BE4-5

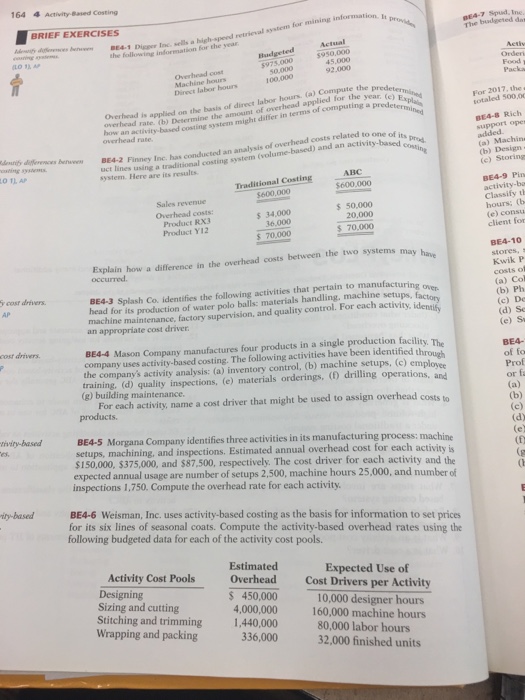

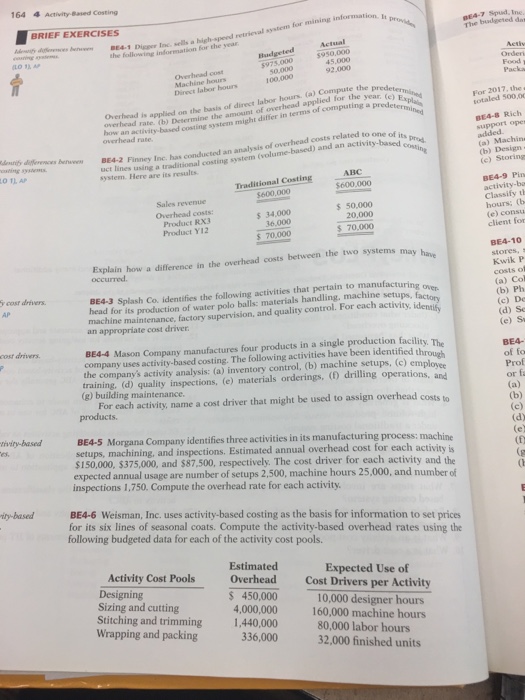

164 4 Activity Based Costing BRIEF EXERCISES dy inc 8E4-1 Digger Inc. sells a for mining information GEA-7 Spud, Ine The biadgeted das the following information for the year 950,000 45,000 92.000 5975,000 Food Machine hours Direct labor hours 100,000 For 2017, the totaled 500,0 for the year. (e) Orerhrad is applied overhead rate. (b) Determine the amount ot on the basis of direct labor hours. (a) Compute the how an activity-based costing system might ditter in overhead rate BE4-8 Rich support opes BE4-2 Finney Inc. has conducted an analysis of over uct lines using a traditional costing system costs related to one of i (solume-based) and an activity-based .nty difer was benaw" (a) Machins (b) Design (c) Storing O 11 AP system. Here are its resalts Traditional CostingABC BE4-9 Pin activity-ba Classify th hours; (b (e) consu client for $600,000 $600,000 Sales revenue Overhead costs: Product RX3 Product Y12 $ 50,000 20,000 s 70,000 $ 34,000 36,000 s 70,000 Ccepalain how a difference in the overhead costs bertween the two systems BE4-3 Splash Co. identifies the following activities that pertain to manufacturing machine maintenance, factory supervision, and quality control. For each activi BE4-10 Kwik P cost drivers AP (a) Col (b) Ph (c) De its production of water polo balls: materials handling, machine setups an appropriate cost driver (e) S nost drivers. BE4-4 Mason Company manufactures four products in a single production facility. The company uses activity-based costing. The following activities have been identified throue the company's activity analysis: (a) inventory control, (b) machine setups, (c) emplovee training. (d) quality inspections, (e) materials orderings, (D drilling operations, and (g) building maintenance BEA- of fo Prof For each activity, name a cost driver that might be used to assign overhead costs to BE4-5 Morgana Company identifies three activi ties in its manufacturing process: machine setups, machining, and inspections. Estimated annual overhead cost for each activity i $150,000, $375,000, and $87,500, respectively. The cost driver for each activity and the annual usage are number of setups 2,500, machine hours 25,000, and number of (el expected inspections 1,750. Compute the overhead rate for each activity. ity-based BE4-6 Weisman, Inc. uses activity-based costing as the basis for information to set prices for its six lines of seasonal coats. Compute the activity-based overhead rates using the following budgeted data for each of the activity cost pools. Activity Cost Pools Designing Sizing and cutting Stitching and trimming Wrapping and packing Estimated Overhead 450,000 4,000,000 Expected Use of Cost Drivers per Activity 10,000 designer hours 160,000 machine hours 1,440,000 80,000 labor hours 336,000 32,000 finished units

BE4-5

BE4-5