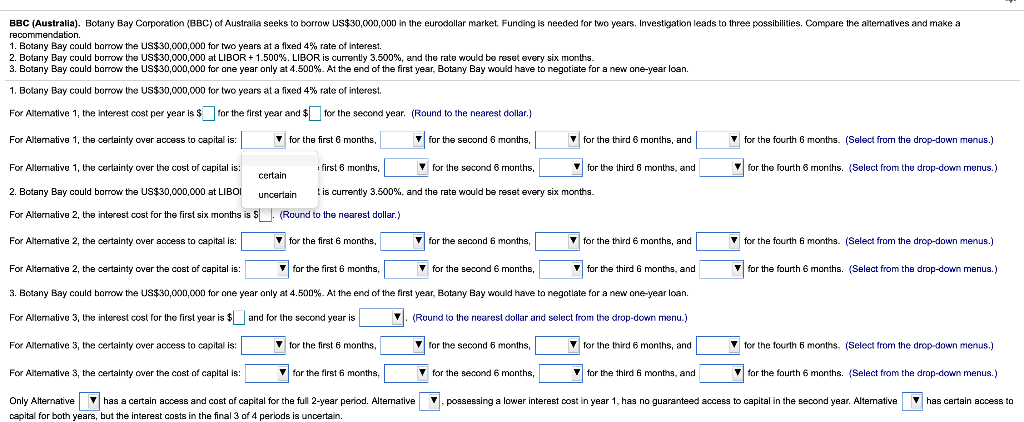

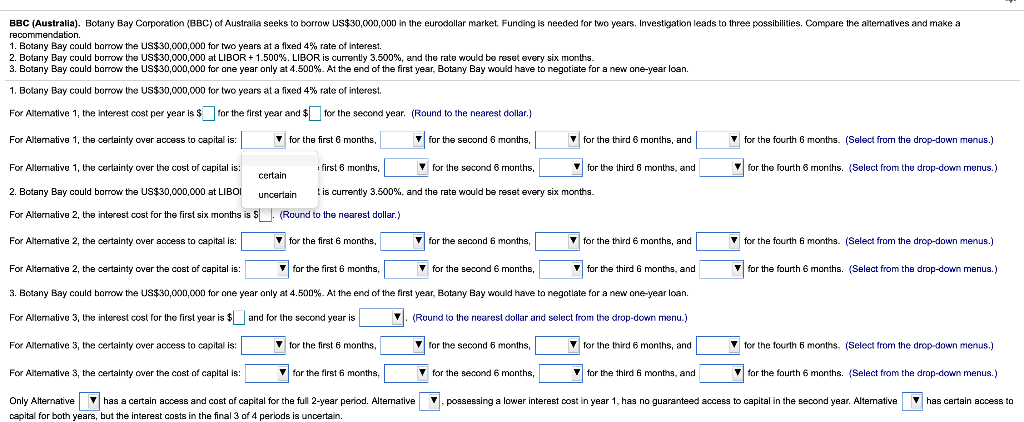

BBC (Australia). Botany Bay Corporation (BBC) of Australia seeks to borrow US$30,000,000 in the eurodollar market. Funding is needed for two years. Investigation leads to three possibilities Compare the alternatives and make a recommendation. 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 4% rate of interest. 2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.500%. LIBOR is currently 3.500%, and the rate would be reset every six months. 3. Botany Bay could borrow the US$30,000,000 for one year only at 4.500%. At the end of the first year, Botany Bay would have to negotiate for a new one-year loan 1. Bolany Bay could borrow the US$30,000,000 for two years at a fixed 4% rate of interest For Altemative 1, the interest cost per year is $ for the first year and for the second year. (Round to the nearest dollar.) For Alternative 1, the certainty over access to capital is: for the first 6 months, for the second 6 months. for the third 6 months, and for the fourth 6 months. (Select from the drop-down menus.) for the fourth 6 months. (Select from the drop-down menus.) For Alternative 1, the certainty over the cost of capital is: first 6 months, for the second 6 months , for the third 6 months, and certain 2. Botany Bay could borrow the US$30,000,000 at LIBOI uncertain ! is currently 3.500%, and the rate would be reset every six months. For Alternative 2, the interest cost for the first six months is $ . (Round to the nearest dollar.) For Alternative 2, the certainty over access to capital is: for the first 6 months, VI for the second 6 months, for the third 6 months, and for the fourth 6 months. (Select from the drop-down menus.) For Alternative 2, the certainty over the cost of capital is: for the first 6 months, for the second 6 months, for the third 6 months, and for the fourth 6 months. (Select from the drop-down menus.) 3. Botany Bay could borrow the US$30,000,000 for one year only at 4.500%. At the end of the first year, Botany Bay would have to negotiate for a new one-year loan. For Alternative 3, the interest cost for the first year is $ and for the second year is V. (Round to the nearest dollar and select from the drop-down menu.) For Alterative 3, the certainty over access to capital is: for the first 6 months, , for the second 6 months, , for the third 6 months, and for the fourth 6 months. (Select from the drop-down menus.) For Alterative 3, the certainty over the cost of capital is: for the first 6 months, for the second 6 months, for the third 6 months, and for the fourth 6 months. (Select from the drop-down menus.) Only Alternative has a certain access and cost of capital for the full 2-year period. Alternative capital for both years, but the interest costs in the final 3 of 4 periods is uncertain. possessing a lower interest cost in year 1, has no guaranteed access to capital in the second year. Alterative has certain access to