Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BE 2-1 Issuance of materials Obj. 2 On May 7, Bergan Company purchased on account 10,000 units of raw materials at $8 per unit. During

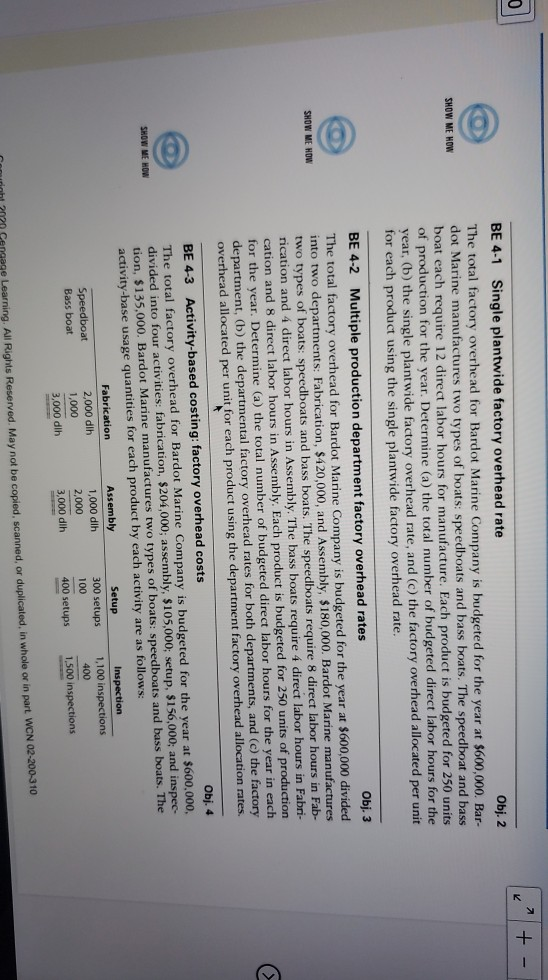

BE 2-1 Issuance of materials Obj. 2 On May 7, Bergan Company purchased on account 10,000 units of raw materials at $8 per unit. During May, raw materials were requisitioned for production as follows: 7,500 units for Job 200 at $8 per unit and 1,480 units for Job 305 at $5 per unit. Journalize the entry on May 7 to record the purchase and on May 31 to record the requisition from the materials storeroom. SHOW ME HOW BE 2-2 Direct labor costs Obj. 2 During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. The total direct labor was incurred at a rate of $28 per direct labor hour for Job 200 and $24 per direct labor hour for Job 305. Journalize the entry to record the flow of labor costs into production during May. SHOW ME HOW BE 2-3 Factory overhead costs Obj. 2 During May, Bergan Company incurred factory overhead costs as follows: indirect materials, $8,800; indirect labor, $6,600; utilities cost, $4,800; and factory depreciation, $9,000. Journalize the entry to record the factory overhead incurred during May. SHOW ME HOW SHOW ME HOW BE 24 Applying factory overhead Obj. 2 Bergan Company estimates that total factory overhead costs will be $620,000 for the year. Direct labor hours are estimated to be 80,000. For Bergan Company, (a) determine the predetermined factory overhead rate using direct labor hours as the activity base, (b) determine the amount of factory overhead applied to Jobs 200 and 305 in May using the data on direct labor hours from BE 2-2, and (c) prepare the journal entry to apply factory overhead to both jobs in May according to the predetermined overhead rate. Chapter 2 Job Order Costing BE 2-5 Job costs Obj. 2 At the end of May, Bergan Company had completed Jobs 200 and 305. Job 200 is for 2,390 units, and Job 305 is for 2,053 units. Using the data from BE 2-1, BE 2-2, and BE 2-4, determine (a) the balance on the job cost sheets for Jobs 200 and 305 at the end of May, and (b) the cost per unit for Jobs 200 and 305 at the end of May. SHOW ME HOW BE 2-6 Cost of goods sold Obj. 2 Pine Creek Company completed 200,000 units during the year at a cost of $3,000,000. The beginning finished goods inventory was 25,000 units at $310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow. SHOW ME HOW 0 SHOW ME HOW BE 4-1 Single plantwide factory overhead rate Obj. 2 The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000. Bar- dot Marine manufactures two types of boats: speedboats and bass boats. The speedboat and bass boat each require 12 direct labor hours for manufacture. Each product is budgeted for 250 units of production for the year. Determine (a) the total number of budgeted direct labor hours for the year, (b) the single plant wide factory overhead rate, and (c) the factory overhead allocated per unit for each product using the single plantwide factory overhead rate. SHOW ME HOW BE 4-2 Multiple production department factory overhead rates Obj. 3 The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000 divided into two departments: Fabrication, $420,000, and Assembly, $180,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require 8 direct labor hours in Fab- rication and 4 direct labor hours in Assembly. The bass boats require 4 direct labor hours in Fabri- cation and 8 direct labor hours in Assembly. Each product is budgeted for 250 units of production for the year. Determine (a) the total number of budgeted direct labor hours for the year in each department, (b) the departmental factory overhead rates for both departments, and (c) the factory overhead allocated per unit for each product using the department factory overhead allocation rates. SHOW ME HOW BE 4-3 Activity-based costing: factory overhead costs Obj. 4 The total factory overhead for Bardot Marine Company is budgeted for the year at $600.000, divided into four activities: fabrication, $204,000; assembly, $105,000; setup. $156,000; and inspec- tion, $135,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 2,000 dih 1,000 dih 300 setups 1,100 inspections Bass boat 1,000 2,000 3,000 dih 3,000 dih 400 setups 1.500 inspections 100 400 12070 Gangage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part WCN 02-200-310 Chapter 4 Activity-Based Costing 181 Each product is budgeted for 250 units of production for the year. Determine (a) the activity rates for each activity and (b) the activity-based factory overhead per unit for each product. SHOW ME HOW BE 4-4 Activity-based costing: selling and administrative expenses Obj. 5 Jungle Junior Company manufactures and sells outdoor play equipment. Jungle Junior uses activity-based costing to determine the cost of the sales order processing and the customer return activity. The sales order processing activity has an activity rate of $20 per sales order, and the cus- tomer return activity has an activity rate of $100 per return. Jungle Junior sold 2,500 swing sets, which consisted of 750 orders and 80 returns. Determine (a) the total and (b) the per-unit sales order processing and customer return activity cost for swing sets. SHOW ME HOW BE 4-5 Activity-based costing for a service business Obj. 6 Sterling Hotel uses activity-based costing to determine the cost of servicing customers. There are three activity pools: guest check-in, room cleaning, and meal service. The activity rates associated with each activity pool are $8 per guest check-in, $25 per room cleaning, and $4 per served meal (not including food). Ginny Campbell visited the hotel for a three-night stay. Campbell had three meals in the hotel during her visit. Determine the total activity-based cost for Campbell's visit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started