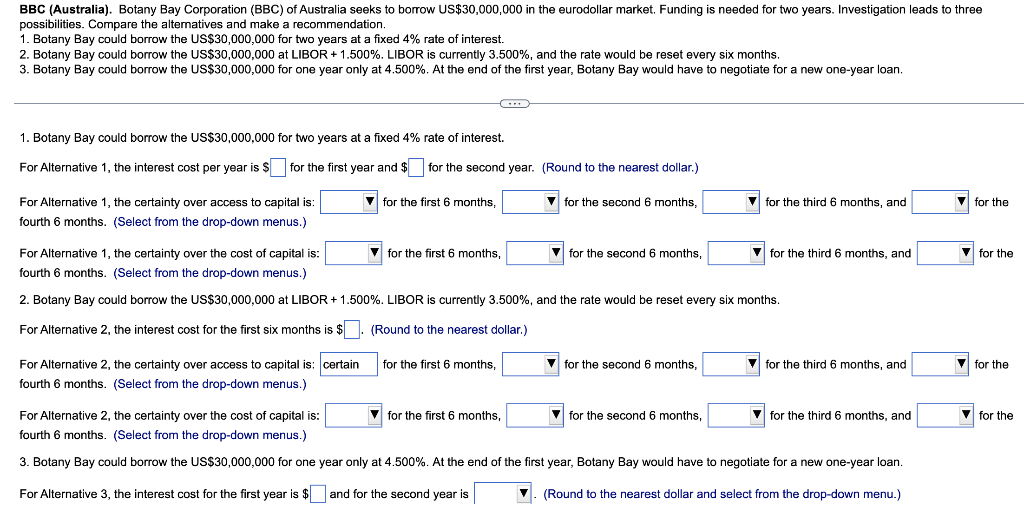

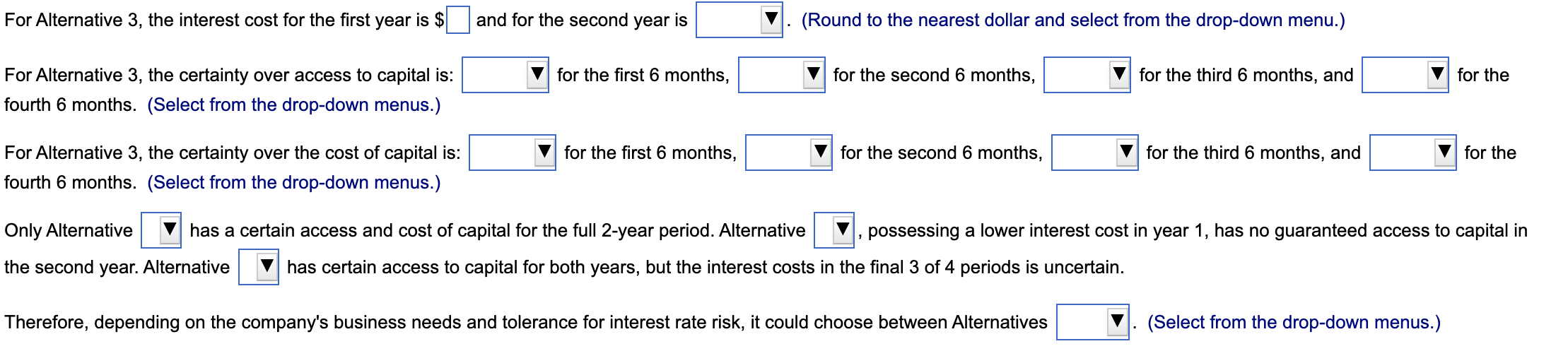

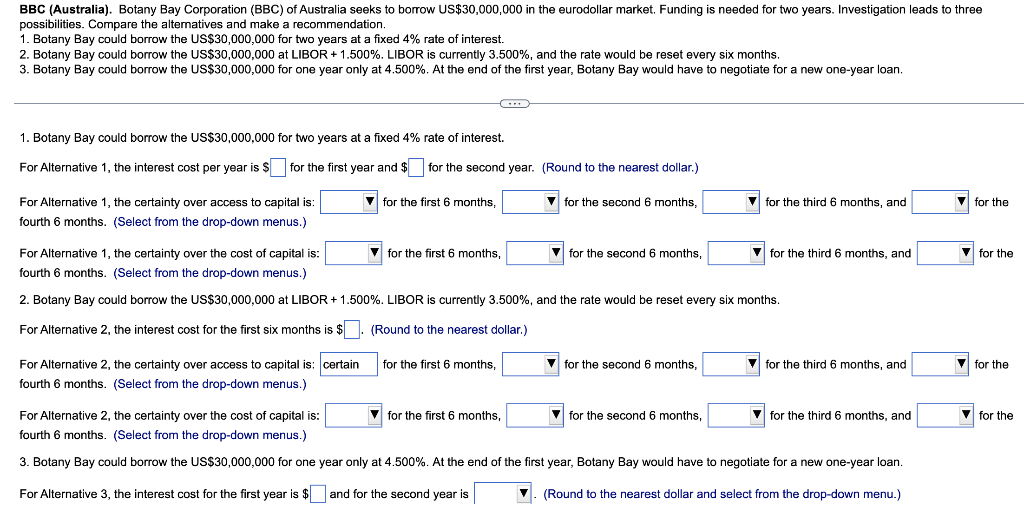

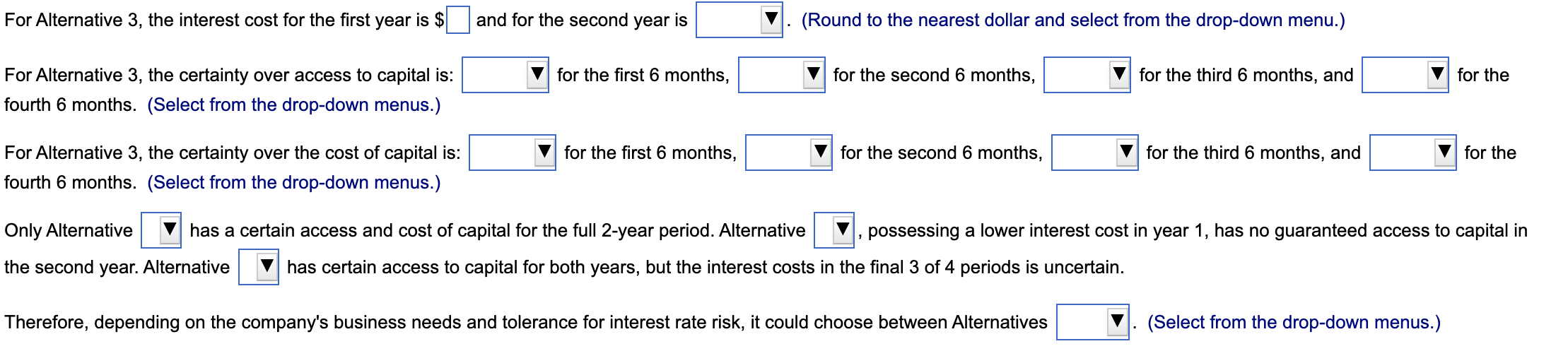

BBC (Australia). Botany Bay Corporation (BBC) of Australia seeks to borrow US$30,000,000 in the eurodollar market. Funding is needed for two years. Investigation leads to three possibilities. Compare the alternatives and make a recommendation 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 4% rate of interest. 2. Botany Bay could borrow the US$30,000,000 at LIBOR +1.500%. LIBOR is currently 3.500%, and the rate would be reset every six months. 3. Botany Bay could borrow the US$30,000,000 for one year only at 4.500%. At the end of the first year, Botany Bay would have to negotiate for a new one-year loan. C 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 4% rate of interest. For Alternative 1, the interest cost per year is for the first year and $ for the second year. (Round to the nearest dollar.) $ for the first 6 months, for the second 6 months, for the third 6 months, and for the For Alternative 1, the certainty over access to capital is: fourth 6 months. (Select from the drop-down menus.) for the for the first 6 months, for the second For Alternative 1, the certainty over the cost of capital is: months, for the third 6 months, and fourth 6 months. (Select from the drop-down menus.) 2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.500%. LIBOR is currently 3.500%, and the rate would be reset every six months. For Alternative 2, the interest cost for the first six months is $. (Round to the nearest dollar.) for the first 6 months, for the second 6 months, for the third 6 months, and v for the For Alternative 2, the certainty over access to capital is certain fourth 6 months. (Select from the drop-down menus.) for the first 6 months, 7 for the second months, for the third 6 months, and for the For Alternative 2, the certainty over the cost of capital is: fourth months. (Select from the drop-down menus.) 3. Botany Bay could borrow the US$30,000,000 for one year only at 4.500%. At the end of the first year, Botany Bay would have to nego for a new one-year loan. For Alternative 3, the interest cost for the first year is $ and for the second year is (Round to the nearest dollar and select from the drop-down menu.) For Alternative 3, the interest cost for the first year is $ and for the second year is (Round to the nearest dollar and select from the drop-down menu.) for the first 6 months, for the second 6 months, for the third 6 months, and for the For Alternative 3, the certainty over access to capital is: fourth 6 months. (Select from the drop-down menus.) for the first 6 months, for the second 6 months, for the third 6 months, and for the For Alternative 3, the certainty over the cost of capital is: fourth 6 months. (Select from the drop-down menus.) Only Alternative has a certain access and cost of capital for the full 2-year period. Alternative possessing a lower interest cost in year 1, has no guaranteed access to capital in the second year. Alternative has certain access to capital for both years, but the interest costs in the final 3 of 4 periods is uncertain. Therefore, depending on the company's business needs and tolerance for interest rate risk, it could choose between Alternatives (Select from the drop-down menus.)