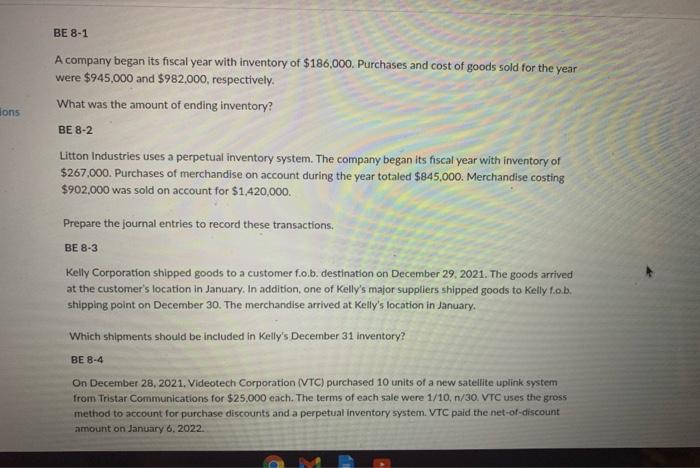

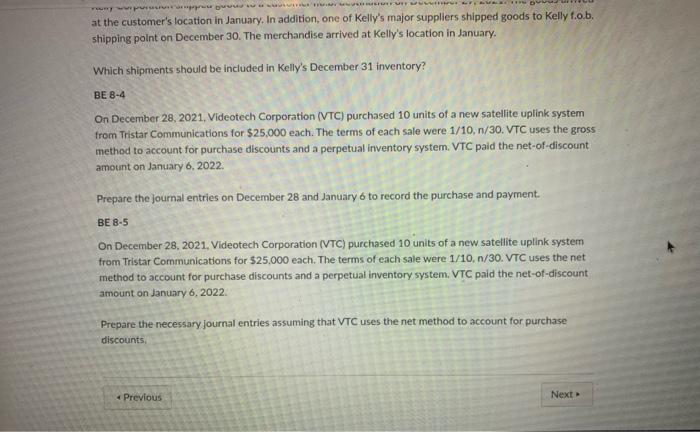

BE 8-1 lons A company began its fiscal year with inventory of $186,000. Purchases and cost of goods sold for the year were $945,000 and $982,000, respectively. What was the amount of ending inventory? BE 8-2 Litton Industries uses a perpetual inventory system. The company began its fiscal year with inventory of $267.000. Purchases of merchandise on account during the year totaled $845.000. Merchandise costing $902,000 was sold on account for $1.420,000 Prepare the journal entries to record these transactions. BE 8-3 Kelly Corporation shipped goods to a customer f.o.b. destination on December 29, 2021. The goods arrived at the customer's location in January. In addition, one of Kelly's major suppliers shipped goods to Kelly fo.b. shipping point on December 30. The merchandise arrived at Kelly's location in January Which shipments should be included in Kelly's December 31 inventory? BE 8-4 On December 28, 2021. Videotech Corporation (VTC) purchased 10 units of a new satellite uplink system from Tristar Communications for $25,000 each. The terms of each sale were 1/10,n/30. VTC uses the gross method to account for purchase discounts and a perpetual inventory system. VTC paid the net-of-discount amount on January 6, 2022 at the customer's location in January. In addition, one of Kelly's major suppliers shipped goods to Kelly f.o.b. shipping point on December 30. The merchandise arrived at Kelly's location in January Which shipments should be included in Kelly's December 31 inventory? BE 8-4 On December 28, 2021, Videotech Corporation (VTC) purchased 10 units of a new satellite uplink system from Tristar Communications for $25,000 each. The terms of each sale were 1/10,n/30. VTC uses the gross method to account for purchase discounts and a perpetual inventory system. VTC paid the net-of-discount amount on January 6, 2022. Prepare the journal entries on December 28 and January 6 to record the purchase and payment. BE 8-5 On December 28, 2021. Videotech Corporation (VTC) purchased 10 units of a new satellite uplink system from Tristar Communications for $25,000 each. The terms of each sale were 1/10,n/30. VTC uses the net method to account for purchase discounts and a perpetual inventory system. VTC paid the net-of-discount amount on January 6, 2022. Prepare the necessary journal entries assuming that VTC uses the net method to account for purchase discounts Previous Next