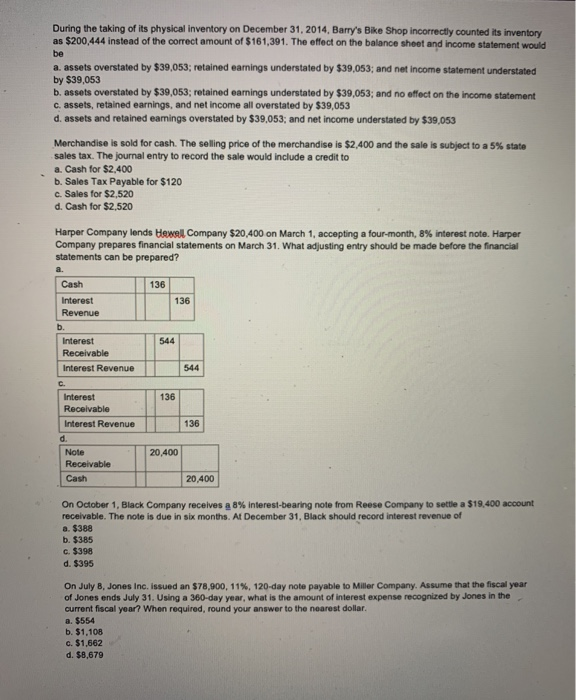

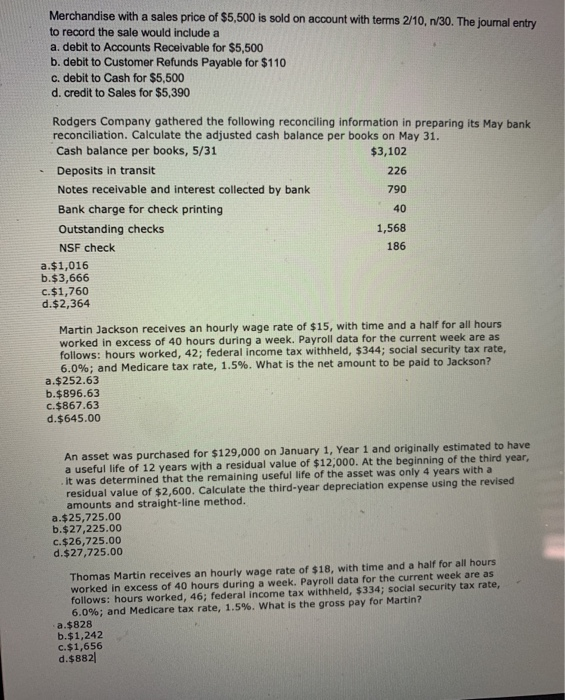

be by $39,053 During the taking of its physical inventory on December 31, 2014, Barry's Bike Shop incorrectly counted its inventory as $200,444 instead of the correct amount of $161,391. The effect on the balance sheet and income statement would a assets overstated by $39,053; retained earnings understated by $39,053; and net income statement understated b.assets overstated by $39,053; retained earnings understated by $39,053; and no effect on the income statement c.assets, retained earnings, and net income all overstated by $39,053 d. assets and retained earnings overstated by $39,053; and net income understated by $39,053 Merchandise is sold for cash. The selling price of the merchandise is $2,400 and the sale is subject to a 5% state sales tax. The journal entry to record the sale would include a credit to a. Cash for $2,400 b. Sales Tax Payable for $120 c. Sales for $2,520 d. Cash for $2,520 Harper Company lends Hewal Company $20,400 on March 1, accepting a four-month, 8% interest note. Harper Company prepares financial statements on March 31. What adjusting entry should be made before the financial statements can be prepared? a. Cash 136 136 Interest Revenue b. Interest Receivable Interest Revenue 544 544 C. 136 136 Interest Receivable Interest Revenue d Note Receivable Cash 20,400 20,400 On October 1, Black Company receives a 8% interest-bearing note from Reese Company to settle a $19.400 account receivable. The note is due in six months. At December 31, Black should record interest revenue of a. $388 b. $385 c. $398 d. $395 On July 8, Jones Inc. issued an $78,900,11%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar. a $554 b. $1,108 c. $1,662 d. $8,679 Merchandise with a sales price of $5,500 is sold on account with terms 2/10, 1/30. The journal entry to record the sale would include a a. debit to Accounts Receivable for $5,500 b. debit to Customer Refunds Payable for $110 c. debit to Cash for $5,500 d. credit to Sales for $5,390 Rodgers Company gathered the following reconciling information in preparing its May bank reconciliation. Calculate the adjusted cash balance per books on May 31. Cash balance per books, 5/31 $3,102 Deposits in transit 226 Notes receivable and interest collected by bank 790 Bank charge for check printing Outstanding checks 1,568 NSF check 186 a $1,016 b.$3,666 c. $1,760 d.$2,364 40 Martin Jackson receives an hourly wage rate of $15, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 42; federal income tax withheld, $344; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the net amount to be paid to Jackson? a $252.63 b.$896.63 c. $867.63 d. $645.00 An asset was purchased for $129,000 on January 1, Year 1 and originally estimated to have a useful life of 12 years with a residual value of $12,000. At the beginning of the third year, . it was determined that the remaining useful life of the asset was only 4 years with a residual value of $2,600. Calculate the third-year depreciation expense using the revised amounts and straight-line method. a. $25,725.00 b.$ 27,225.00 c. $26,725.00 d. $27,725.00 Thomas Martin receives an hourly wage rate of $18, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $334; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a $828 b.$1,242 c. $1,656 d.$882