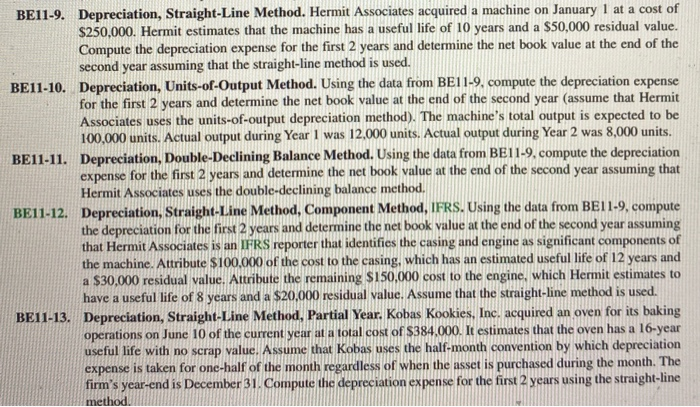

BE11-9. Depreciation, Straight-Line Method. Hermit Associates acquired a machine on January 1 at a cost of $250.000. Hermit estimates that the machine has a useful life of 10 years and a $50,000 residual value. Compute the depreciation expense for the first 2 years and determine the net book value at the end of the second year assuming that the straight-line method is used. BE11-10. Depreciation, Units-of-Output Method. Using the data from BE11-9, compute the depreciation expense for the first 2 years and determine the net book value at the end of the second year (assume that Hermit Associates uses the units-of-output depreciation method). The machine's total output is expected to be 100.000 units. Actual output during Year I was 12,000 units. Actual output during Year 2 was 8,000 units. BE11-11. Depreciation, Double-Declining Balance Method. Using the data from BE11-9. compute the depreciation expense for the first 2 years and determine the net book value at the end of the second year assuming that Hermit Associates uses the double-declining balance method. BE11-12. Depreciation, Straight-Line Method, Component Method, IFRS. Using the data from BE11-9, compute the depreciation for the first 2 years and determine the net book value at the end of the second year assuming that Hermit Associates is an IFRS reporter that identifies the casing and engine as significant components of the machine. Attribute $100,000 of the cost to the casing, which has an estimated useful life of 12 years and a $30,000 residual value. Attribute the remaining S150,000 cost to the engine, which Hermit estimates to have a useful life of 8 years and a $20,000 residual value. Assume that the straight-line method is used. BE11-13. Depreciation, Straight-Line Method, Partial Year. Kobas Kookies, Inc. acquired an oven for its baking operations on June 10 of the current year at a total cost of $384.000. It estimates that the oven has a 16-year useful life with no scrap value. Assume that Kobas uses the half-month convention by which depreciation expense is taken for one-half of the month regardless of when the asset is purchased during the month. The firm's year-end is December 31. Compute the depreciation expense for the first 2 years using the straight-line method