Answered step by step

Verified Expert Solution

Question

1 Approved Answer

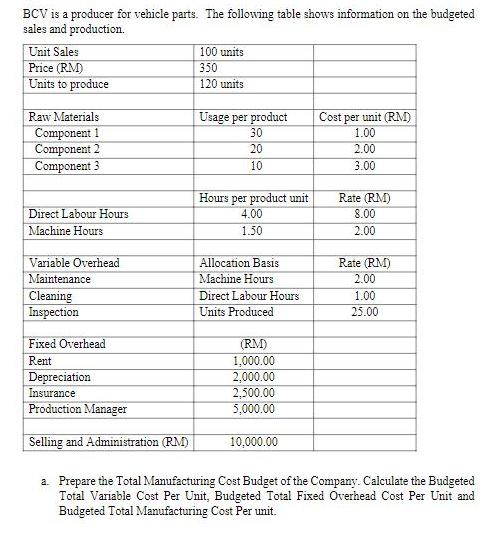

BCV is a producer for vehicle parts. The following table shows information on the budgeted sales and production. Unit Sales Price (RM) Units to

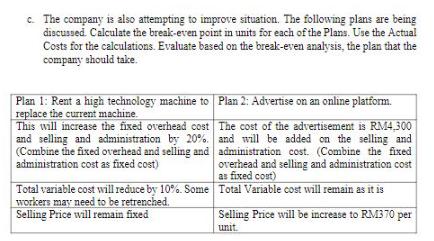

BCV is a producer for vehicle parts. The following table shows information on the budgeted sales and production. Unit Sales Price (RM) Units to produce Raw Materials Component 1 Component 2 Component 3 Direct Labour Hours Machine Hours Variable Overhead Maintenance Cleaning Inspection Fixed Overhead Rent Depreciation Insurance Production Manager Selling and Administration (RM) 100 units 350 120 units Usage per product 30 20 10 Hours per product unit 4.00 1.50 Allocation Basis Machine Hours Direct Labour Hours Units Produced (RM) 1,000.00 2,000.00 2,500.00 5,000.00 10,000.00 Cost per unit (RM) 1.00 2.00 3.00 Rate (RM) 8.00 2.00 Rate (RM) 2.00 1.00 25.00 a. Prepare the Total Manufacturing Cost Budget of the Company. Calculate the Budgeted Total Variable Cost Per Unit, Budgeted Total Fixed Overhead Cost Per Unit and Budgeted Total Manufacturing Cost Per unit. b. The following table are the Actual outcome of the operations. Prepare the Actual Total Manufacturing Cost of the Company. Calculate the Actual Total Variable Cost Per Unit, Actual Total Fixed Overhead Cost Per Unit and Actual Total Manufacturing Cost Per unit. Unit Sales Price (RM) Units Produced Raw Materials Component 1 Component 2 Component 3 Direct Labour Hours Machine Hours Variable Overhead Maintenance Cleaning Inspection Fixed Overhead Rent Depreciation Insurance Production Manager Selling and Administration (RM) 100 350 120 Usage per product 35 20 10 Hours per product unit 5.00 2.00 Allocation Basis Machine Hours Direct Labour Hours Units Produced (RM) 1,200.00 2,000.00 2,500.00 5,500.00 10,000.00 Cost per unit (RM) 1.00 2.50 3.00 Rate (RM) 6.00 2.00 Rate (RM) 3.00 0.80 35.00 c. The company is also attempting to improve situation. The following plans are being discussed Calculate the break-even point in units for each of the Plans. Use the Actual Costs for the calculations. Evaluate based on the break-even analysis, the plan that the company should take. Plan 1: Rent a high technology machine to replace the current machine. This will increase the fixed overhead cost and selling and administration by 20%. (Combine the fixed overhead and selling and administration cost as fixed cost) Plan 2: Advertise on an online platform. The cost of the advertisement is RM4,300 and will be added on the selling and administration cost. (Combine the fixed overhead and selling and administration cost as fixed cost) Total variable cost will reduce by 10%. Some Total Variable cost will remain as it is workers may need to be retrenched. Selling Price will remain fixed Selling Price will be increase to RM370 per unit.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started