Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BE 9-7 please keep in mind we are going from under capacity to over capacity. per unit, calculate the target selling price Corporation produces high

BE 9-7 please keep in mind we are going from under capacity to over capacity.

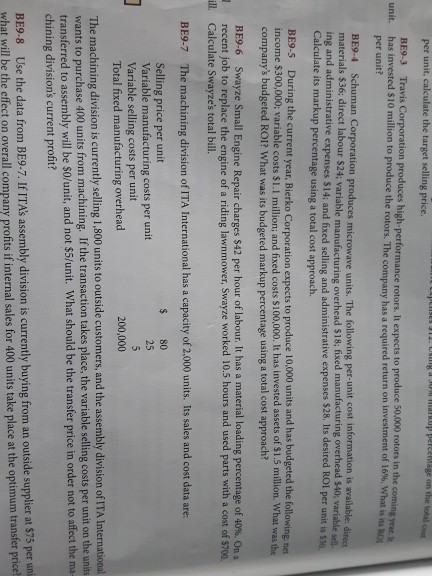

per unit, calculate the target selling price Corporation produces high performance rotors. It expects to produce 50.,000 rotors in the comi has invested sio million to produce the rotors. The company has a required return on investment of 16% per unit? unit. BE9.4 Sc human Corporation produces microwave units. The following per-unit cost information is available materials $36; direct labour $24: variable manufacturing overhead $18; fixed manufacturing overhead $40; variable ing and administrative expenses $14; and fixed selling and administrative expenses $28. Its desired ROI per unit Calculate its markup percentage using a total cost approach BE9-5 During the current year, Bierko Corporation expects to produce 10,000 units and has budgeted the followin income $300,000; variable costs $1.1 million; and fixed costs S100,000. It has invested assets of $1.5 million. What was the company's budgeted RO1? What was its budgeted markup percentage using a total cost approach? Swayze Small Engine Repair charges S42 per hour of labour. It has a material loading percentage of 40% on a BE9-6 recent job to replace the engine of a riding lawnmower, Swayze worked 10.5 hours and used parts with a cost of $700 ill. Calculate Swayze's total bill ??9-7 The machining division of ITA International has a capacity of 2,000 units. Its sales and cost data are: $ 80 25 Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Total fixed manufacturing overhead 200,000 1,800 units to outside customers, and the assembly division of ITA Internatio The machining division is currently selling wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be S0/unit, and not $5/unit. What should be the transfer price in order not to affect the ma chining division's current profit? BE98 Use the data from BE9.7 If ITA's assembly division is currently buying from an outside supplier at $75 per un what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started