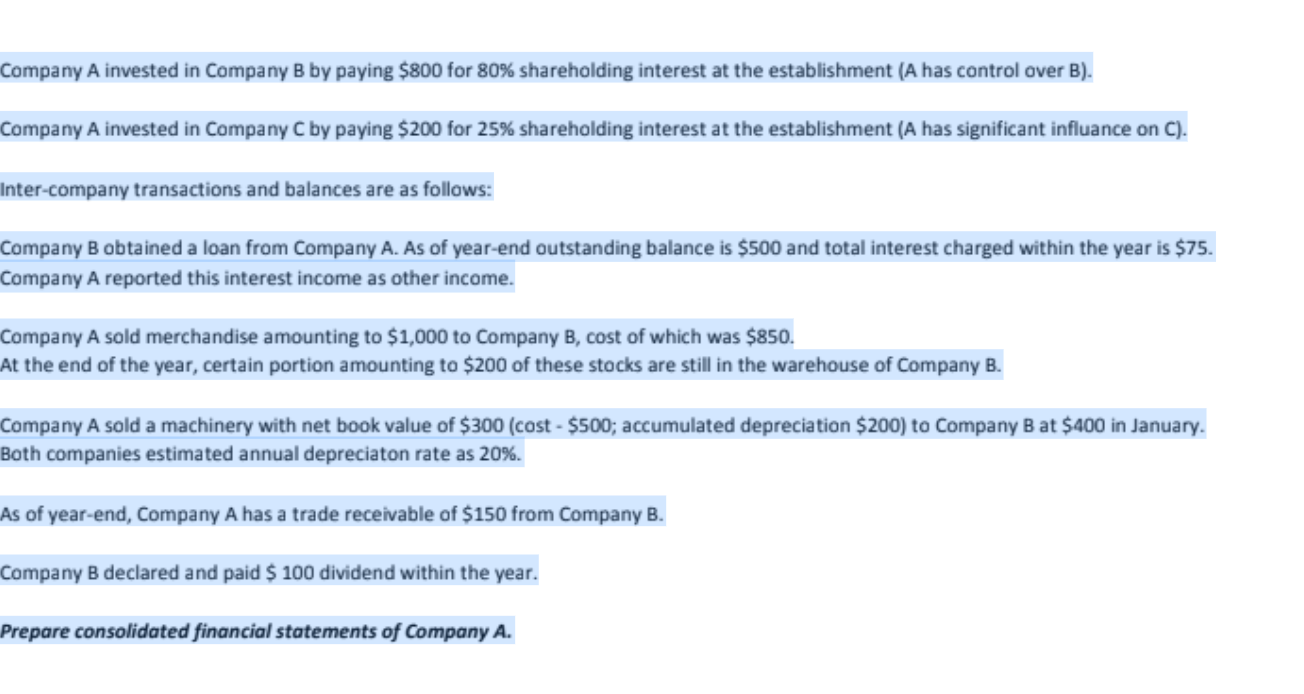

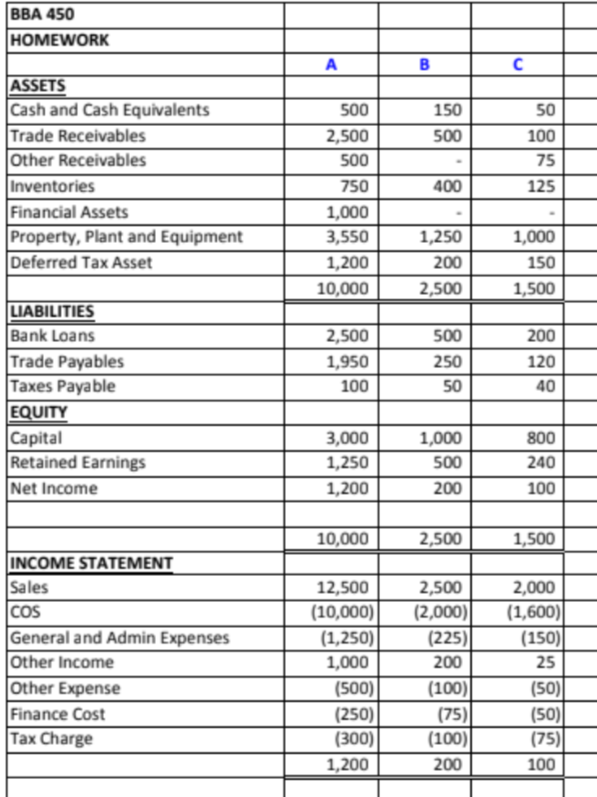

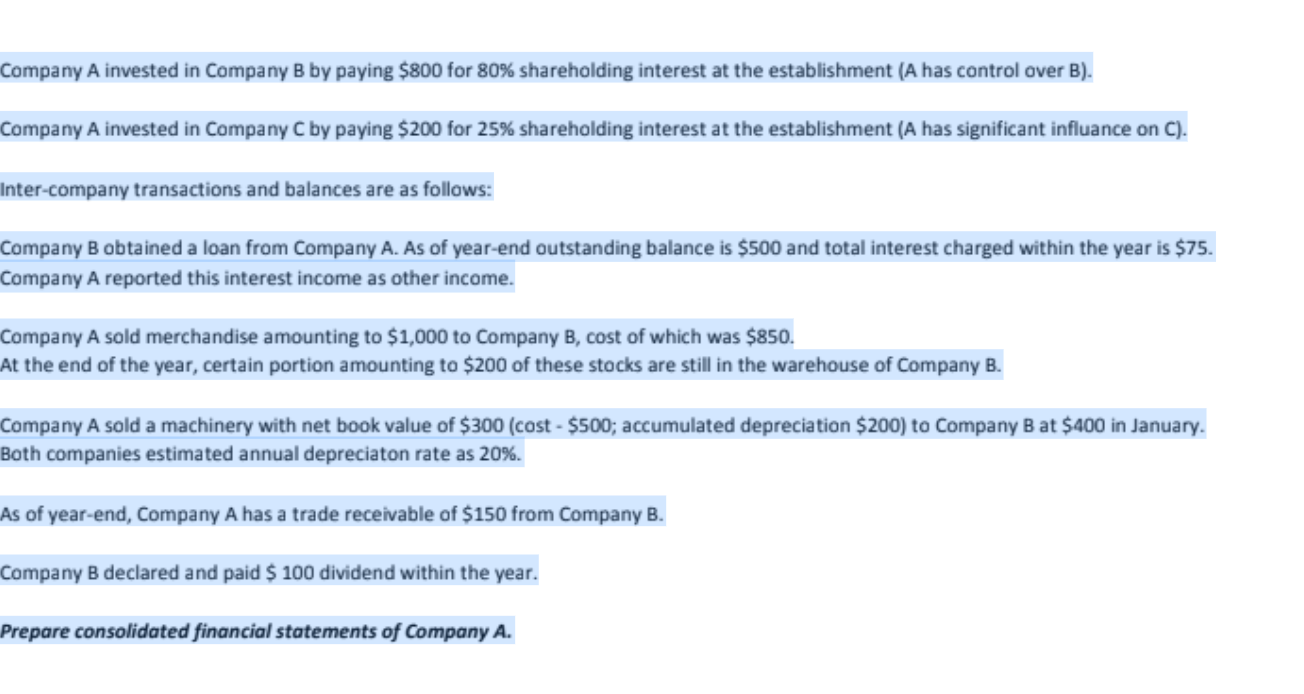

BBA 450 HOMEWORK 150 500 ASSETS Cash and Cash Equivalents Trade Receivables Other Receivables Inventories Financial Assets Property, plant and Equipment Deferred Tax Asset 50 100 75 125 400 500 2,500 500 750 1,000 3,550 1,200 10,000 1,250 200 2,500 1,000 150 1,500 2,500 1,950 100 500 250 50 200 120 40 LIABILITIES Bank Loans Trade Payables Taxes Payable EQUITY Capital Retained Earnings Net Income 3,000 1,250 1,200 1,000 500 200 800 240 100 1 10,000 2,500 1,500 INCOME STATEMENT Sales ICOS General and Admin Expenses Other Income Other Expense Finance Cost Tax Charge 12,500 (10,000)| (1,250)| 1,000 (500) (250) (300) 1,200 2,500 (2,000)| (225) 200 (100) (75) (100) 200 2,000 (1,600)| (150)|| 25 (50)| (50)| (75) 100 Company A invested in Company B by paying $800 for 80% shareholding interest at the establishment (A has control over B). Company A invested in Company C by paying $200 for 25% shareholding interest at the establishment (A has significant influance on C). Inter-company transactions and balances are as follows: Company B obtained a loan from Company A. As of year-end outstanding balance is $500 and total interest charged within the year is $75. Company A reported this interest income as other income. Company A sold merchandise amounting to $1,000 to Company B, cost of which was $850. At the end of the year, certain portion amounting to $200 of these stocks are still in the warehouse of Company B. Company A sold a machinery with net book value of $300 (cost-$500; accumulated depreciation $200) to Company B at $400 in January. Both companies estimated annual depreciaton rate as 20% As of year-end, Company A has a trade receivable of $150 from Company B. Company B declared and paid $ 100 dividend within the year. Prepare consolidated financial statements of Company A. BBA 450 HOMEWORK 150 500 ASSETS Cash and Cash Equivalents Trade Receivables Other Receivables Inventories Financial Assets Property, plant and Equipment Deferred Tax Asset 50 100 75 125 400 500 2,500 500 750 1,000 3,550 1,200 10,000 1,250 200 2,500 1,000 150 1,500 2,500 1,950 100 500 250 50 200 120 40 LIABILITIES Bank Loans Trade Payables Taxes Payable EQUITY Capital Retained Earnings Net Income 3,000 1,250 1,200 1,000 500 200 800 240 100 1 10,000 2,500 1,500 INCOME STATEMENT Sales ICOS General and Admin Expenses Other Income Other Expense Finance Cost Tax Charge 12,500 (10,000)| (1,250)| 1,000 (500) (250) (300) 1,200 2,500 (2,000)| (225) 200 (100) (75) (100) 200 2,000 (1,600)| (150)|| 25 (50)| (50)| (75) 100 Company A invested in Company B by paying $800 for 80% shareholding interest at the establishment (A has control over B). Company A invested in Company C by paying $200 for 25% shareholding interest at the establishment (A has significant influance on C). Inter-company transactions and balances are as follows: Company B obtained a loan from Company A. As of year-end outstanding balance is $500 and total interest charged within the year is $75. Company A reported this interest income as other income. Company A sold merchandise amounting to $1,000 to Company B, cost of which was $850. At the end of the year, certain portion amounting to $200 of these stocks are still in the warehouse of Company B. Company A sold a machinery with net book value of $300 (cost-$500; accumulated depreciation $200) to Company B at $400 in January. Both companies estimated annual depreciaton rate as 20% As of year-end, Company A has a trade receivable of $150 from Company B. Company B declared and paid $ 100 dividend within the year. Prepare consolidated financial statements of Company A