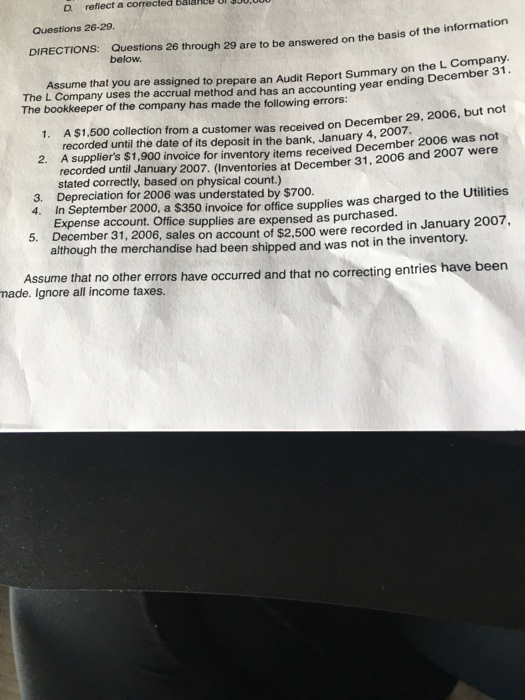

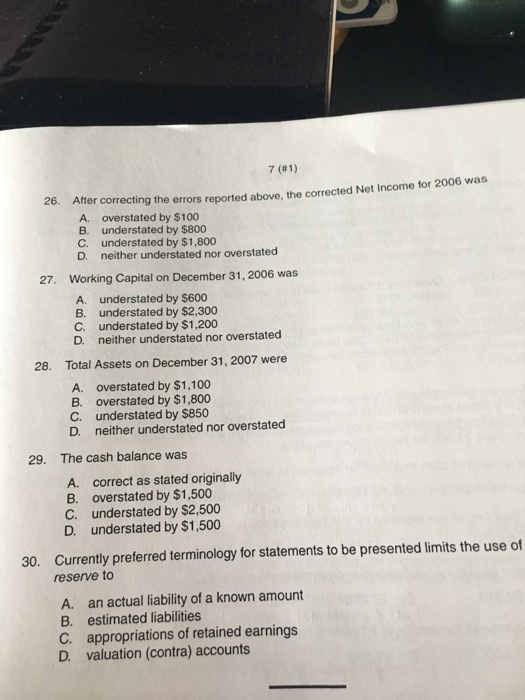

be answered on the basis of the information accounting year ending December 31. D reflect a corrected balance UI SJU,000 Questions 26-29. DIRECTIONS: Questions 26 through 29 are to be answered on the basis on below. Assume that you are assigned to prepare an Audit Report Su assigned to prepare an Audit Report Summary on the company. The L Company uses the accrual method and has an accounting year ending The bookkeeper of the company has made the following errors: 1. A $1,500 collection from a customer was received on December a customer was received on December 29, 2006, but not recorded until the date of its deposit in the bank, January 4, 20 January 4, 2007. 2. A suppliers $1,900 invoice for inventory iteme received December 2000 was recorded until January 2007. (Inventories at December 31, 2000 and stated correctly, based on physical count.) 3. Depreciation for 2006 was understated by $700. 4. In September 2000, a $350 invoice for office supplies was charged to t was charged to the Utilities Expense account. Office supplies are expensed as purchased. 5. December 31, 2006, sales on account of $2.500 were recorded in January 2007, although the merchandise had been shipped and was not in the inventory. Assume that no other errors have occurred and that no correcting entries have been made. Ignore all income taxes. 7 (1) 20. After correcting the errors reported above, the corrected Net Income for 2006 was A overstated by $100 B. understated by $800 c. understated by $1,800 D. neither understated nor overstated imod 27. Working Capital on December 31, 2006 was A understated by $600 B. understated by $2,300 c. understated by $1,200 D. neither understated nor overstated 28. Total Assets on December 31, 2007 were overstated by $1,100 B. overstated by $1,800 C. understated by $850 D. neither understated nor overstated 29. The cash balance was A. correct as stated originally B. overstated by $1,500 C. understated by $2,500 D understated by $1,500 30. Currently preferred terminology for statements to be presented limits the use of reserve to A. an actual liability of a known amount B. estimated liabilities C. appropriations of retained earnings D valuation (contra) accounts