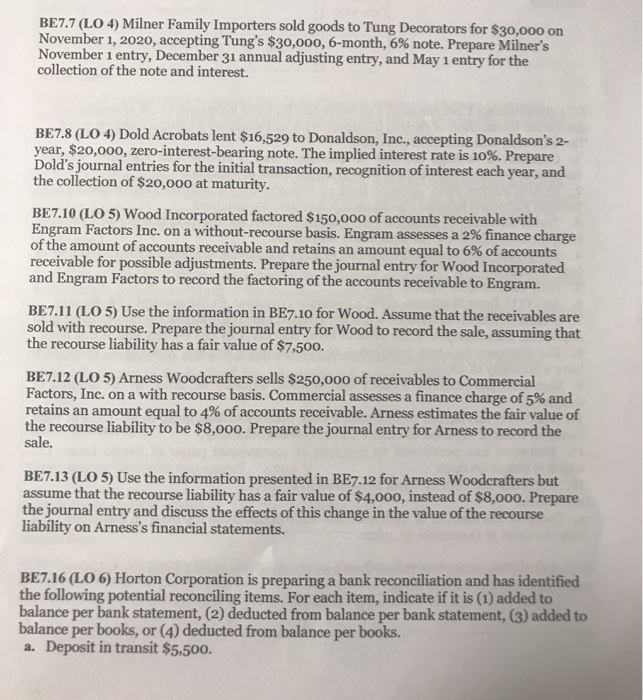

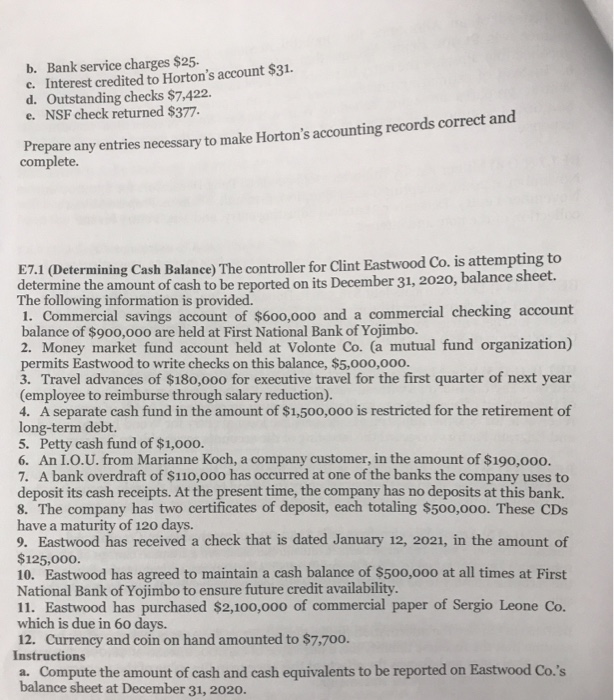

BE7.7 (LO 4) Milner Family Importers sold goods to Tung Decorators for $30,000 on November 1, 2020, accepting Tung's $30,000, 6-month, 6% note. Prepare Milner's November 1 entry, December 31 annual adjusting entry, and May 1 entry for the collection of the note and interest. BE7.8 (LO 4) Dold Acrobats lent $16,529 to Donaldson, Inc., accepting Donaldson's 2- year, $20,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare Dold's journal entries for the initial transaction, recognition of interest each year, and the collection of $20,000 at maturity. BE7.10 (LO 5) Wood Incorporated factored $150,000 of accounts receivable with Engram Factors Inc. on a without-recourse basis. Engram assesses a 2% finance charge of the amount of accounts receivable and retains an amount equal to 6% of accounts receivable for possible adjustments. Prepare the journal entry for Wood Incorporated and Engram Factors to record the factoring of the accounts receivable to Engram. BE7.11 (LO 5) Use the information in BE7.10 for Wood. Assume that the receivables are sold with recourse. Prepare the journal entry for Wood to record the sale, assuming that the recourse liability has a fair value of $7,500. BE7.12 (LO 5) Arness Woodcrafters sells $250,000 of receivables to Commercial Factors, Inc. on a with recourse basis. Commercial assesses a finance charge of 5% and retains an amount equal to 4% of accounts receivable. Arness estimates the fair value of the recourse liability to be $8,000. Prepare the journal entry for Arness to record the sale. BE7.13 (LO 5) Use the information presented in BE7.12 for Arness Woodcrafters but assume that the recourse liability has a fair value of $4,000, instead of $8,000. Prepare the journal entry and discuss the effects of this change in the value of the recourse liability on Arness's financial statements. BE7.16 (LO 6) Horton Corporation is preparing a bank reconciliation and has identified the following potential reconciling items. For each item, indicate if it is (1) added to balance per bank statement, (2) deducted from balance per bank statement. (3) added to balance per books, or (4) deducted from balance per books. a. Deposit in transit $5,500. b. Bank service charges $25. c. Interest credited to Horton's account $31. d. Outstanding checks $7,422. e. NSF check returned $377. Prepare any entries necessary to make Horton's accounting records correct and complete. E7.1 (Determining Cash Balance) The controller for Clint Eastwood Co. is attempting to determine the amount of cash to be reported on its December 31, 2020, balance sheet. The following information is provided. 1. Commercial savings account of $600,000 and a commercial checking account balance of $900,000 are held at First National Bank of Yojimbo. 2. Money market fund account held at Volonte Co. (a mutual fund organization) permits Eastwood to write checks on this balance, $5,000,000. 3. Travel advances of $180,000 for executive travel for the first quarter of next year (employee to reimburse through salary reduction). 4. A separate cash fund in the amount of $1,500,000 is restricted for the retirement of long-term debt. 5. Petty cash fund of $1,000. 6. An I.O.U. from Marianne Koch, a company customer, in the amount of $190.000 7. A bank overdraft of $110,000 has occurred at one of the banks the company uses to deposit its cash receipts. At the present time, the company has no deposits at this bank. 8. The company has two certificates of deposit, each totaling $500,000. These CDs have a maturity of 120 days. 9. Eastwood has received a check that is dated January 12, 2021, in the amount of $125,000. 10. Eastwood has agreed to maintain a cash balance of $500,000 at all times at First National Bank of Yojimbo to ensure future credit availability. 11. Eastwood has purchased $2,100,000 of commercial paper of Sergio Leone Co. which is due in 60 days. 12. Currency and coin on hand amounted to $7,700. Instructions a. Compute the amount of cash and cash equivalents to be reported on Eastwood Co.'s balance sheet at December 31, 2020