Question

Because of the availability of equipment and labor, Clear View has started making mass market picture frames at its Orlando, Florida plant with the excess

Because of the availability of equipment and labor, Clear View has started making mass market picture frames at its Orlando, Florida plant with the excess capacity. Clear View has determined that process costing would be most appropriate for this product. Management wants to know the differences between using the Weighted Average and FIFO methods

Every picture frame passes through two departments: the assembly department and the finishing department. This problem focuses on the assembly department. The process-costing system at Clear View has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added when the assembly department process is 10% complete. Conversion costs are added evenly during the assembly department's process.

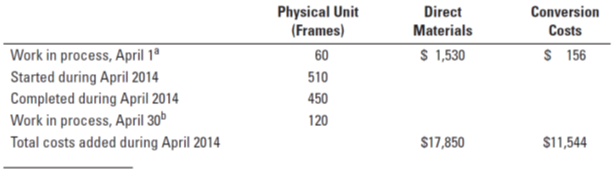

Consider the following data for the assembly department in April 2014:

Degree of completion: direct materials, 100%; conversion costs, 40%.

Degree of completion: direct materials, 100%; conversion costs, 15%.

Summarize the total assembly department costs for April 2014, and assign them to units completed (and transferred out) and to units in ending work in process using the weighted average method.

What issues should a manager focus on when reviewing the equivalent units calculation?

Summarize the total assembly department costs for April 2014, and assign them to units completed (and transferred out) and to units in ending work in process using the FIFO method.

Explain any difference between the cost of work completed and transferred out and the cost of ending work in process in the assembly department under the weighted-average method and the FIFO method. Should Clear View's managers choose the weighted-average method or the FIFO method? Explain briefly.

| Project Part II Section 2 | |||

| FIFO Method | |||

| Equivalent Units | |||

| Physical | Direct | Conversion | |

| Flow of Production | Units | Materials | Costs |

| Work in process, beginning | |||

| Started during current period | |||

| To account for | |||

| Completed and transferred out | |||

| Started and Completed | |||

| Work in process, ending | |||

| Accounted for | |||

| Equivalent units of work done to date | |||

| Total | |||

| Production | Direct | Conversion | |

| Costs | Materials | Costs | |

| Work in process, beginning | |||

| Costs added in current period | |||

| Total costs to account for | |||

| Costs added in current period | |||

| Equivalent Units from row 65 | |||

| Cost per Equivalent Unit | |||

| Assignment of costs: | |||

| Completed and transferred out : | |||

| WIP Beginning Inventory | |||

| Costs added to Beginning WIP | |||

| Total from Beginning Inventory | |||

| Started and Completed | |||

| Total WIP and Transferred Out | |||

| Work in process, ending | |||

| Total costs accounted for | |||

| The following table summarizes the costs assigned to units completed and those still in process under the weighted-average and FIFO process-costing methods | |||

| Weighted Average | FIFO | Difference | |

| Cost of units completed and transferred out | |||

| Work in process, ending | |||

| Total costs accounted for | |||

| Explain differences | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started