Question

BBS has just approached Bulldog requesting a $300,000 loan to strengthen the Cash account and to pay certain, pressing short-term obligations. Bulldog is uncertain whether

BBS has just approached Bulldog requesting a $300,000 loan to strengthen the Cash account and to pay certain, pressing short-term obligations. Bulldog is uncertain whether the loan should be made, and has asked your group to analyze the Companys financial situation and make a recommendation.

You determine the following ratios are typical of companies in BBS industry:

| Current Ratio | 2.5 |

| Acid-Test Ratio | 1.2 |

| Average Collection Period | 18 days |

| Average Sale Period | 50 days |

| Return on Assets | 10% |

| Debt-to-Equity Ratio | 0.75 |

| Times Interest Earned | 6.0 |

| Price-Earnings Ratio | 9 |

Common Size Balance Sheet

| This Year | Last Year | |

| Current Assets: | ||

| Cash | 2.3% | 6.1% |

| Marketable Securities | 0.0% | 1.5% |

| Accounts Receivable, net | ||

| Inventory | 24.2% | |

| Prepaid Expenses | 0.5% | 0.6% |

| Total Current Assets | 51.5% | |

| Plant and Equipment, net | 55.5% | |

| Total Assets | 100% | 100% |

| Liabilities: | ||

| Current Liabilities | 27.5% | |

| Bonds Payable, 12% | 18.8% | 22.7% |

| Total Liabilities | 40.9% | |

| Stockholders' Equity: | ||

| Preferred Stock, $50 par, 8% | 5.0% | 6.1% |

| Common Stock, $10 par | 15.2% | |

| Retained Earnings | 36.3% | |

| Total Stockholders' Equity | 53.8% | |

| Total Liabilities & Stockholders' Equity | 100% | 100% |

**Note: Columns do not total down in all cases due to rounding.

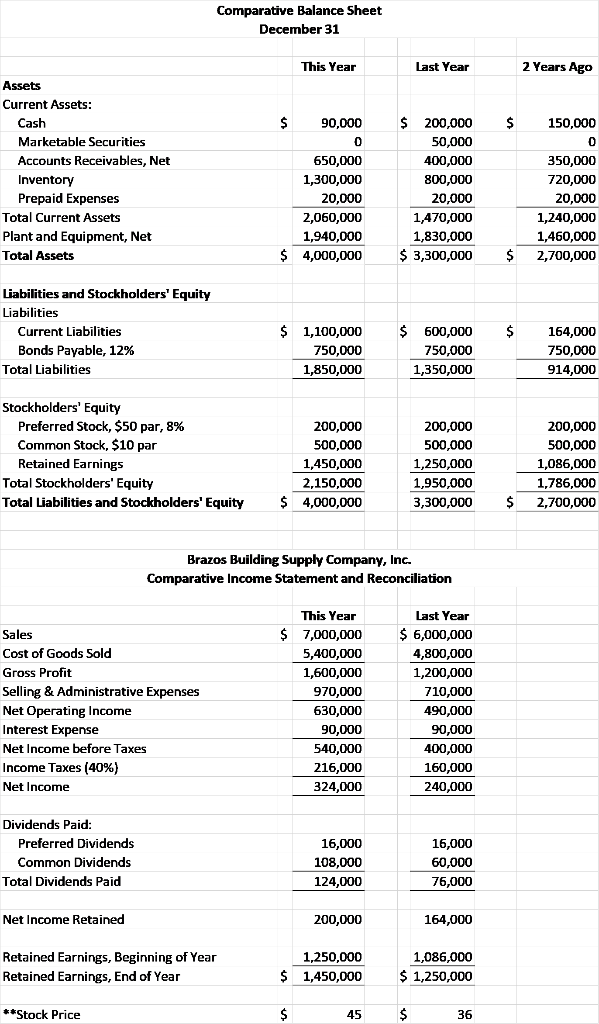

Given the information above and from the additional Financial Statements, what would be the % of Total Current Assets from Last Year?

Given the information above and from the additional Financial Statements, what would be the % of Plant and Equipment, net for This Year?

Given the information above and from the additional Financial Statements, what would be the % of Current Liabilities from Last Year?

Comparative Balance Sheet December 31 This Year Last Year 2 Years Ago 90,000 $ 150,000 Assets Current Assets: Cash Marketable Securities Accounts Receivables, Net Inventory Prepaid Expenses Total Current Assets Plant and Equipment, Net Total Assets 650,000 1,300,000 20,000 2,060,000 1,940,000 4,000,000 $ 200,000 50,000 400,000 800,000 20,000 1,470,000 1,830,000 $ 3,300,000 350,000 720,000 20,000 1,240,000 1,460,000 2,700,000 $ $ Liabilities and Stockholders' Equity Liabilities Current Liabilities Bonds Payable, 12% Total Liabilities $ $ $ 1,100,000 750,000 1,850,000 600,000 750,000 1,350,000 164,000 750,000 914,000 Stockholders' Equity Preferred Stock, $50 par, 8% Common Stock, $10 par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 200,000 500,000 1,450,000 2,150,000 4,000,000 200,000 500,000 1,250,000 1,950,000 3,300,000 200,000 500,000 1,086,000 1,786,000 2,700,000 $ $ Brazos Building Supply Company, Inc. Comparative Income Statement and Reconciliation $ Sales Cost of Goods Sold Gross Profit Selling & Administrative Expenses Net Operating Income Interest Expense Net Income before Taxes Income Taxes (40%) Net Income This Year 7,000,000 5,400,000 1,600,000 970,000 630,000 90,000 540,000 216,000 324,000 Last Year $ 6,000,000 4,800,000 1,200,000 710,000 490,000 90,000 400,000 160,000 240,000 Dividends Paid: Preferred Dividends Common Dividends Total Dividends Paid 16,000 108,000 124,000 16,000 60,000 76,000 Net Income Retained 200,000 164,000 Retained Earnings, Beginning of Year Retained Earnings, End of Year $ 1,250,000 1,450,000 1,086,000 $ 1,250,000 **Stock Price $ 45 $ 36Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started