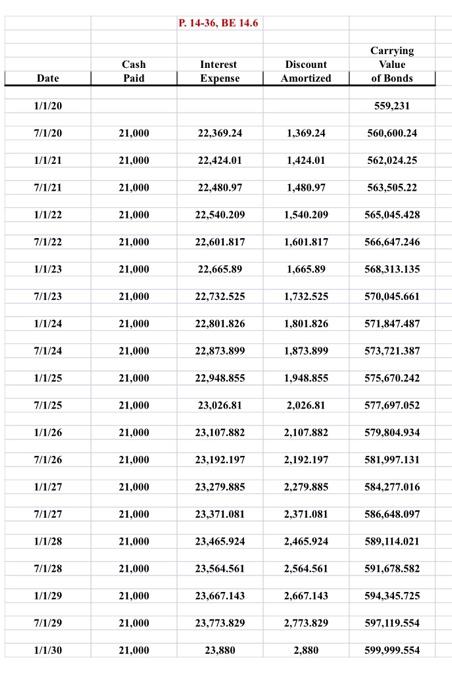

BE14.6 (LO 1) On January 1, 2020, JWS Corporation issued $600,000 of 7% bonds, due in 10 years. The bonds were issued for $559,224, and pay interest each July 1 and January 1. JWS uses the effective-interest method. Prepare the companys journal entries for (a) the January 1 issuance, (b) the July 1 interest pay- ment, and (c) the December 31 adjusting entry. Assume an effective-interest rate of 8%.

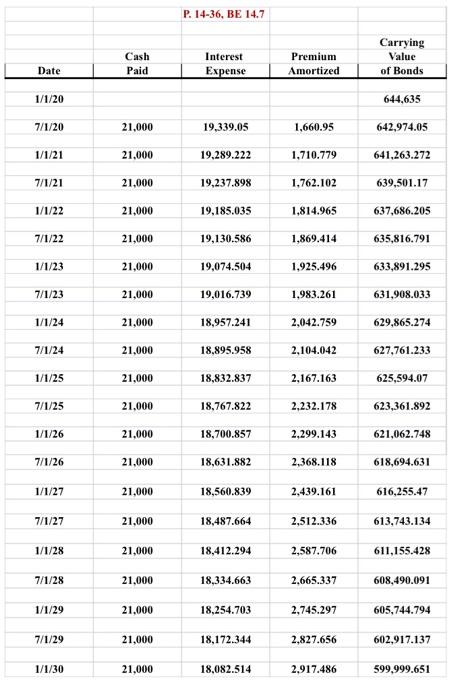

BE14.7 (LO 1) Assume the bonds in BE14.6 were issued for $644,636 and the effective-interest rate is 6%. Prepare the companys journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry.

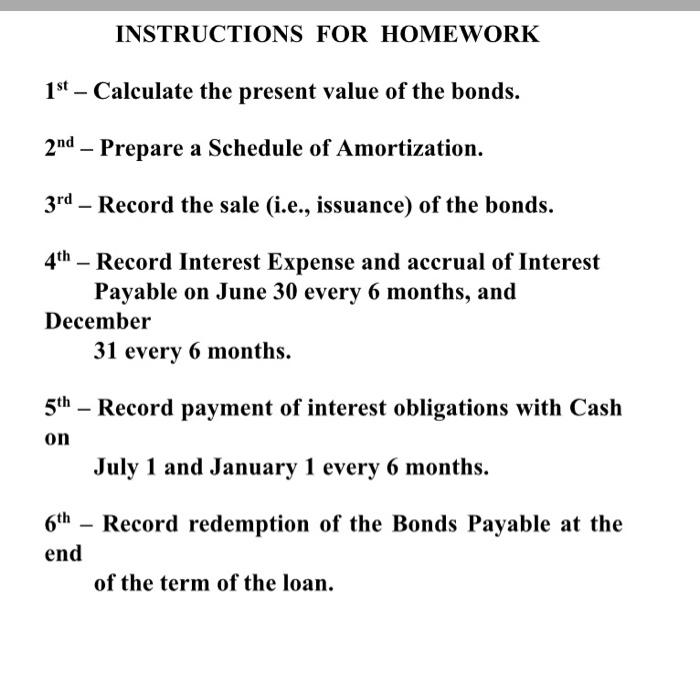

INSTRUCTIONS FOR HOMEWORK 1st - Calculate the present value of the bonds. 2nd - Prepare a Schedule of Amortization. 3rd Record the sale (i.e., issuance) of the bonds. 4th Record Interest Expense and accrual of Interest Payable on June 30 every 6 months, and December 31 every 6 months. 5th - Record payment of interest obligations with Cash on July 1 and January 1 every 6 months. 6th end Record redemption of the Bonds Payable at the of the term of the loan. P. 14-36, BE 14.7 Cash Paid Interest Expense Premium Amortized Carrying Value of Bonds Date 1/1/20 644,635 7/1/20 21,000 19.339.05 1,660.95 642,974.05 1/1/21 21,000 19,289.222 1,710.779 641,263.272 7/1/21 21,000 19,237.898 1,762.102 639,501.17 1/1/22 21,000 19,185.035 1,814.965 637,686.205 7/1/22 21,000 19,130.586 1,869.414 635,816.791 1/1/23 21,000 19,074.504 1.925.496 633,891.295 7/1/23 21,000 19,016.739 1,983.261 631,908.033 1/1/24 21,000 18,957.241 2,042.759 629,865.274 7/1/24 21,000 18,895.958 2,104.042 627,761.233 1/1/25 21,000 18,832.837 2,167.163 625,594.07 7/1/25 21,000 18,767.822 2,232.178 623,361.892 1/1/26 21,000 18,700.857 2,299.143 621,062.748 7/1/26 21,000 18,631.882 2,368.118 618,694.631 1/1/27 21,000 18,560.839 2.439.161 616,255.47 7/1/27 21,000 18,487.664 2,512.336 613,743.134 1/1/28 21,000 18,412.294 2,587.706 611,155.428 7/1/28 21,000 18,334.663 2.665.337 608,490.091 1/1/29 21,000 18,254.703 2,745.297 605,744.794 7/1/29 21,000 18,172.344 2.827.656 602,917.137 1/1/30 21,000 18.082.514 2,917.486 599,999.651 P. 14-36, BE 14.6 Interest Cash Paid Carrying Value of Bonds Discount Amortized Date Expense 1/1/20 559,231 7/1/20 21.000 22,369.24 1,369.24 560,600.24 1/1/21 21,000 22,424.01 1.424.01 562,024.25 7/1/21 21,000 22.480.97 1,480.97 563,505.22 1/1/22 21.000 22.540.209 1.540.209 565,045.428 7/1/22 21.000 22,601.817 1,601.817 566,647.246 1/1/23 21,000 22,665.89 1,665.89 568,313.135 7/1/23 21,000 22,732.525 1.732.525 570,045.661 1/1/24 21,000 22,801.826 1,801.826 571,847.487 7/1/24 21,000 22.873.899 1,873.899 573.721.387 1/1/25 21,000 22.948.855 1,948.855 575,670.242 7/1/25 21.000 23.026.81 2,026.81 577.697.052 1/1/26 21,000 23.107.882 2.107.882 579.804.934 7/1/26 21,000 23,192.197 2.192.197 581,997.131 1/1/27 21,000 23.279.885 2.279.885 584,277.016 7/1/27 21,000 23,371.081 2,371.081 586,648.097 1/1/28 21.000 23.465.924 2,465.924 589,114.021 7/1/28 21,000 23,564.561 2,564.561 591,678.582 1/1/29 21,000 23,667.143 2,667.143 594,345.725 7/1/29 21,000 23,773.829 2,773.829 597,119.554 1/1/30 21,000 23.880 2.880 599,999.554