Answered step by step

Verified Expert Solution

Question

1 Approved Answer

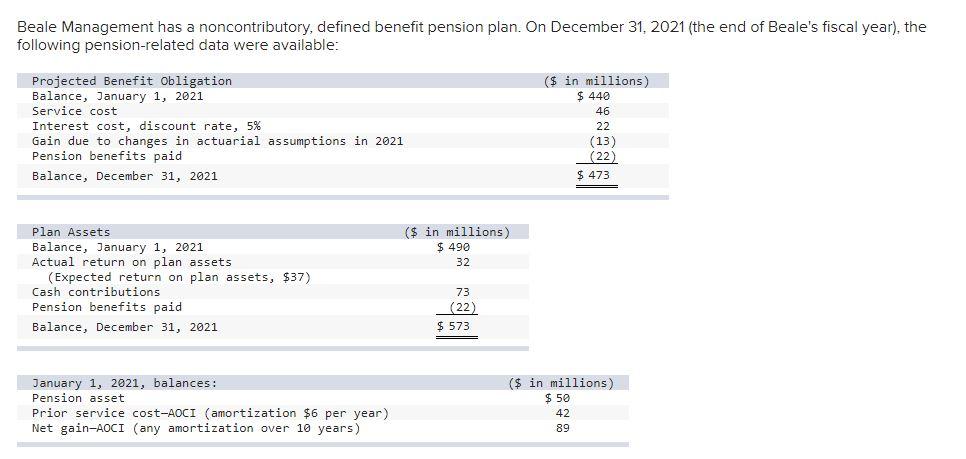

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2021 (the end of Beale's fiscal year), the following pension-related data were

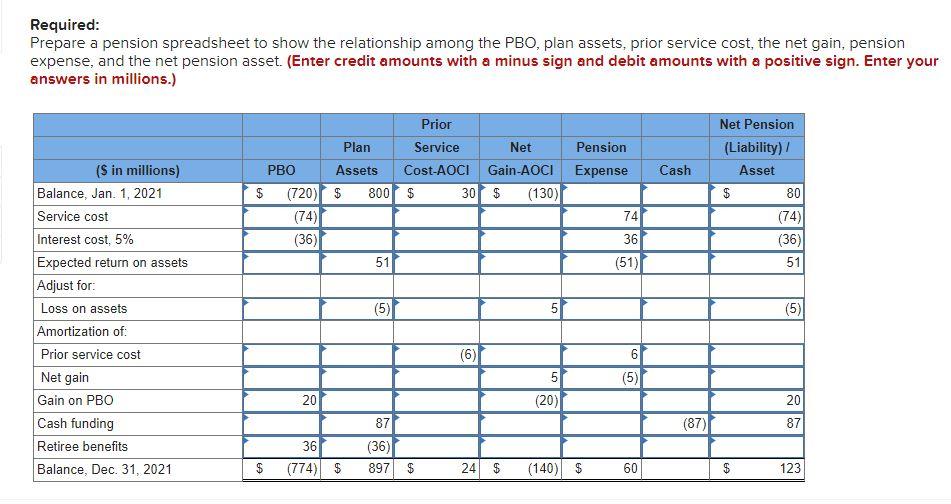

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2021 (the end of Beale's fiscal year), the following pension-related data were available: Projected Benefit Obligation Balance, January 1, 2021 Service cost Interest cost, discount rate, 5% Gain due to changes in actuarial assumptions in 2021 Pension benefits paid Balance, December 31, 2021 ($ in millions) $ 440 46 22 (13) (22) $ 473 Plan Assets Balance, January 1, 2021 Actual return on plan assets (Expected return on plan assets, $37) Cash contributions ($ in millions) $ 490 32 Pension benefits paid Balance, December 31, 2021 January 1, 2021, balances: Pension asset Prior service cost-AOCI (amortization $6 per year) Net gain-AOCI (any amortization over 10 years) 73 (22) $ 573 ($ in millions) $ 50 42 89 Required: Prepare a pension spreadsheet to show the relationship among the PBO, plan assets, prior service cost, the net gain, pension expense, and the net pension asset. (Enter credit amounts with a minus sign and debit amounts with a positive sign. Enter your answers in millions.) ($ in millions) Balance, Jan. 1, 2021 Service cost Interest cost, 5% Expected return on assets Adjust for: Loss on assets Amortization of: Prior service cost Net gain Gain on PBO Plan Prior Service Net Pension PBO Assets Cost-AOCI Gain-AOCI Expense Cash Net Pension (Liability)/ Asset $ (720) $ 800 $ 30 $ (130) $ 80 (74) (36) 51 74 36 (51) (74) (36) 51 (5) 5 (5) (6) 6 5 (5) (20) 20 (87) 87 20 Cash funding 87 Retiree benefits 36 (36) Balance, Dec. 31, 2021 $ (774) $ 897 $ 24 (140) $ 60 123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started