Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the following pension-related data were available:

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the following pension-related data were available:

| Projected Benefit Obligation | ($ in millions) |

|---|---|

| Balance, January 1, 2024 | $ 440 |

| Service cost | 46 |

| Interest cost, discount rate, 5% | 22 |

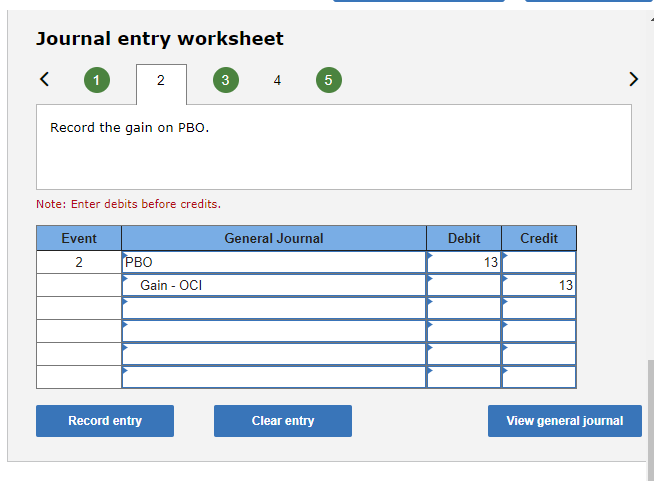

| Gain due to changes in actuarial assumptions in 2024 | (13) |

| Pension benefits paid | (22) |

| Balance, December 31, 2024 | $ 473 |

| Plan Assets | ($ in millions) |

|---|---|

| Balance, January 1, 2024 | $ 460 |

| Actual return on plan assets | 32 |

| (Expected return on plan assets, $37) | |

| Cash contributions | 73 |

| Pension benefits paid | (22) |

| Balance, December 31, 2024 | $ 543 |

| January 1, 2024, balances: | ($ in millions) |

|---|---|

| Pension asset | $ 20 |

| Prior service costAOCI (amortization $6 per year) | 42 |

| Net gainAOCI (any amortization over 10 years) | 86 |

Required:

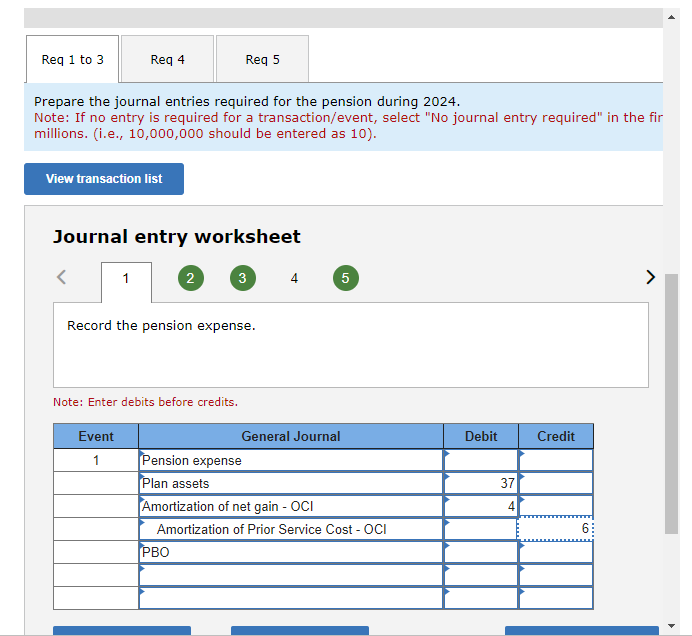

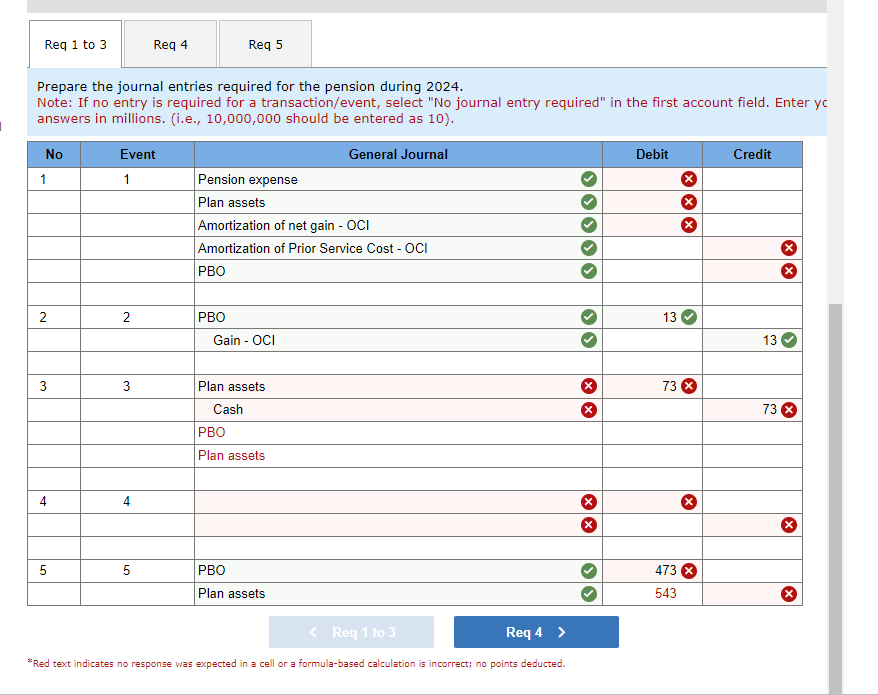

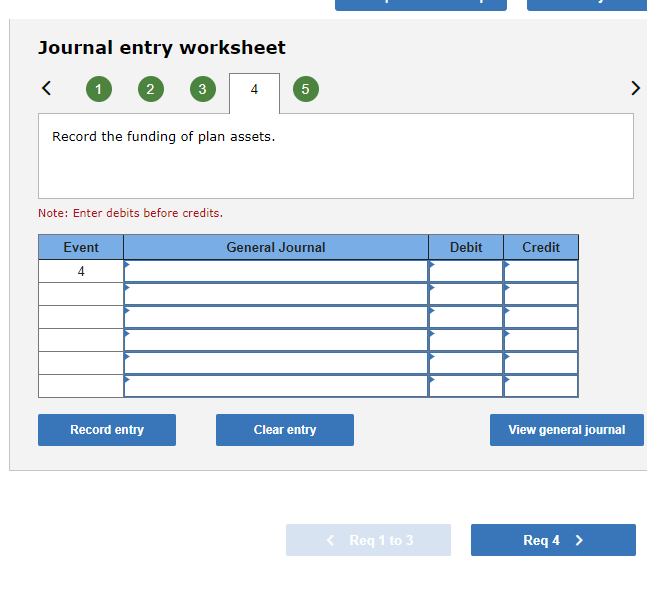

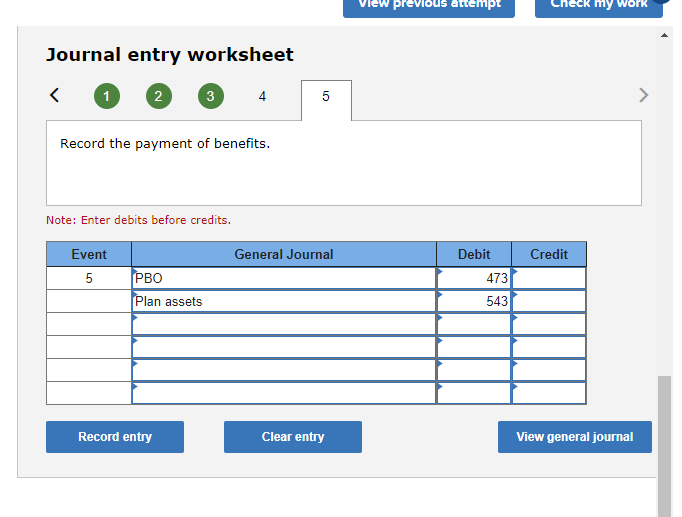

1. to 3. Prepare the journal entries required for the pension during 2024.

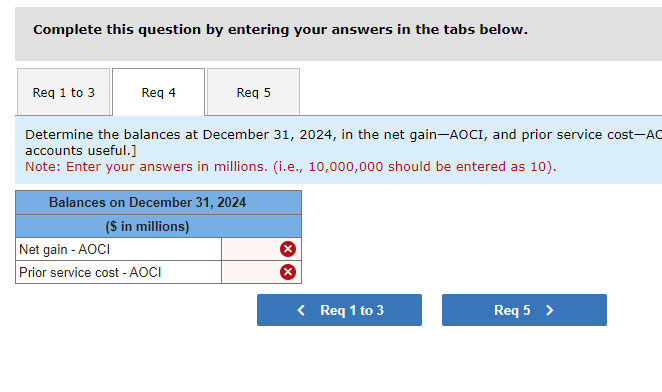

4. Determine the balances at December 31, 2024, in the net gainAOCI, and prior service costAOCI. [Hint: You might find T-accounts useful.]

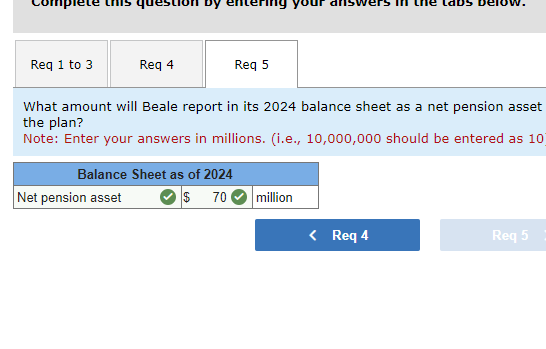

5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started