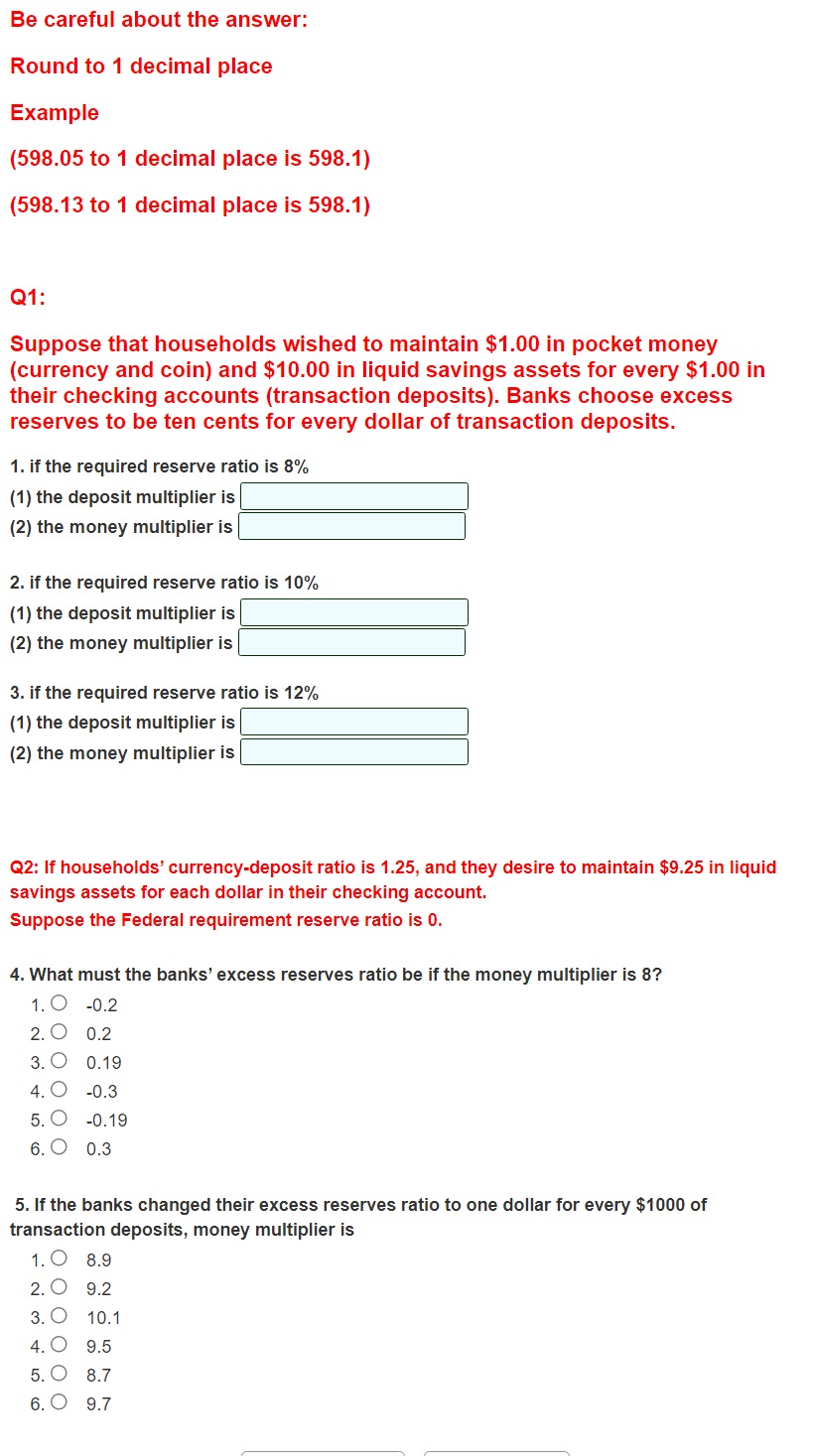

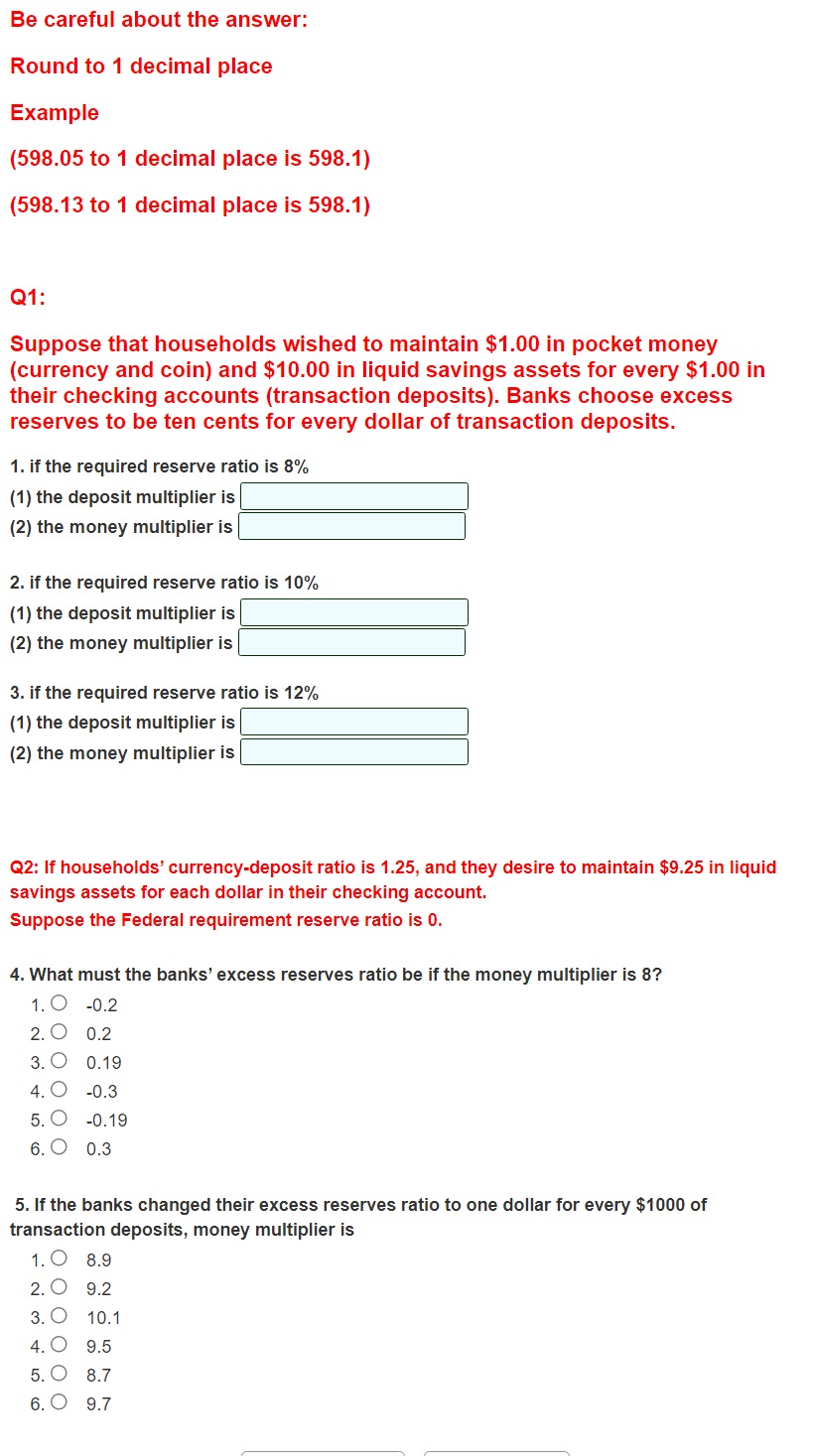

Be careful about the answer: Round to 1 decimal place Example (598.05 to 1 decimal place is 598.1) (598.13 to 1 decimal place is 598.1) Q1: Suppose that households wished to maintain $1.00 in pocket money (currency and coin) and $10.00 in liquid savings assets for every $1.00 in their checking accounts (transaction deposits). Banks choose excess reserves to be ten cents for every dollar of transaction deposits. 1. if the required reserve ratio is 8% (1) the deposit multiplier is (2) the money multiplier is 2. if the required reserve ratio is 10% (1) the deposit multiplier is (2) the money multiplier is 3. if the required reserve ratio is 12% (1) the deposit multiplier is (2) the money multiplier is Q2: If households' currency-dep ratio is 1.25, and they desire to maintain $9.25 in liquid savings assets for each dollar in their checking account. Suppose the Federal requirement reserve ratio is 0. 4. What must the banks' excess reserves ratio be if the money multiplier is 8? 1. O -0.2 2. O 0.2 3. O 0.19 4. O -0.3 5. O -0.19 6. O 0.3 5. If the banks changed their excess reserves ratio to one dollar for every $1000 of transaction deposits, money multiplier is 1. O 8.9 2. O 9.2 3. O 10.1 4. O 9.5 5. O 8.7 6.0 9.7 Be careful about the answer: Round to 1 decimal place Example (598.05 to 1 decimal place is 598.1) (598.13 to 1 decimal place is 598.1) Q1: Suppose that households wished to maintain $1.00 in pocket money (currency and coin) and $10.00 in liquid savings assets for every $1.00 in their checking accounts (transaction deposits). Banks choose excess reserves to be ten cents for every dollar of transaction deposits. 1. if the required reserve ratio is 8% (1) the deposit multiplier is (2) the money multiplier is 2. if the required reserve ratio is 10% (1) the deposit multiplier is (2) the money multiplier is 3. if the required reserve ratio is 12% (1) the deposit multiplier is (2) the money multiplier is Q2: If households' currency-dep ratio is 1.25, and they desire to maintain $9.25 in liquid savings assets for each dollar in their checking account. Suppose the Federal requirement reserve ratio is 0. 4. What must the banks' excess reserves ratio be if the money multiplier is 8? 1. O -0.2 2. O 0.2 3. O 0.19 4. O -0.3 5. O -0.19 6. O 0.3 5. If the banks changed their excess reserves ratio to one dollar for every $1000 of transaction deposits, money multiplier is 1. O 8.9 2. O 9.2 3. O 10.1 4. O 9.5 5. O 8.7 6.0 9.7