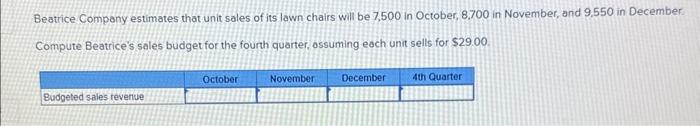

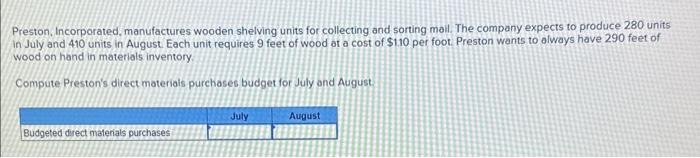

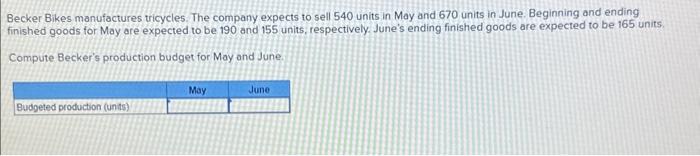

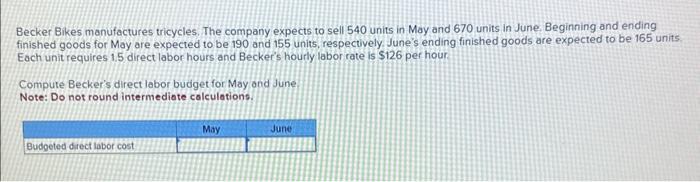

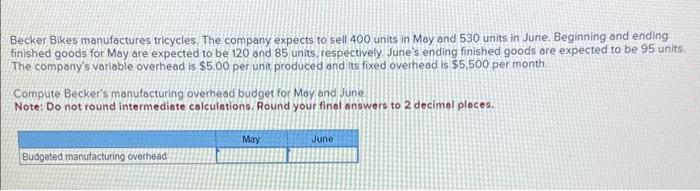

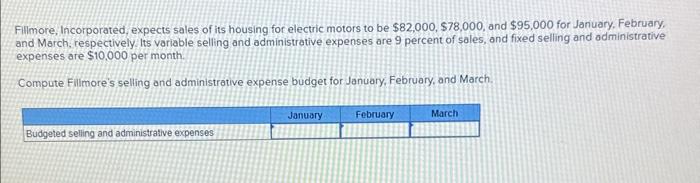

Beatrice Company estimates that unit sales of its lawn chairs will be 7,500 in October, 8.700 in November, and 9,550 in December Compute Beatrice's sales budget for the fourth quarter, ossuming each unit sells for $29.00. Preston, Incorporated, manufactures wooden shelving units for collecting and sorting mail. The company expects to produce 280 units in July and 410 units in August. Each unit requires 9 feet of wood ot a cost of $1.10 per foot. Preston wants to olways have 290 feet of wood on hand in materials inventory Compute Preston's direct materials purchases budget for July and August Becker Bikes manufactures tricycles. The company expects to sell 540 units in May and 670 units in June. Beginning and ending finished goods for May are expected to be 190 and 155 units, respectively. June's ending finished goods are expected to be 165 units. Compute Becker's production budget for May and June. Becker Bikes manufactures tricycles. The company expects to sell 540 units in May and 670 units in June. Beginning and ending finished goods for May are expected to be 190 and 155 units, respectively. June's ending finished goods are expected to be 165 units. Each unit requires 1.5 direct labor hours and Becker's hourly labor rate is $126 per hour Compute Becker's direct labor budiget for May and June Note: Do not round intermediate calculations. Becker Bikes manufactures tricycles. The company expects to sell 400 units in May ond 530 units in June. Beginning and ending finished goods for May are expected to be 120 and 85 units, respectively June's ending finished goods are expected to be 95 units. The company's variable overhead is $5,00 per unit produced and its fixed overhead is $5,500 per month. Compute Becker's manufacturing overheod budget for May and June. Note: Do not round intermediate calculations. Round your final answers to 2 decimol places. Fillmore, Incorporated, expects sales of its housing for electric motors to be $82,000,$78,000, and $95,000 for January. February. and March, respectively. Its variable selling and administrative expenses are 9 percent of sales, and fixed selling and administrative expenses are $10,000 per month Compute Filmore's selling and administrative expense budget for January, February, and March