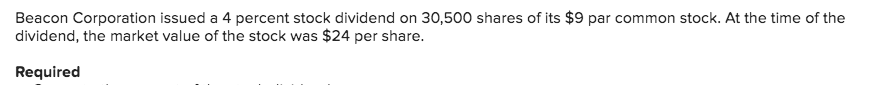

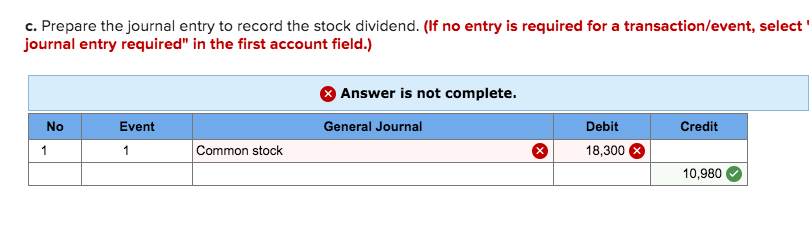

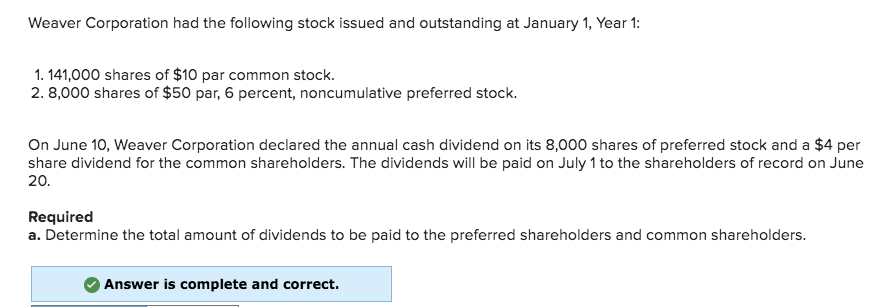

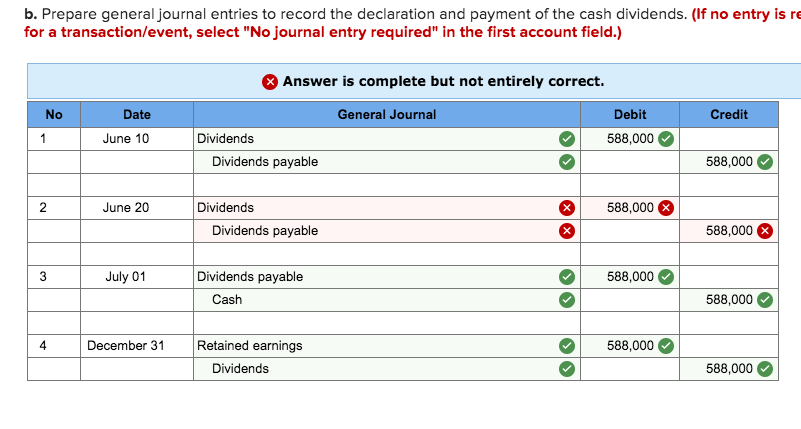

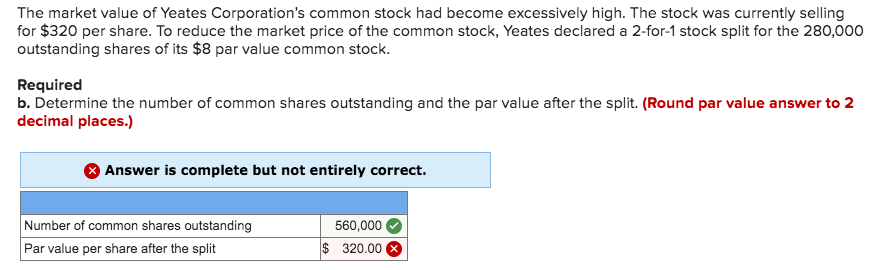

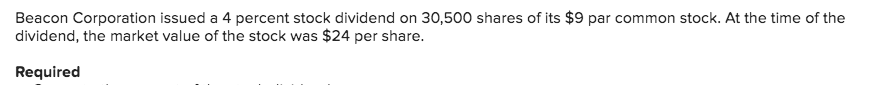

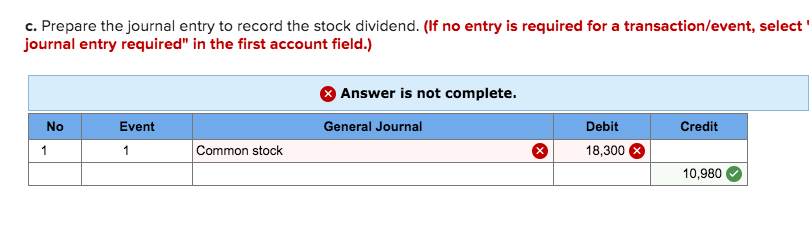

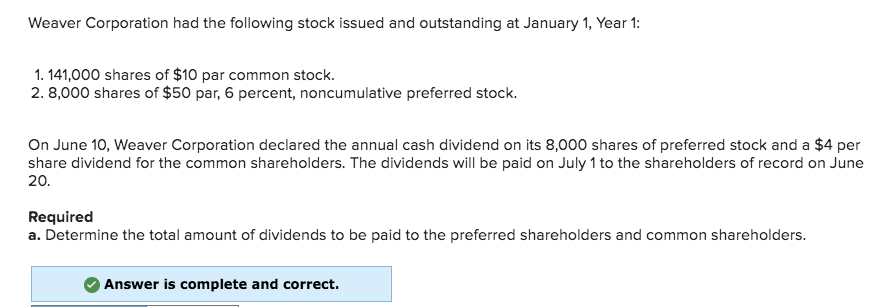

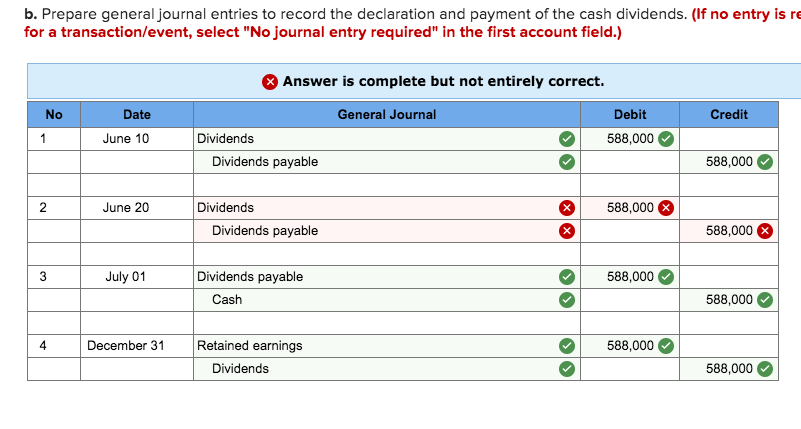

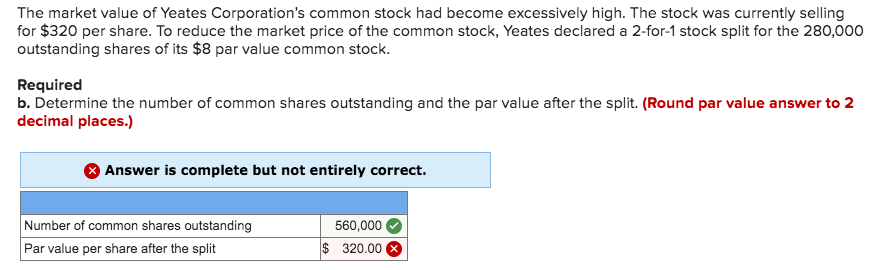

Beacon Corporation issued a 4 percent stock dividend on 30,500 shares of its $9 par common stock. At the time of the dividend, the market value of the stock was $24 per share. Required c. Prepare the journal entry to record the stock dividend. (If no entry is required for a transaction/event, select journal entry required" in the first account field.) Answer is not complete. No Event General Journal Credit Debit 18,300 Common stock 10,980 Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 1. 141,000 shares of $10 par common stock. 2. 8,000 shares of $50 par, 6 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 8,000 shares of preferred stock and a $4 per share dividend for the common shareholders. The dividends will be paid on July 1 to the shareholders of record on June 20. Required a. Determine the total amount of dividends to be paid to the preferred shareholders and common shareholders. Answer is complete and correct. b. Prepare general journal entries to record the declaration and payment of the cash dividends. (If no entry is re for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Date General Journal Credit Debit 588,000 June 10 Dividends Dividends payable 588,000 2 June 20 588,000 X Dividends Dividends payable 588,000 $ July 01 588,000 Dividends payable Cash 588,000 December 31 588,000 Retained earnings Dividends 588,000 The market value of Yeates Corporation's common stock had become excessively high. The stock was currently selling for $320 per share. To reduce the market price of the common stock, Yeates declared a 2-for-1 stock split for the 280,000 outstanding shares of its $8 par value common stock. Required b. Determine the number of common shares outstanding and the par value after the split. (Round par value answer to 2 decimal places.) Answer is complete but not entirely correct. Number of common shares outstanding Par value per share after the split 560,000 $ 320.00