Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beauty Tech Limited (BT) operates a chain of beauty salons in Hong Kong which is owned by its two founders Joyce Lam and Johnson

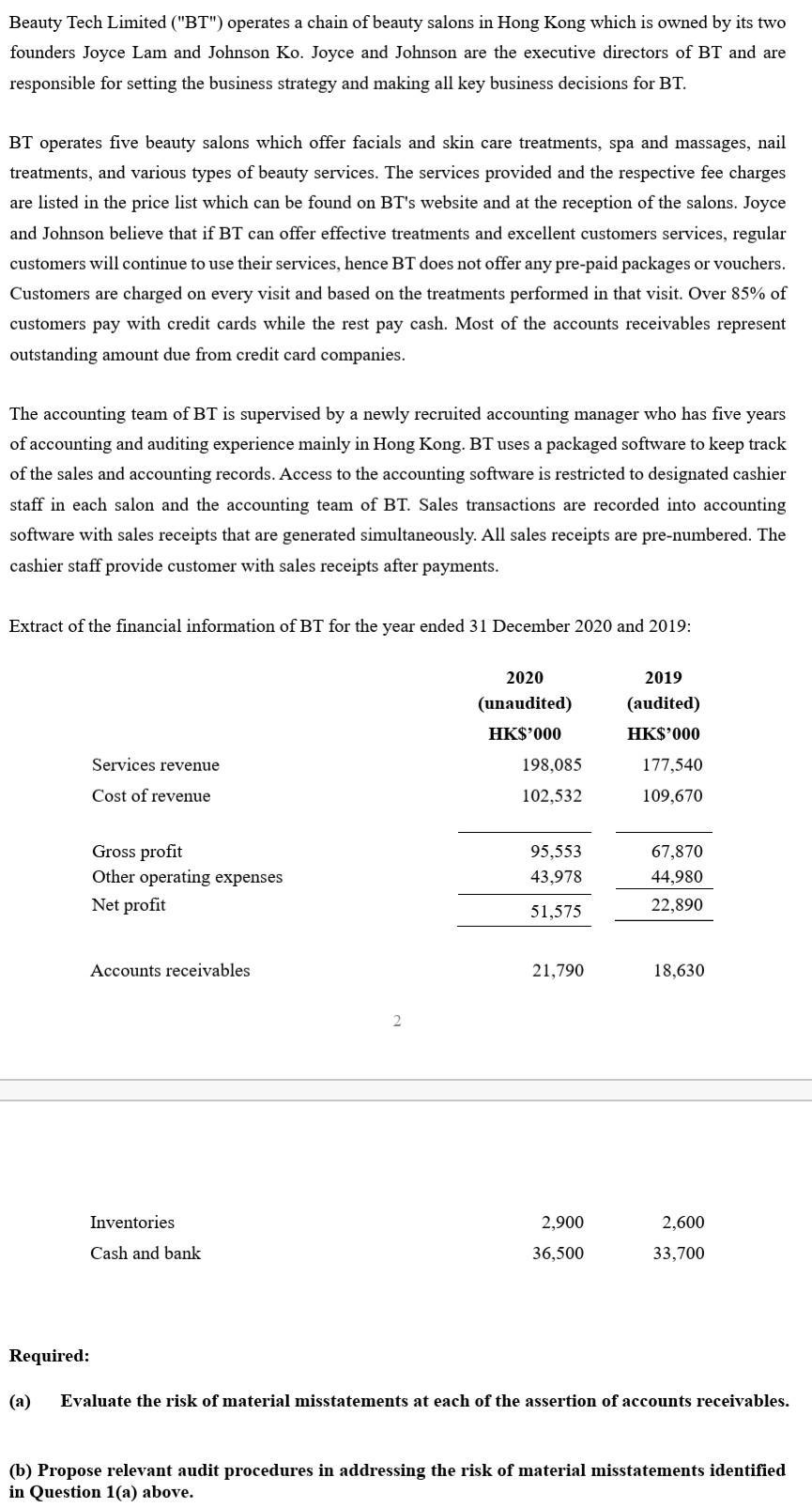

Beauty Tech Limited ("BT") operates a chain of beauty salons in Hong Kong which is owned by its two founders Joyce Lam and Johnson Ko. Joyce and Johnson are the executive directors of BT and are responsible for setting the business strategy and making all key business decisions for BT. BT operates five beauty salons which offer facials and skin care treatments, spa and massages, nail treatments, and various types of beauty services. The services provided and the respective fee charges are listed in the price list which can be found on BT's website and at the reception of the salons. Joyce and Johnson believe that if BT can offer effective treatments and excellent customers services, regular customers will continue to use their services, hence BT does not offer any pre-paid packages or vouchers. Customers are charged on every visit and based on the treatments performed in that visit. Over 85% of customers pay with credit cards while the rest pay cash. Most of the accounts receivables represent outstanding amount due from credit card companies. The accounting team of BT is supervised by a newly recruited accounting manager who has five years of accounting and auditing experience mainly in Hong Kong. BT uses a packaged software to keep track of the sales and accounting records. Access to the accounting software is restricted to designated cashier staff in each salon and the accounting team of BT. Sales transactions are recorded into accounting software with sales receipts that are generated simultaneously. All sales receipts are pre-numbered. The cashier staff provide customer with sales receipts after payments. Extract of the financial information of BT for the year ended 31 December 2020 and 2019: 2020 2019 (unaudited) (audited) HK$'000 HKS'000 Services revenue 198,085 177,540 Cost of revenue 102,532 109,670 Gross profit Other operating expenses 95,553 67,870 43,978 44,980 Net profit 51,575 22,890 Accounts receivables 21,790 18,630 Inventories 2,900 2,600 Cash and bank 36,500 33,700 Required: () Evaluate the risk of material misstatements at each of the assertion of accounts receivables. (b) Propose relevant audit procedures in addressing the risk of material misstatements identified in Question 1(a) above.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started