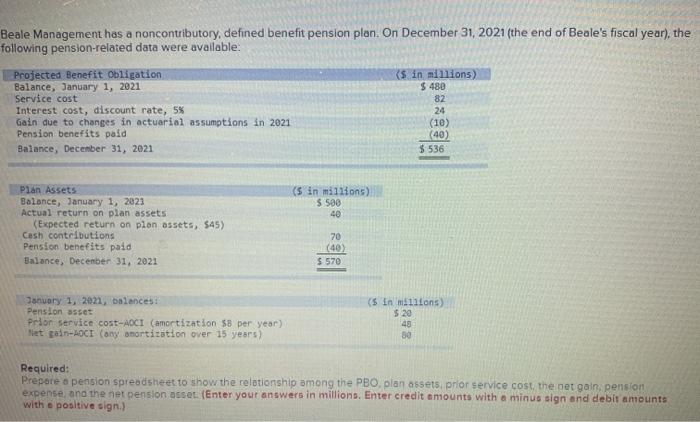

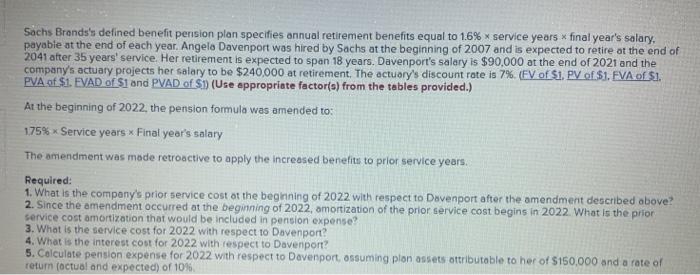

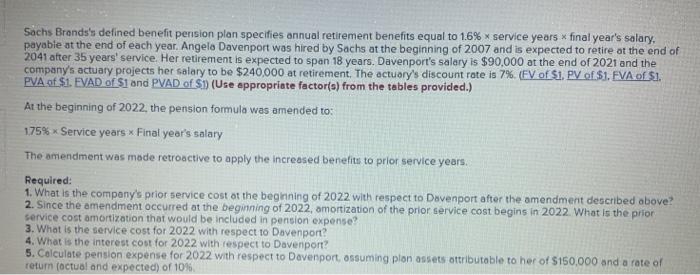

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2021 (the end of Beale's fiscal year), the following pension-related data were available. Projected Benefit Obligation Balance, January 1, 2021 Service cost Interest cost, discount rate, 5% Gain due to changes in actuarial assumptions in 2021 Pension benefits paid Balance, December 31, 2021 (s in millions) $ 480 82 24 (10) (40) $ 536 (s in millions) $ 500 40 Plan Assets Balance, January 1, 2023 Actual return on plan assets Expected return on pion assets, $45) Cash contributions Pension benefits paid Balance, Decenber 31, 2021 70 (40) $ 570 January 1, 2021, balances Pension asset Prior service cost-AOCI (amortization $ per year) Net gain-AOC (any amortization over 15 years) (5 in millions) $ 20 43 30 Required: Prepare a pension spreadsheet to show the relationship among the PBO, plan assets prior service cost, the net gain, pension expense, and the net pension asset. (Enter your answers in millions. Enter credit amounts with a minus sign and debit amounts with a positive sign.) Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.6% service years final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $90,000 at the end of 2021 and the company's actuary projects her salary to be $240,000 at retirement. The actuary's discount rate is 7%. (FV of $1. Py of $1. FVA of $1. PVA of $1. EVAD of Si and PVAD of S1) (Use appropriate factor(s) from the tables provided.) At the beginning of 2022, the pension formula was amended to: 1.75% * Service years x Final year's salary The amendment was made retroactive to apply the increased benefits to prlor service years. Required: 1. What is the company's prior service cost ot the beginning of 2022 with respect to Davenport after the amendment described above 2. Since the amendment occurred at the beginning of 2022, amortization of the prior service cost begins in 2022. What is the prior service cost amortization that would be included in pension expense? 3. What is the service cost for 2022 with respect to Davenport? 4. What is the interest cost for 2022 with respect to Davenpont? 5. Calculate pension expense for 2022 with respect to Davenport, assuming plon assets attributable to her of $150,000 and a rate of retum (actual and expected) of 10%