Answered step by step

Verified Expert Solution

Question

1 Approved Answer

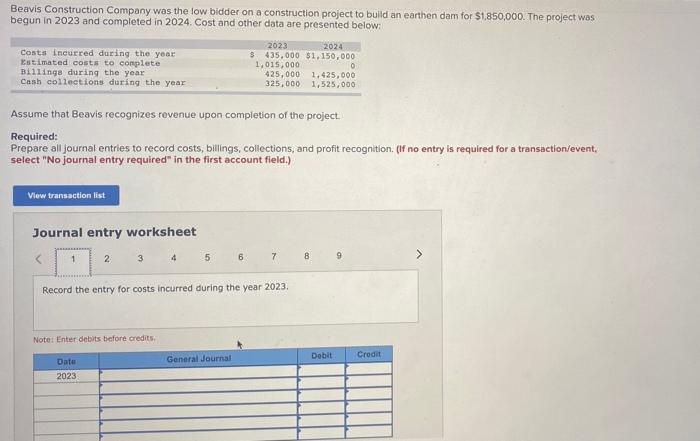

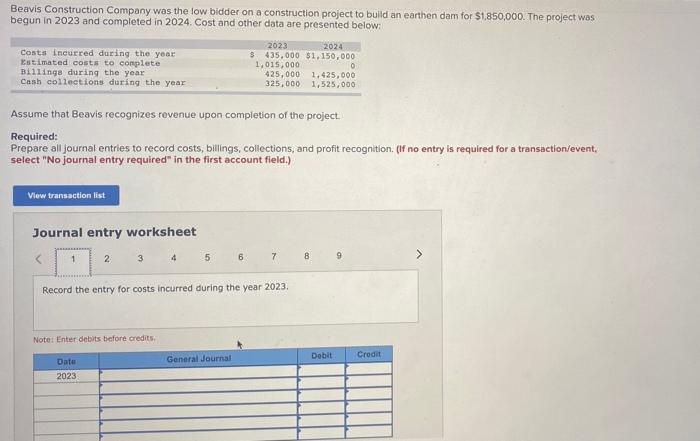

Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1.850,000. The project was begun in 2023 and

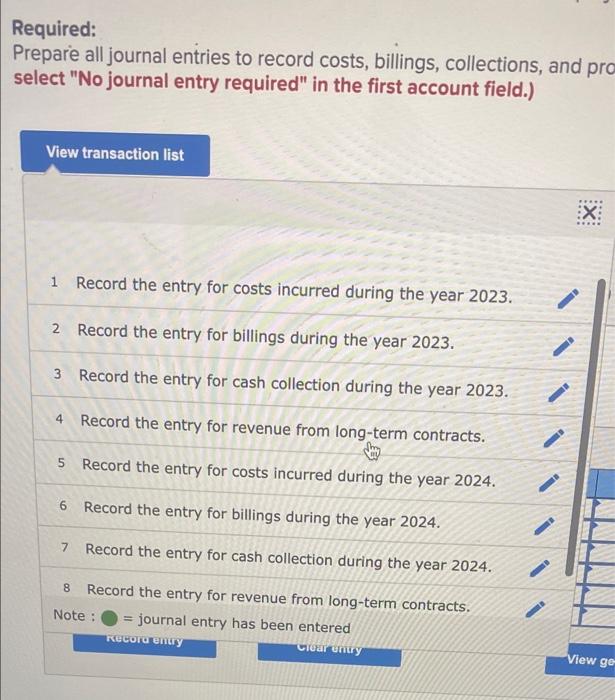

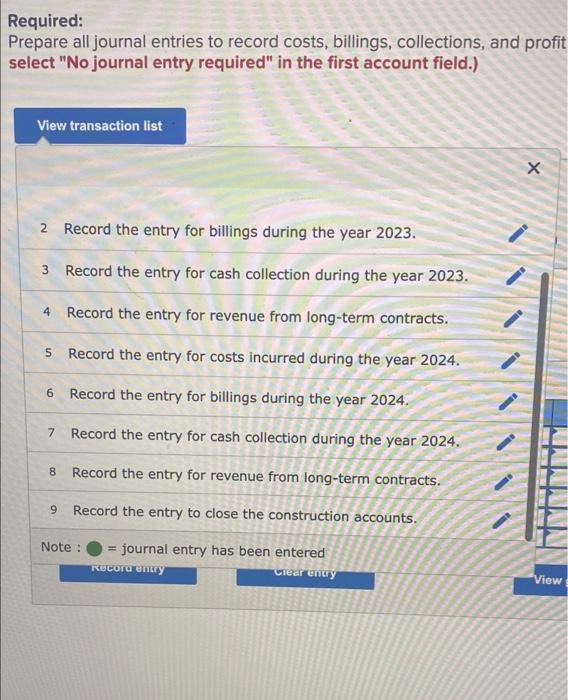

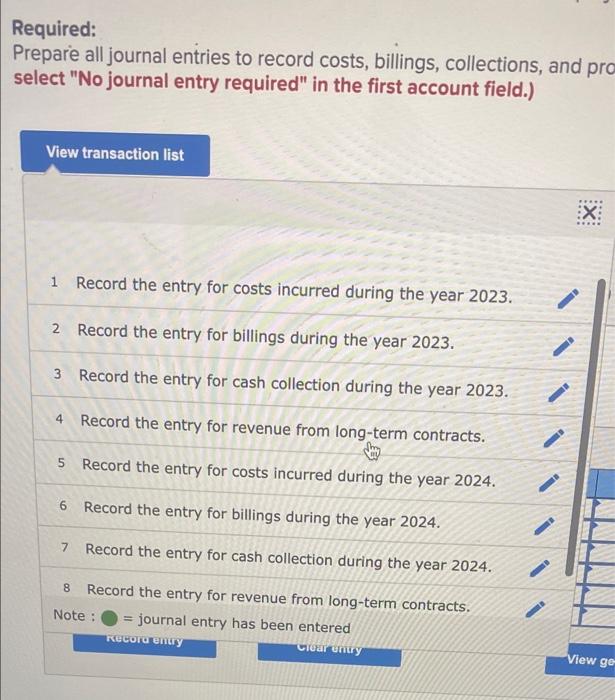

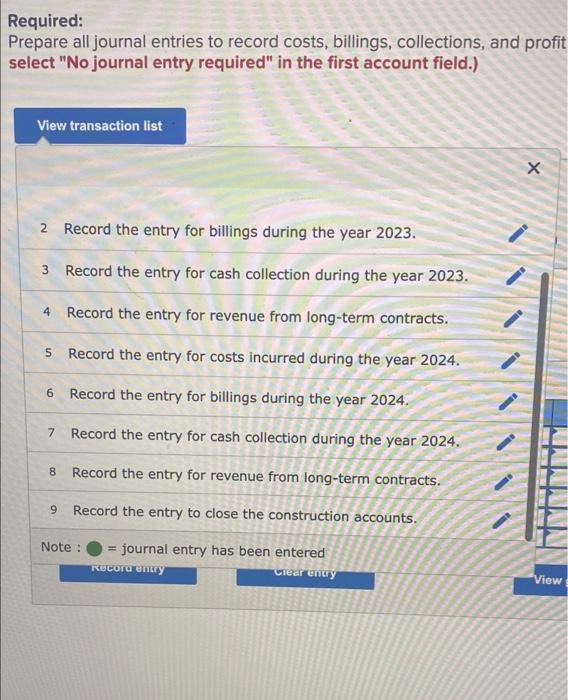

Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1.850,000. The project was begun in 2023 and completed in 2024. Cost and other data are presented below: Costs incurred during the year Estimated costs to complete Billings during the year Cash collections during the year 2023 2024 3435,000 $1,150,000 1,015,000 0 425,000 1.425,000 325,000 1,525,000 Assume that Beavis recognizes revenue upon completion of the project Required: Prepare all journal entries to record costs, billings, collections, and profit recognition. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 1 4 5 6 7 8 9 Record the entry for costs incurred during the year 2023. Note: Enter debits before credits General Journal Dobit Credit Dato 2023 Required: Prepare all journal entries to record costs, billings, collections, and pro select "No journal entry required" in the first account field.) View transaction list X: 1 Record the entry for costs incurred during the year 2023. 2 Record the entry for billings during the year 2023. 3 Record the entry for cash collection during the year 2023. 4 Record the entry for revenue from long-term contracts. 5 Record the entry for costs incurred during the year 2024. 6 Record the entry for billings during the year 2024. 7 Record the entry for cash collection during the year 2024. 8 Record the entry for revenue from long-term contracts. Note : journal entry has been entered Record en Crear entry View ge Required: Prepare all journal entries to record costs, billings, collections, and profit select "No journal entry required" in the first account field.) View transaction list 2 Record the entry for billings during the year 2023. 3 Record the entry for cash collection during the year 2023. 4 Record the entry for revenue from long-term contracts. 5 Record the entry for costs incurred during the year 2024. 6 Record the entry for billings during the year 2024. 7 Record the entry for cash collection during the year 2024. 8 Record the entry for revenue from long-term contracts. 9 Record the entry to close the construction accounts. Note : journal entry has been entered Record any Clear entry View

Beavis Construction Company was the low bidder on a construction project to build an earthen dam for $1.850,000. The project was begun in 2023 and completed in 2024. Cost and other data are presented below: Costs incurred during the year Estimated costs to complete Billings during the year Cash collections during the year 2023 2024 3435,000 $1,150,000 1,015,000 0 425,000 1.425,000 325,000 1,525,000 Assume that Beavis recognizes revenue upon completion of the project Required: Prepare all journal entries to record costs, billings, collections, and profit recognition. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 1 4 5 6 7 8 9 Record the entry for costs incurred during the year 2023. Note: Enter debits before credits General Journal Dobit Credit Dato 2023 Required: Prepare all journal entries to record costs, billings, collections, and pro select "No journal entry required" in the first account field.) View transaction list X: 1 Record the entry for costs incurred during the year 2023. 2 Record the entry for billings during the year 2023. 3 Record the entry for cash collection during the year 2023. 4 Record the entry for revenue from long-term contracts. 5 Record the entry for costs incurred during the year 2024. 6 Record the entry for billings during the year 2024. 7 Record the entry for cash collection during the year 2024. 8 Record the entry for revenue from long-term contracts. Note : journal entry has been entered Record en Crear entry View ge Required: Prepare all journal entries to record costs, billings, collections, and profit select "No journal entry required" in the first account field.) View transaction list 2 Record the entry for billings during the year 2023. 3 Record the entry for cash collection during the year 2023. 4 Record the entry for revenue from long-term contracts. 5 Record the entry for costs incurred during the year 2024. 6 Record the entry for billings during the year 2024. 7 Record the entry for cash collection during the year 2024. 8 Record the entry for revenue from long-term contracts. 9 Record the entry to close the construction accounts. Note : journal entry has been entered Record any Clear entry View

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started