Question

BDB Company manufactures its one product by a process that requires two departments. The production starts in Department A and is completed in Department B.

BDB Company manufactures its one product by a process that requires two departments. The production starts in Department A and is completed in Department B. Direct materials are added at the beginning of the process in Department A. Additional direct materials are added when the process is 50% complete in Department B. Conversion costs are incurred proportionally throughout the production processes in both departments.

BDB Company manufactures its one product by a process that requires two departments. The production starts in Department A and is completed in Department B. Direct materials are added at the beginning of the process in Department A. Additional direct materials are added when the process is 50% complete in Department B. Conversion costs are incurred proportionally throughout the production processes in both departments.

On April 1, Department A had 500 units in Work-in-Process estimated to be 30% complete for conversion; Department B had 300 units in Work-in-Process estimated to be 40% complete for conversion. During April, Department A started 2,000 units and completed 2,100 units; Department B completed 2,000 units. The ending Work-in-Process Inventory on April 30 in Department A is estimated to be 50% complete for conversion, and the ending Work-in-Process Inventory in Department B is estimated to be 70% complete for conversion.

The cost sheet for Department A shows that the units in the beginning Work-in-Process Inventory had $4,950 in direct materials costs and $2,014 in conversion costs. The production costs incurred in April were $20,800 for direct materials and $26,000 for conversion. Department Bs beginning Work-in-Process Inventory on April 1 was $2,740, of which $1,200 was transferred-in costs; it incurred $42,720 in direct materials costs and $27,074 in conversion costs in April.

BDB Company uses the weighted-average method for Departments A and B.

Required:

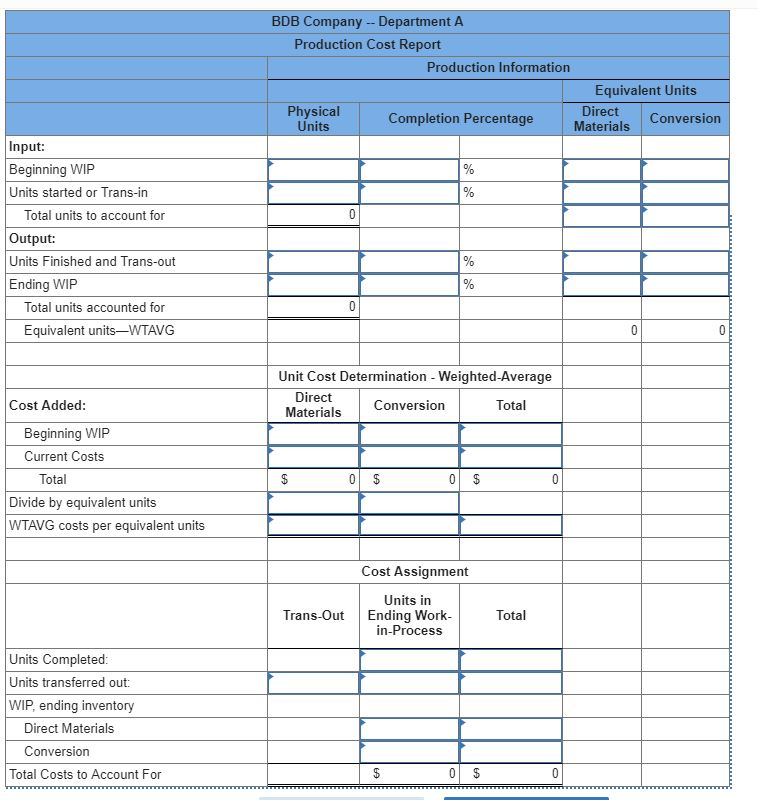

1. Prepare a production cost report for Department A.

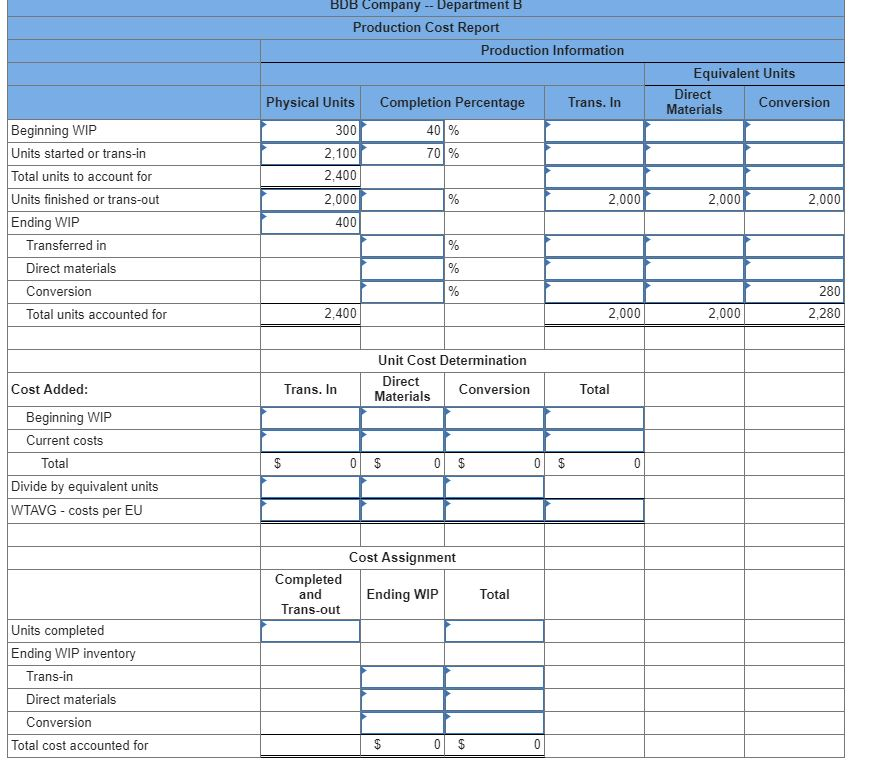

2. Prepare a production cost report for Department B.

BDB Company-Department B Production Cost Report Production Information Equivalent Units Direct Materials Physical Units 300 2,100 2,400 2,000 400 Completion Percentage Trans. In Conversion Beginning WIP Units started or trans-in Total units to account for Units finished or trans-out Ending WIP 401 % 70 | % 2,000 2,000 2,000 Transferred in Direct materials Conversion Total units accounted for 280 2,280 2,400 2,000 2,000 Unit Cost Determination Direct Materials Cost Added Trans. In Conversion Total Beginning WIP Current costs Total Divide by equivalent units WTAVG costs per EU Cost Assignment Completed and Trans-out Ending WIP Total Units completed Ending WIP inventory Trans-in Direct materials Conversion Total cost accounted forStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started