Answered step by step

Verified Expert Solution

Question

1 Approved Answer

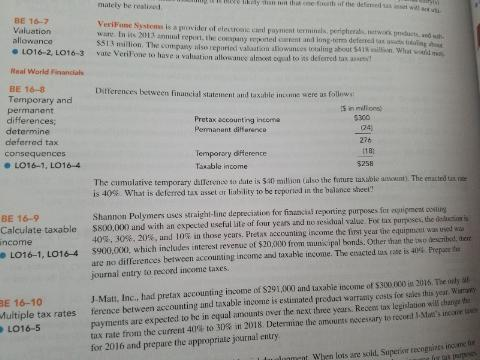

BE 16-8 l mately be realizet BE 16-7 VeriFane Systoms is a poosider of etectr ware In ins D1.3 anniual repet, the coapany veporned c

BE 16-8

l mately be realizet BE 16-7 VeriFane Systoms is a poosider of etectr ware In ins D1.3 anniual repet, the coapany veporned c S513 million, The cunngany adso reparied valaatim vare Veril one to have a valiation allouane almost opal to its roenc card poyment terminls.periphiera network pmoucts s Valuation ut carrent and long-term deternel san usts tiving alowancos totaling ahout S418illin. What watkd allowanco LOI 6-2, LOI 6-3 to its deformed tan asses Real World Financials BE 16-8 Temporary and permanent differences determine deferrad tax consequences Differences between financial statement and tuxithie inone were as follews s in millions 5300 Pretax accounting incorma 24) 276 18; $258 Temporry dfHerence Tsable income e LO16-1, LO164 The cumulative temporary dalterens to dute is 530 milion (also the future tasable asount) The emusted x ne is 40% what is deferred tax asset ar liablity to be roporlod in the balance sheeC Shannon Polymers uses sraighi-line depeeciation for fintaicis reponirg purposes fot coqsimest costug S800,000 and with an expected useful uteof imur ycins and up eudual nalue tas 40%, 30%, 20%, and 10 e in those years. Preta, accounting income the first year the equipnati wai used aa BE 16-9 Calculate taxable ncome e LO16-1, LO16-4 Fix tax purpuses, the doos are no differences between accounaing incame and taxable income. The etsacted tas rote is 40%Prerce a journal entry to necond income taxes 5900,000, which inctudes interest reveru of $20,M00 from munisipal bonds. Other than the swo described der J-Matt, Inc.,had pretax accounting income of $291,000 and taxahie iocome of $300 0co in 2015. The ily ut payments are expected to he in eqal anounts over the next thnee years Recos tax legislation will change h tax rate trorn the current 40% to 30% in 2018 Determine the amounts recessary to rooni istons income for 2016 and prepare the appropriate journal entry BE 16-10 Multiple tax rates L016-5 ference between accounting and taxable incone is esinated preduct warramiy costs for sakes this yest Warn DUCWn lois are soild, Superion tecognints inc me teStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started