Answered step by step

Verified Expert Solution

Question

1 Approved Answer

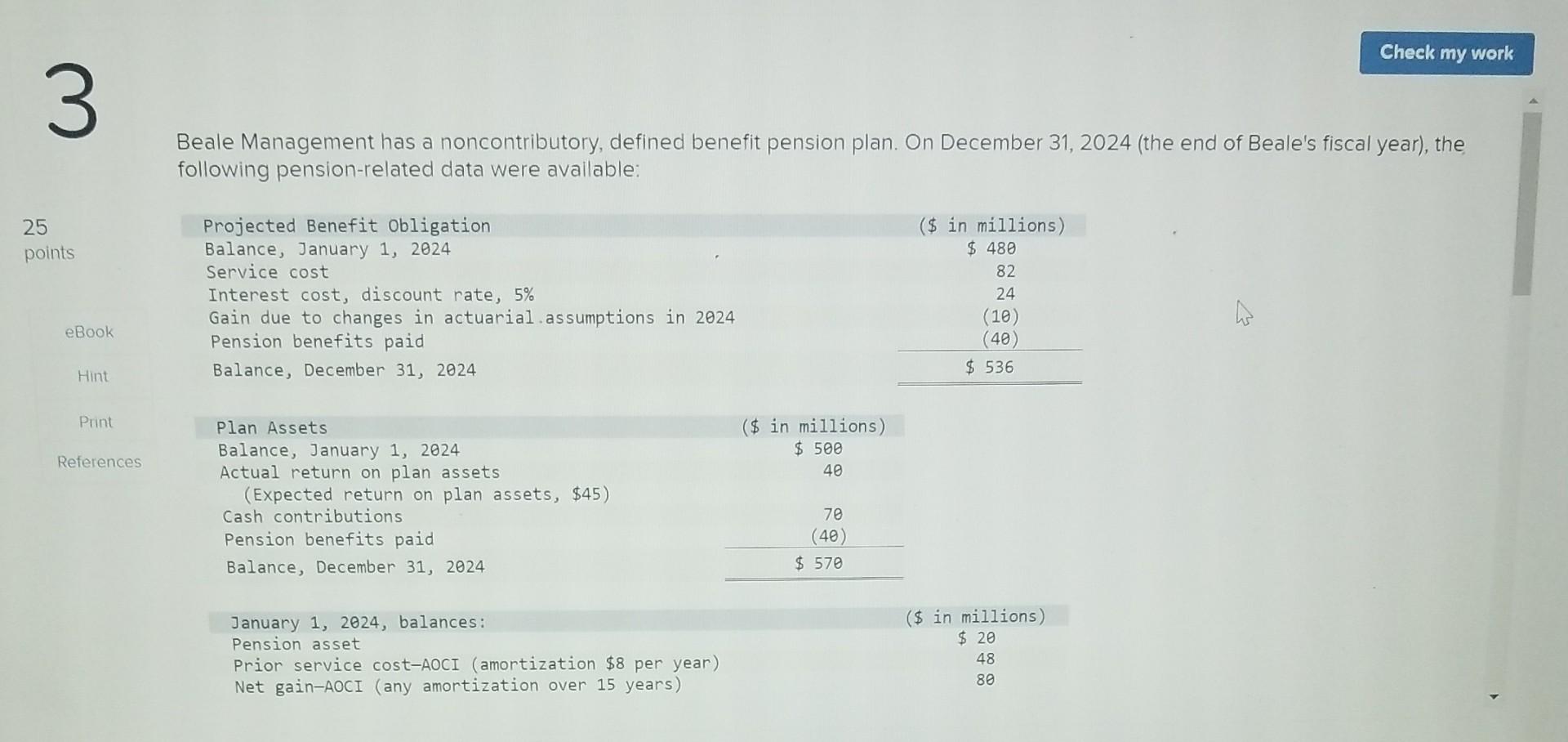

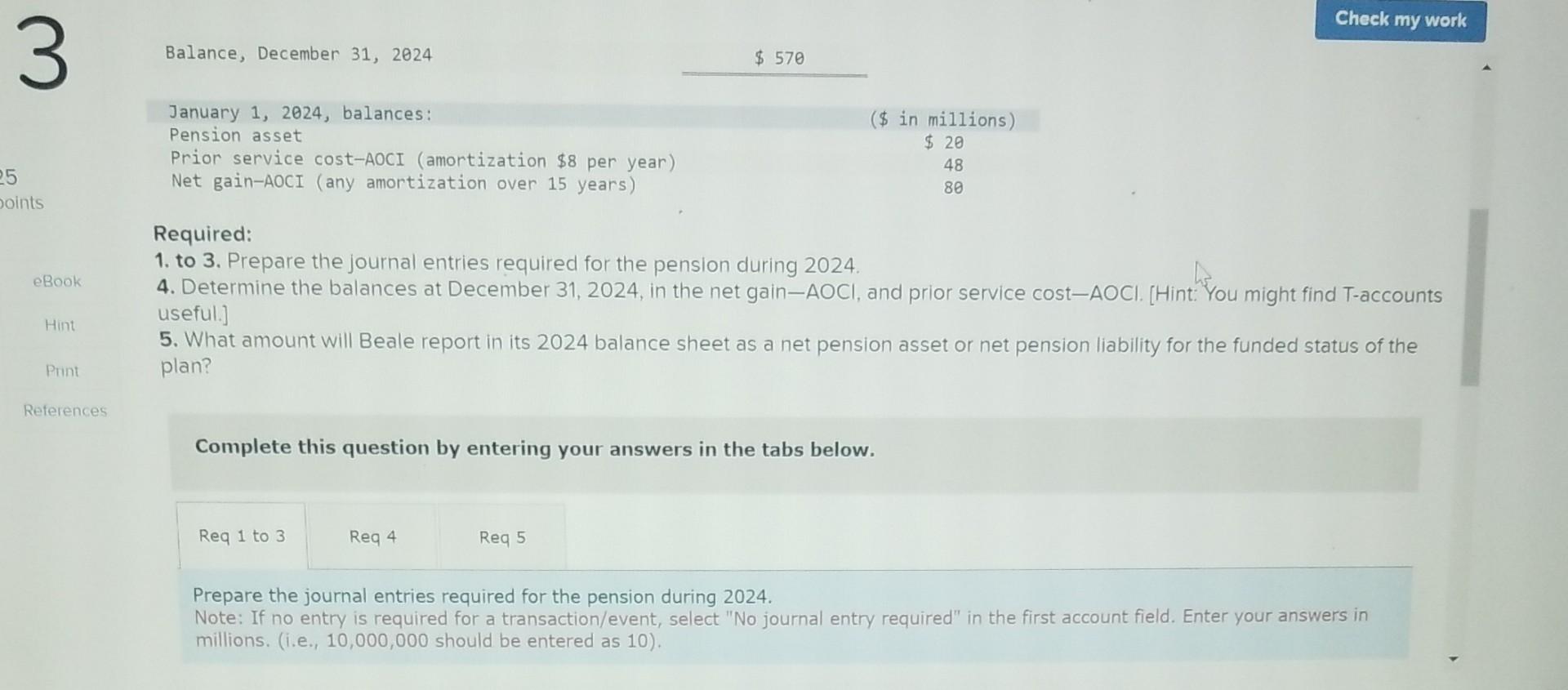

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the ollowing pension-related data were available:

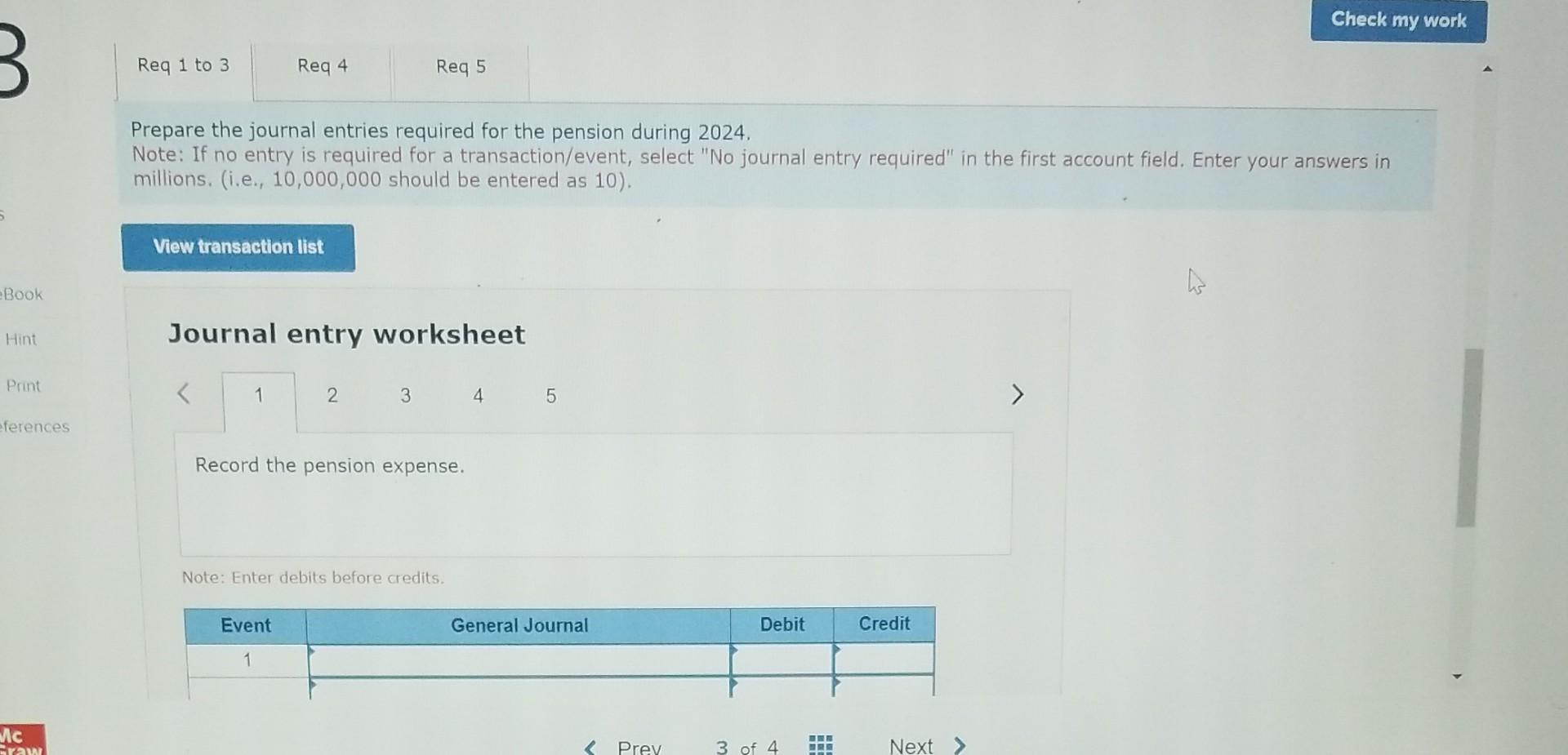

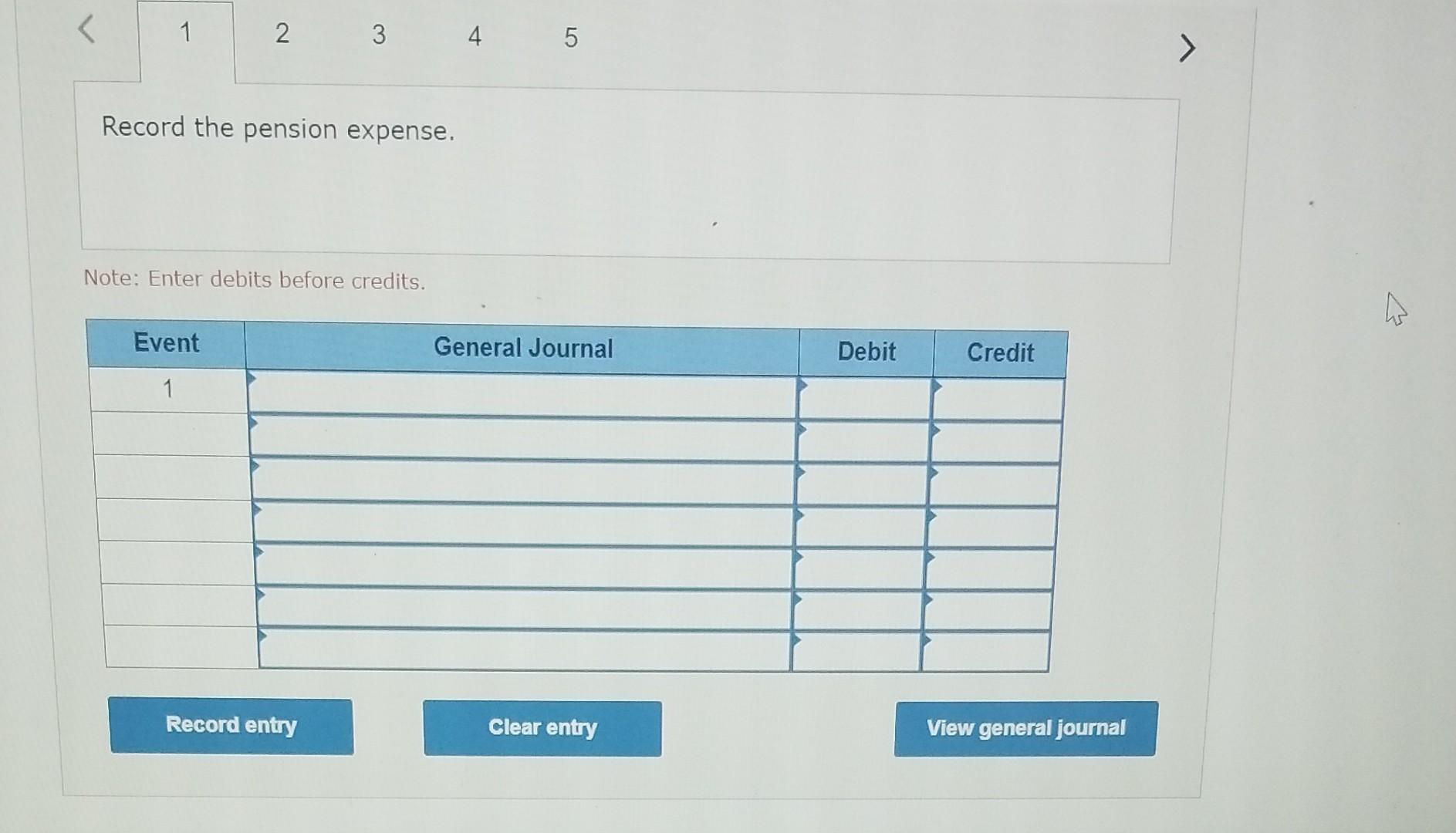

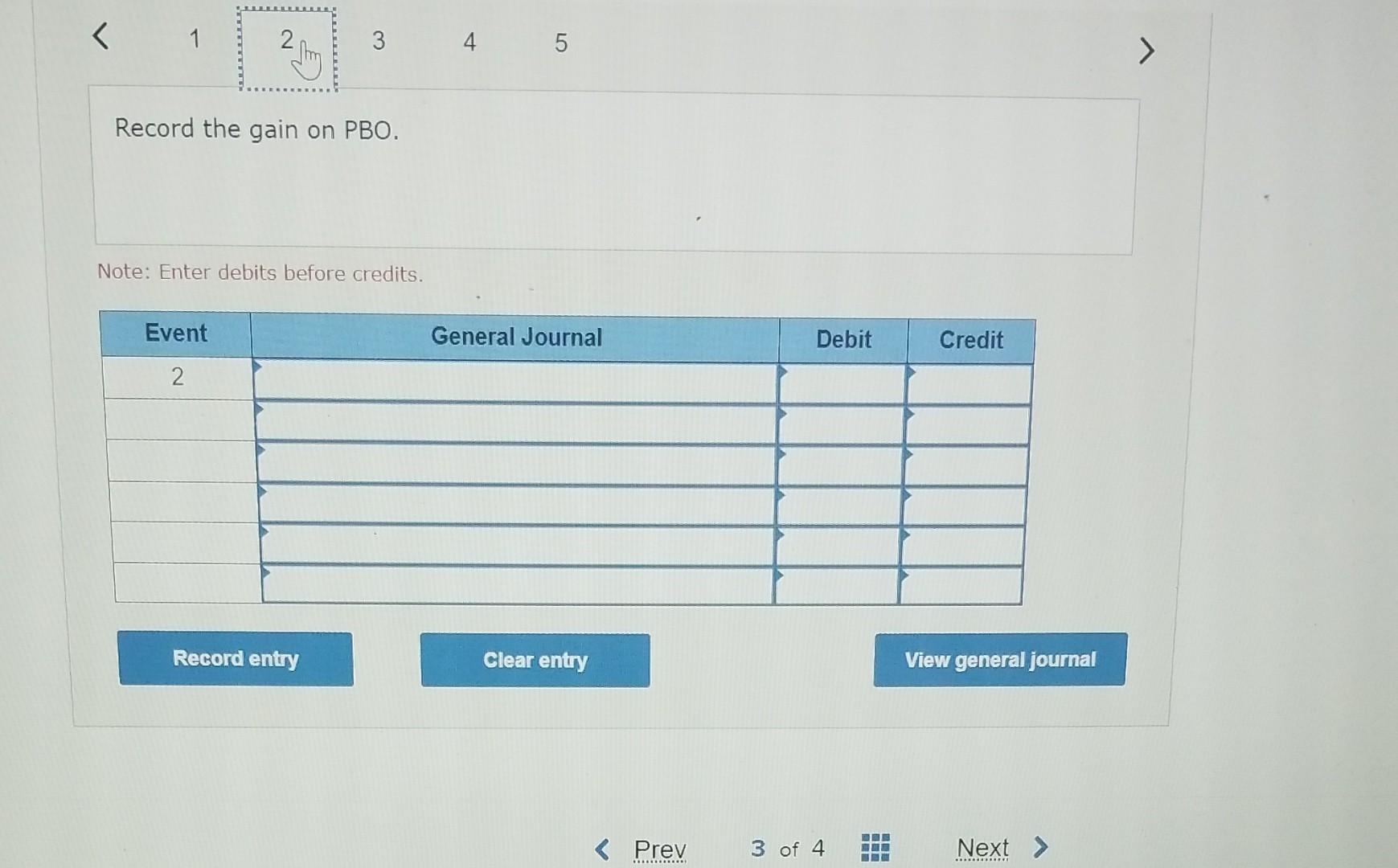

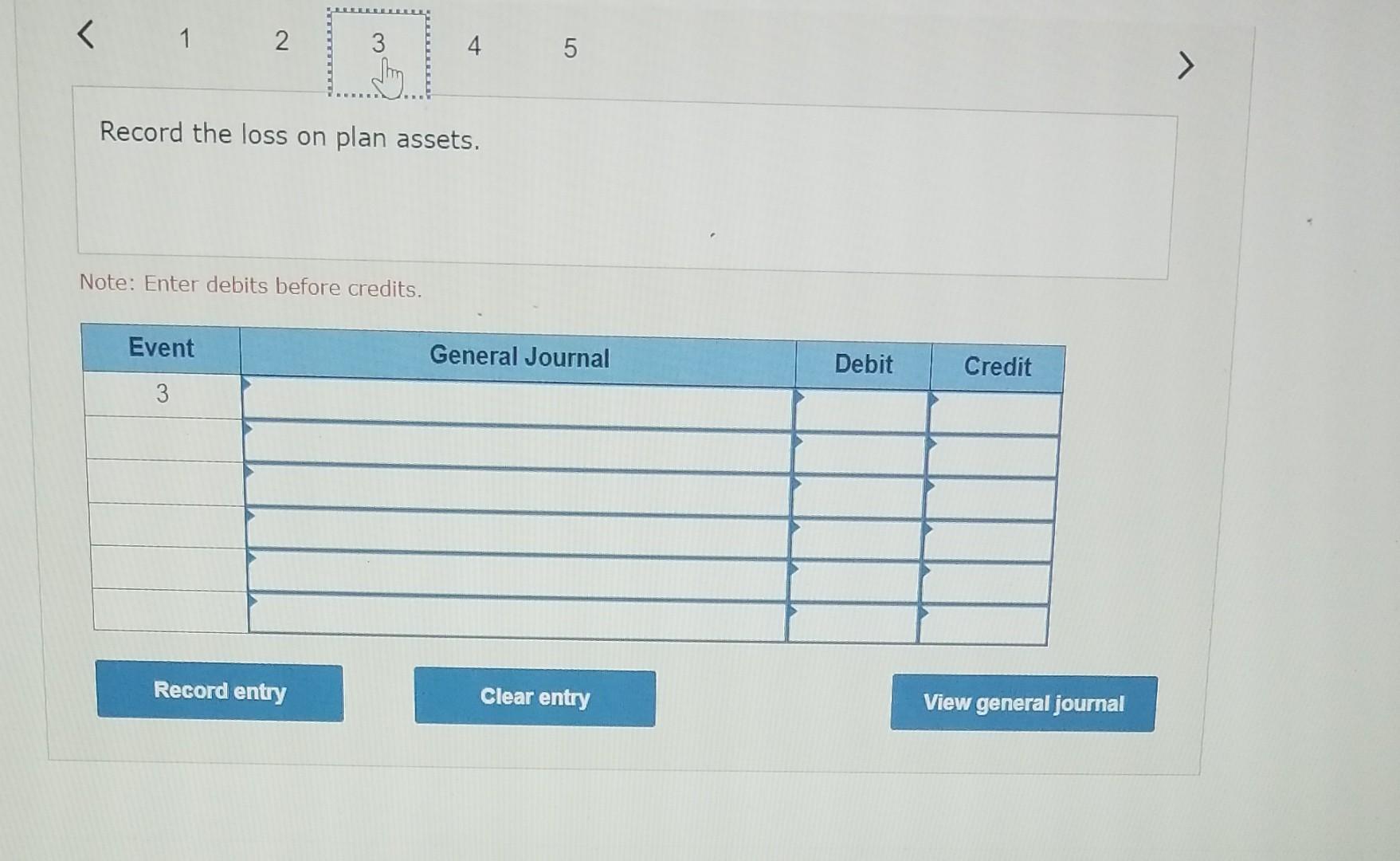

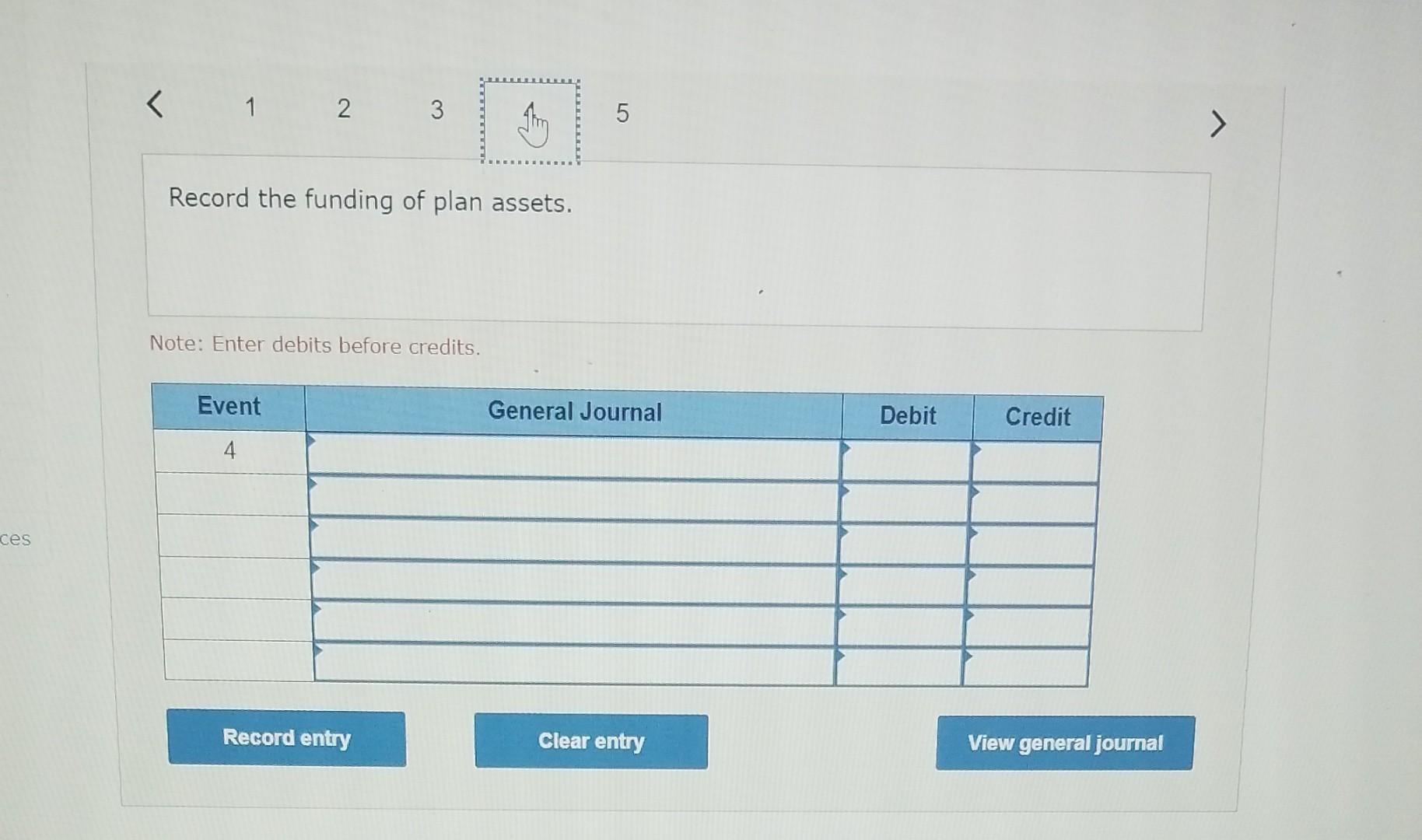

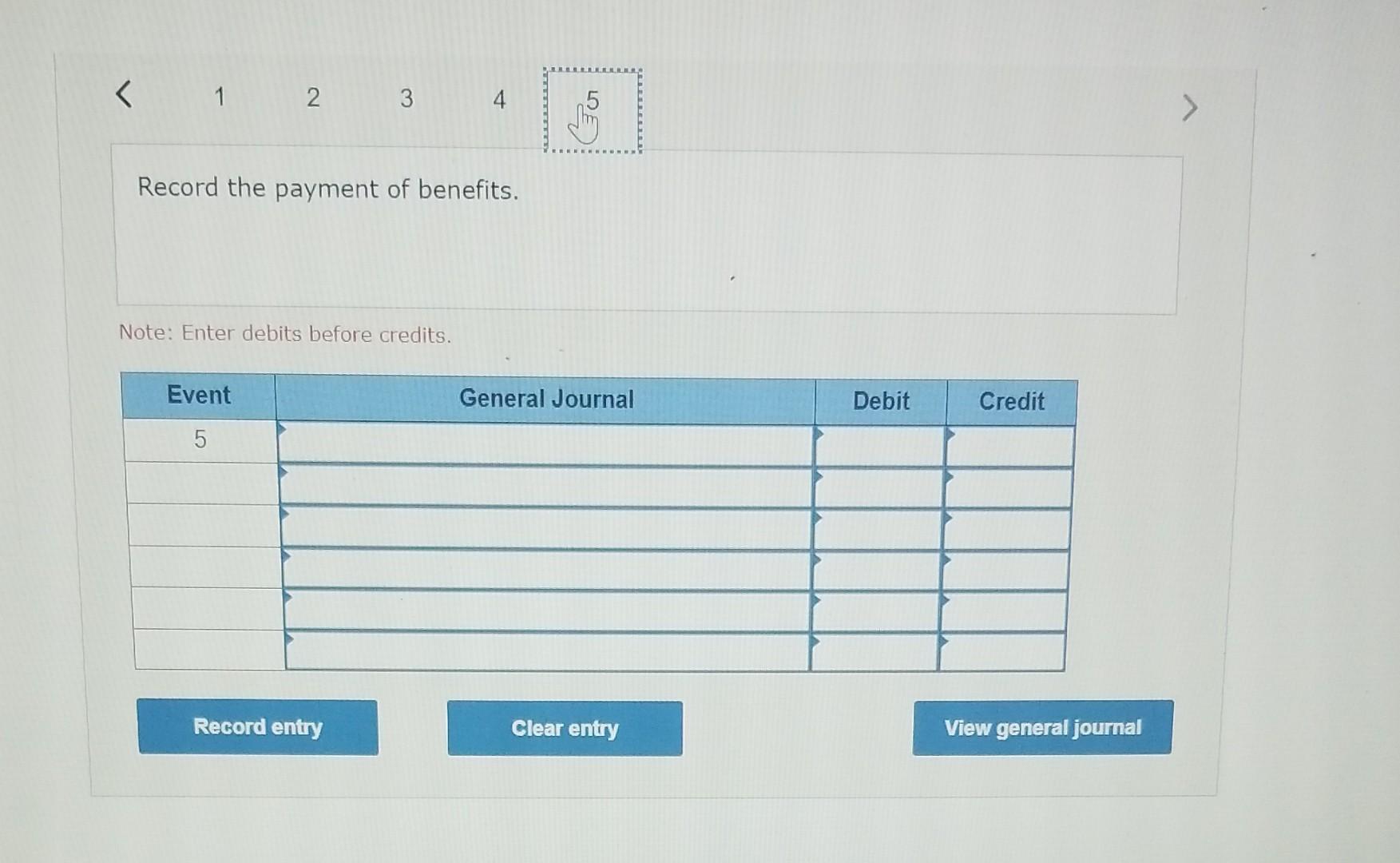

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the ollowing pension-related data were available: Required: 1. to 3. Prepare the journal entries required for the pension during 2024. 4. Determine the balances at December 31, 2024, in the net gain-AOCI, and prior service cost-AOCI. [Hint: You might find T-accounts useful.] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan? Complete this question by entering your answers in the tabs below. Prepare the journal entries required for the pension during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10 ). Prepare the journal entries required for the pension during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10 ). Journal entry worksheet Record the pension expense. Note: Enter debits before credits. Record the gain on PBO. Note: Enter debits before credits. Record the loss on plan assets. Note: Enter debits before credits. Record the funding of plan assets. Note: Enter debits before credits. Record the payment of benefits. Note: Enter debits before credits. Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the ollowing pension-related data were available: Required: 1. to 3. Prepare the journal entries required for the pension during 2024. 4. Determine the balances at December 31, 2024, in the net gain-AOCI, and prior service cost-AOCI. [Hint: You might find T-accounts useful.] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan? Complete this question by entering your answers in the tabs below. Prepare the journal entries required for the pension during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10 ). Prepare the journal entries required for the pension during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10 ). Journal entry worksheet Record the pension expense. Note: Enter debits before credits. Record the gain on PBO. Note: Enter debits before credits. Record the loss on plan assets. Note: Enter debits before credits. Record the funding of plan assets. Note: Enter debits before credits. Record the payment of benefits. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started