Answered step by step

Verified Expert Solution

Question

1 Approved Answer

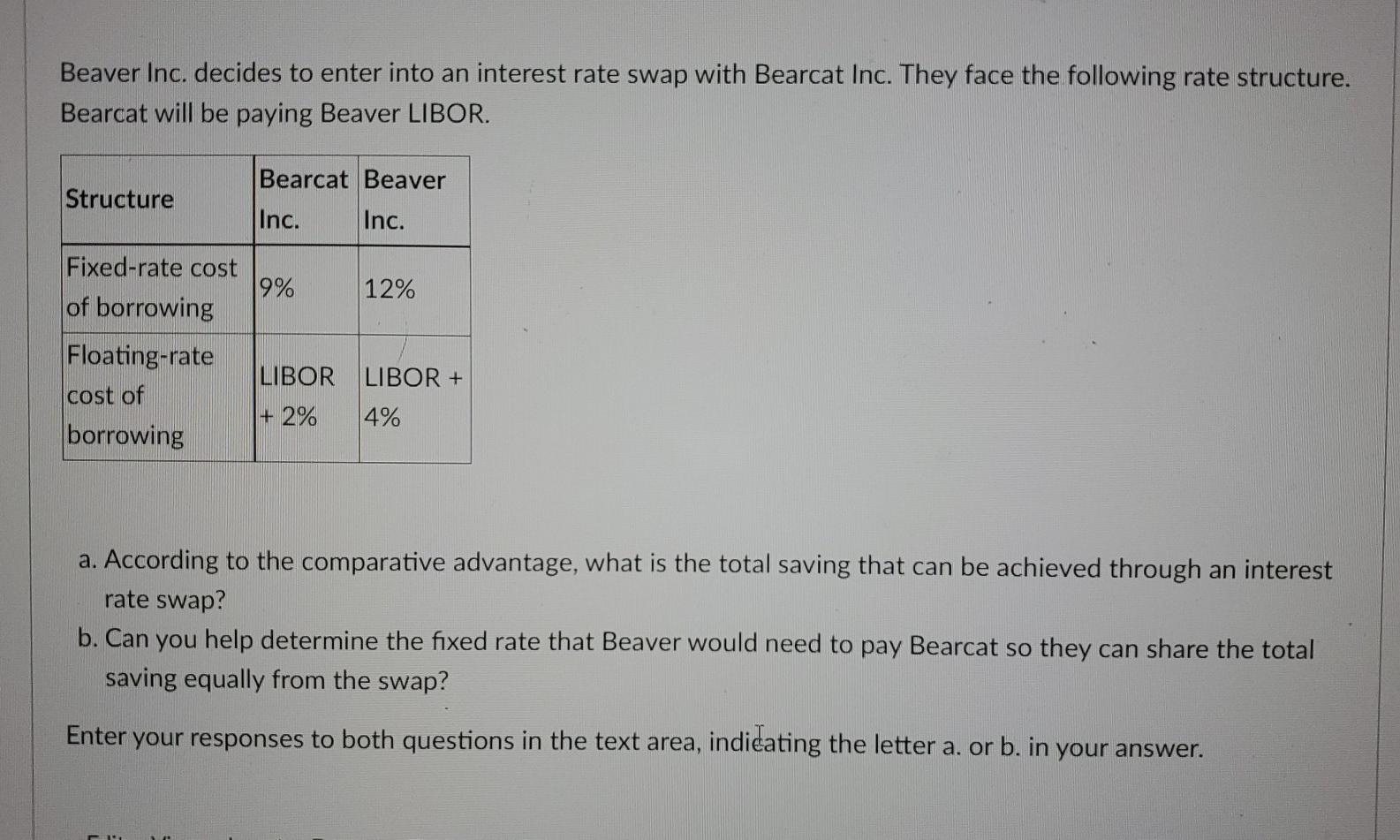

Beaver Inc. decides to enter into an interest rate swap with Bearcat Inc. They face the following rate structure. Bearcat will be paying Beaver LIBOR.

Beaver Inc. decides to enter into an interest rate swap with Bearcat Inc. They face the following rate structure. Bearcat will be paying Beaver LIBOR. Bearcat Beaver Structure Inc. Inc. Fixed-rate cost of borrowing 9% 12% Floating-rate cost of borrowing LIBOR LIBOR + + 2% 4% a. According to the comparative advantage, what is the total saving that can be achieved through an interest rate swap? b. Can you help determine the fixed rate that Beaver would need to pay Bearcat so they can share the total saving equally from the swap? Enter your responses to both questions in the text area, indicating the letter a. or b. in your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started