Question

Because it is important for accountants to demonstrate the filing requirements for specialized tax returns, for this final project you will be completing a corporate

Because it is important for accountants to demonstrate the filing requirements for specialized tax returns, for this final project you will be completing a corporate tax return and then analyzing this experience.

Key Component:

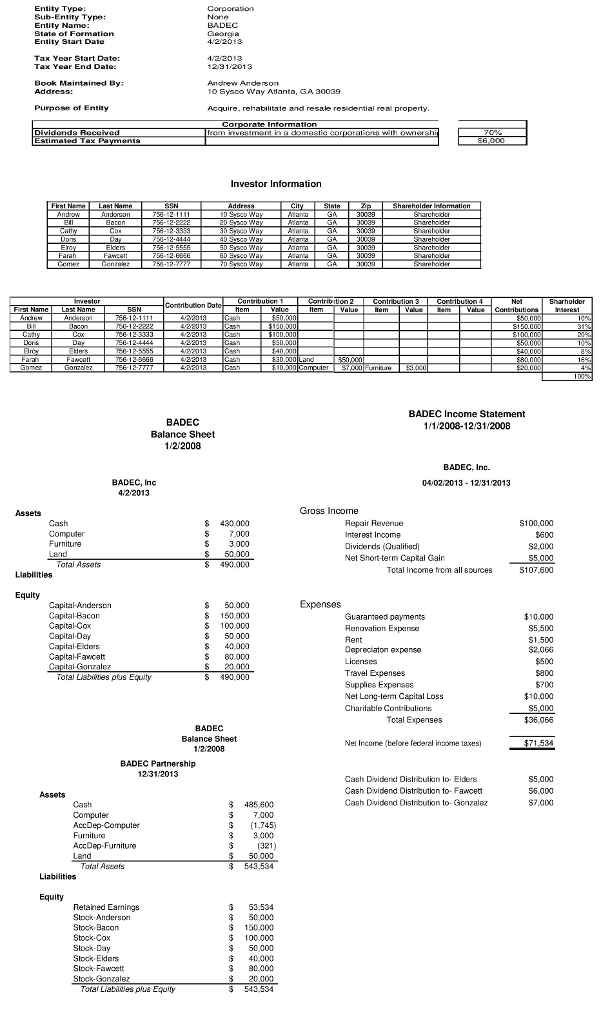

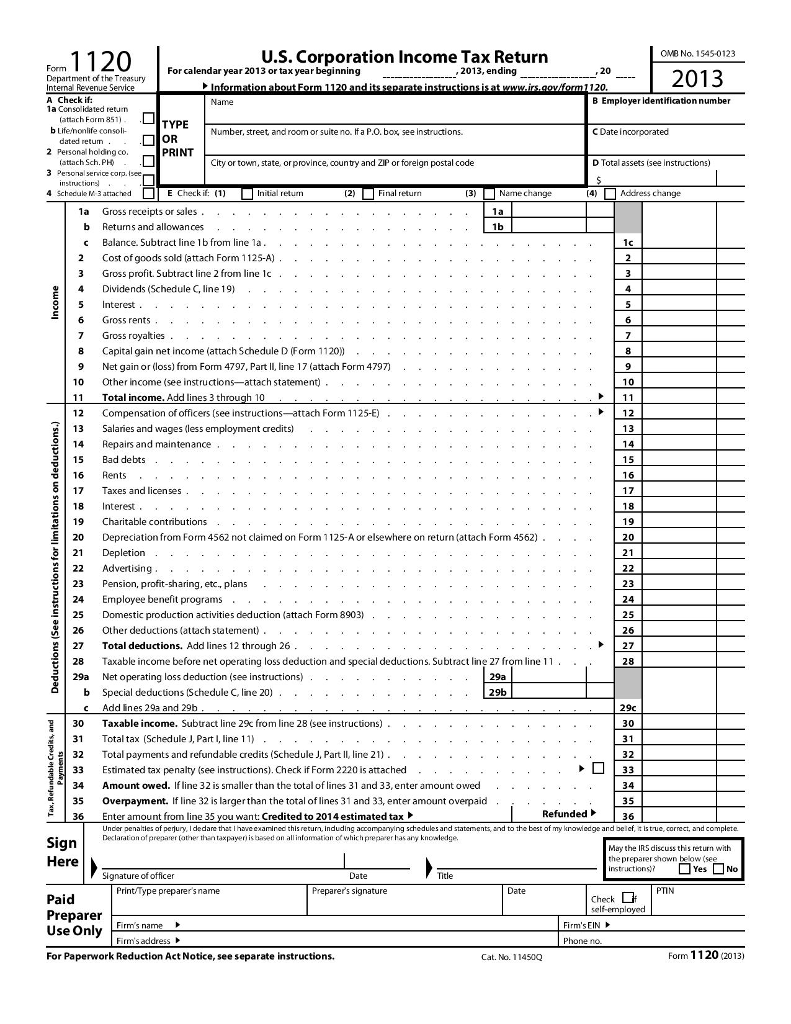

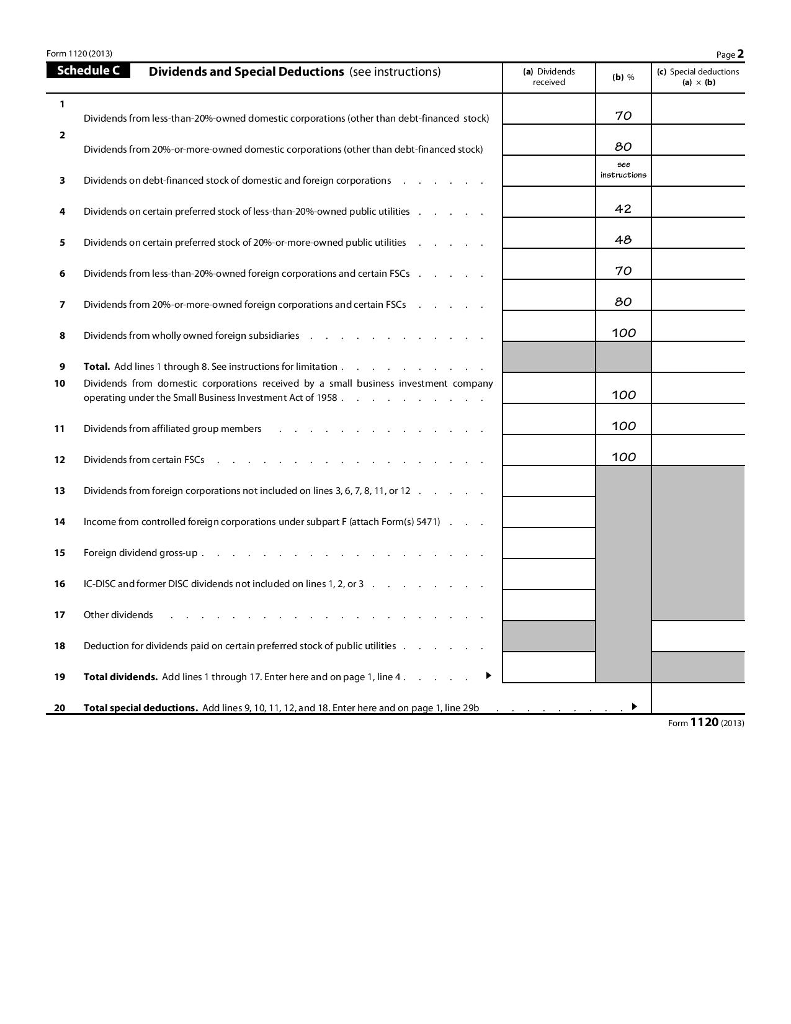

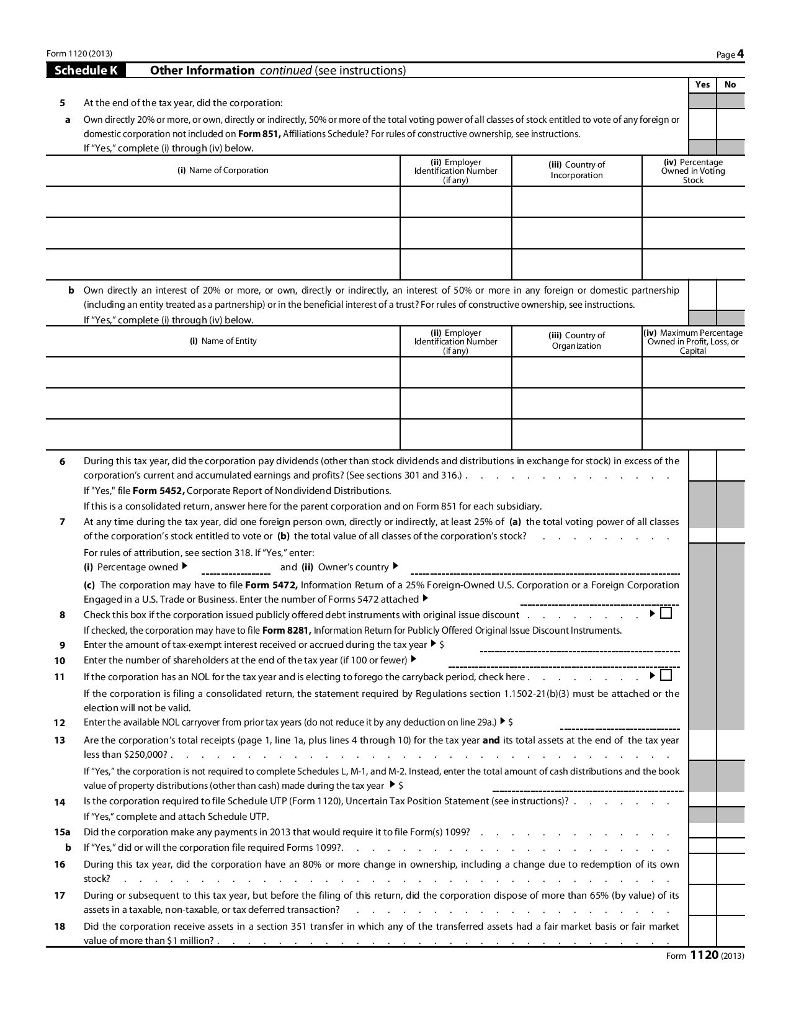

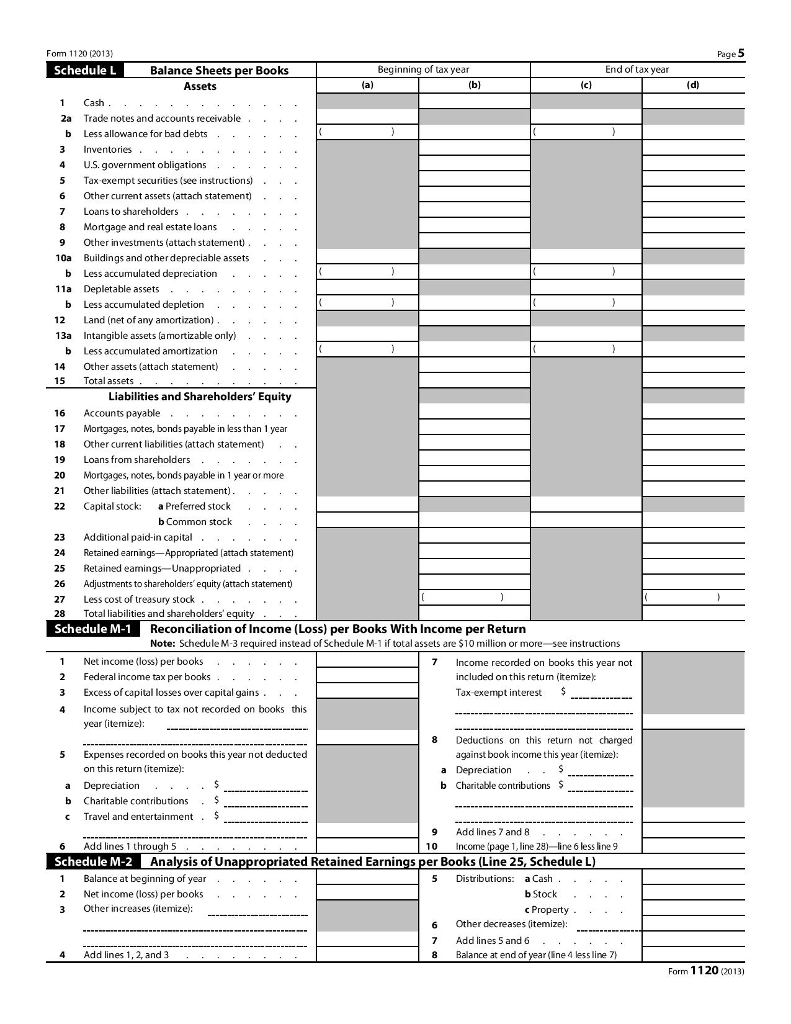

Use the financial data from the following file to complete form 1120.

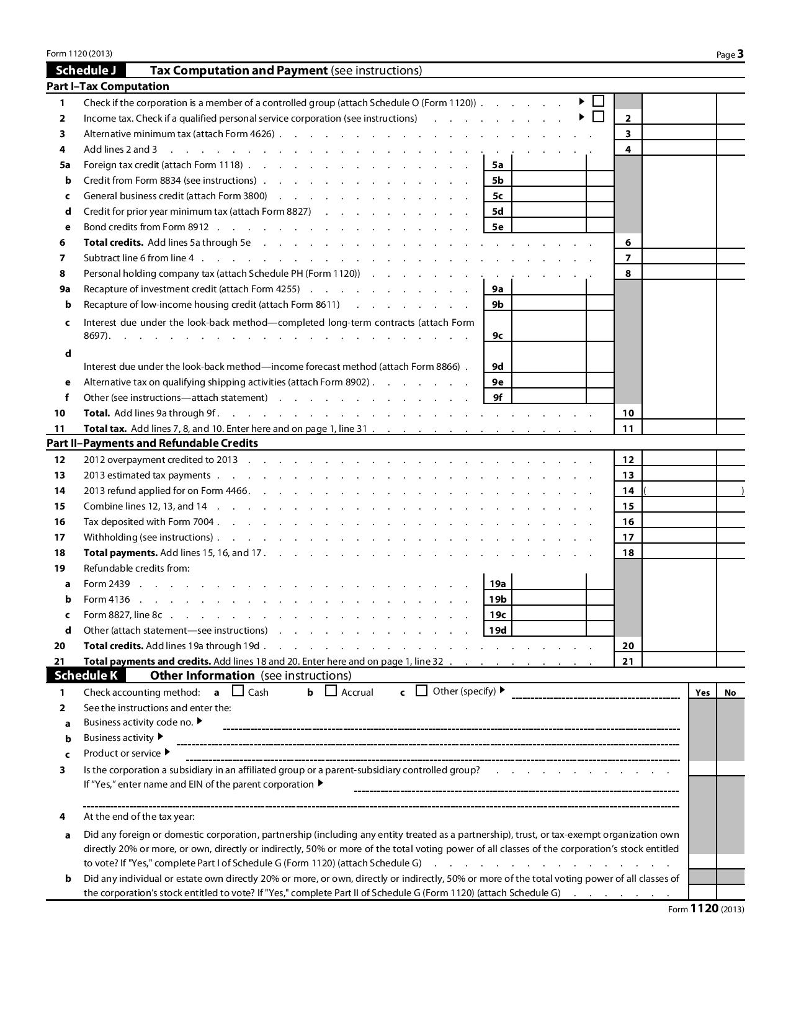

Complete the following template that has the respective tax forms and schedules required to complete the return. Complete all of the parts of your respective business tax return for which there is information.

In the space at the bottom of the template, show your income tax calculations and prepare a write-up on some questions contained within the tax return. Look at the information on Form 1120 Schedule K. With the exception of line 1, discuss the purpose of these questions. (You may select a sub-grouping of these questions to complete your milestone). What are some challenges (identify three to five), both anticipated and unexpected, when completing the corporate tax return? What solutions can you provide to those challenges?

Requirements:

Submit 1) your tax return template and 2) your write-up about the tax return questions to the drop box identified for that submission.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started