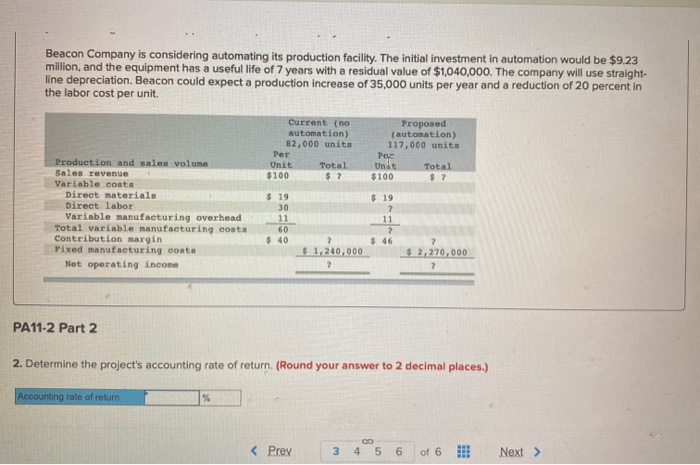

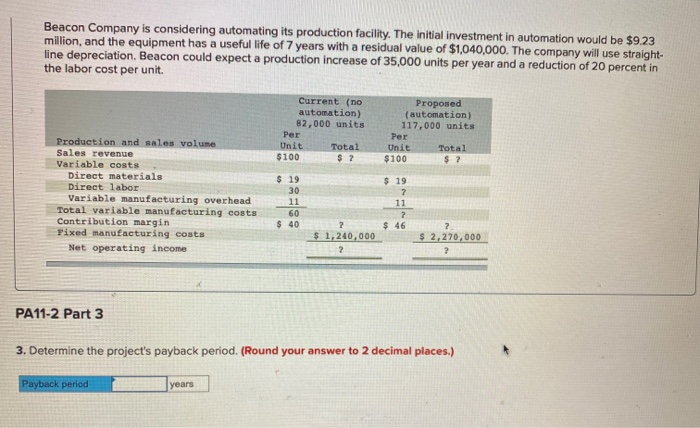

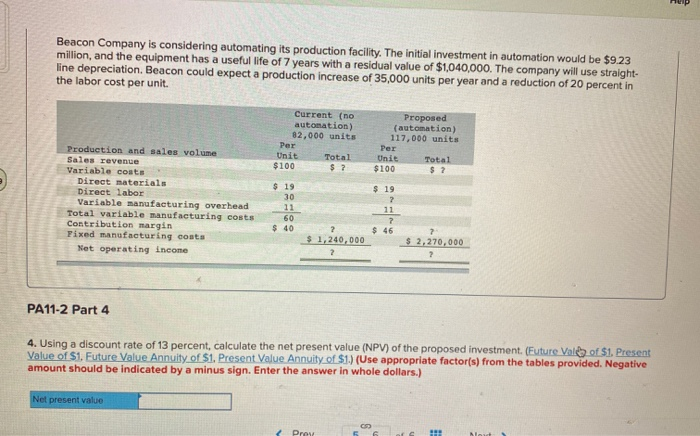

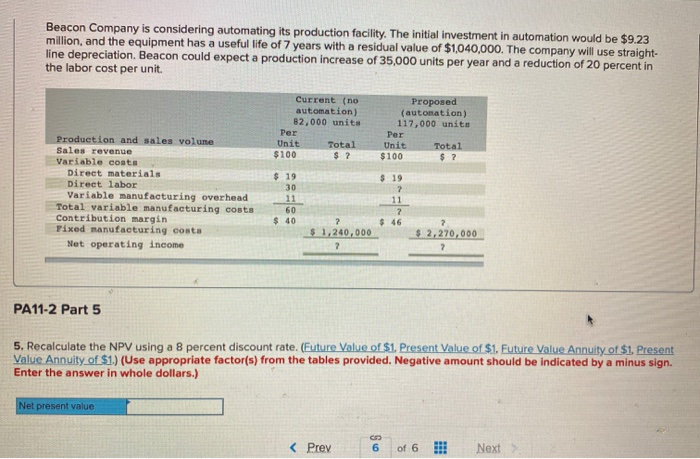

Beacon Company is considering automating its production facility. The initial investment in automation would be $9.23 million, and the equipment has a useful life of 7 years with a residual value of $1,040,000. The company will use straight- line depreciation. Beacon could expect a production increase of 35,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Per Total $100 $? Proposed (automation) 117,000 units Unit $100 Total $2 Production and sales volume Sales revenue Variable costs Direct materials Direct labor Variable manufacturing overhead Total variable manufacturing costs Contribution margin Pixed manufacturing costs Net operating income $ 19 30 11 60 $40 $ 19 2 11 2 $ 46 2 $ 1,240,000 ? $ 2,270,000 2 PA11-2 Part 2 2. Determine the project's accounting rate of return. (Round your answer to 2 decimal places.) Accounting rate of return % Beacon Company is considering automating its production facility. The initial investment in automation would be $9.23 million, and the equipment has a useful life of 7 years with a residual value of $1,040,000. The company will use straight- line depreciation. Beacon could expect a production increase of 35,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Per Unit Total $100 $ ? Proposed (automation) 117,000 units Per Unit Total $100 $ ? Production and sales volume Sales revenue Variable costs Direct materials Direct labor Variable manufacturing overhead Total variable manufacturing costa Contribution margin Fixed manufacturing costs Net operating income $ 19 30 11 60 $ 40 $ 19 2 11 7 $ 46 $ 1,240,000 2 ? $ 2,270,000 2 PA11-2 Part 3 3. Determine the project's payback period. (Round your answer to 2 decimal places.) Payback period years Beacon Company is considering automating its production facility. The initial investment in automation would be $9.23 million, and the equipment has a useful life of 7 years with a residual value of $1,040,000. The company will use straight- line depreciation. Beacon could expect a production increase of 35,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 82,000 units Per Unit Total $100 $ ? Proposed (automation) 117,000 units Per Unit Total $100 $? Production and sales volume Sales revenue Variable costs Direct materials Direct Labor Variable manufacturing overhead Total variable manufacturing costs Contribution margin Fixed manufacturing costs Net operating income $ 19 30 11 60 $ 40 $ 19 ? 11 2 $ 46 2 $ 1,240,000 2 $ 2,270,000 2 PA11-2 Part 4 4. Using a discount rate of 13 percent, calculate the net present value (NPV) of the proposed investment. (Euture Val of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Enter the answer in whole dollars.) Net present value