Question

Because of the large change in net income, XYZ Auditors benchmarked materiality on total assets instead of net income before taxes. XYZ Auditors have determined

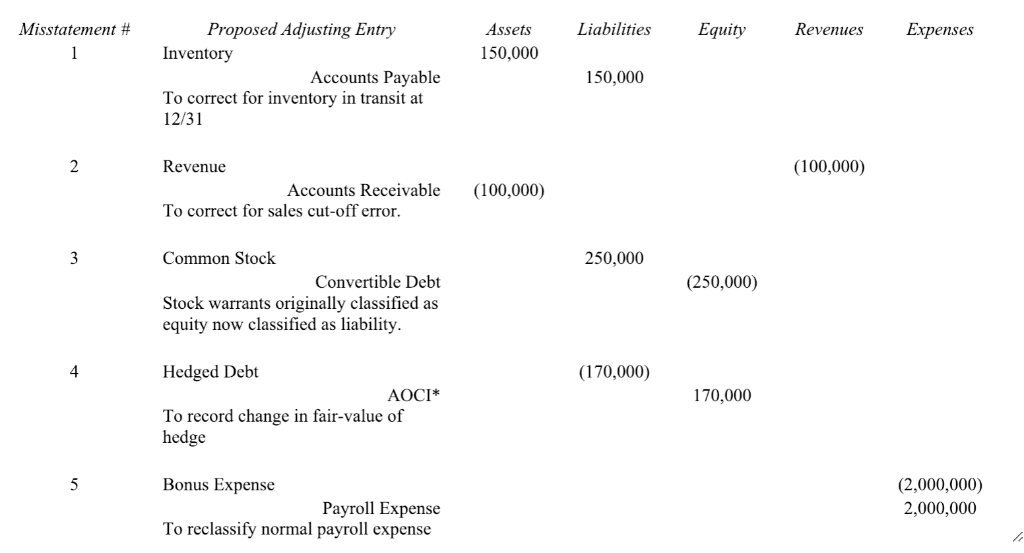

Because of the large change in net income, XYZ Auditors benchmarked materiality on total assets instead of net income before taxes. XYZ Auditors have determined that overall materiality is .5% of total assets. From their calculation, overall materiality is $1,666,667 and performance materiality is 60% of overall materiality, or $1,000,000. Note that amounts in parentheses on the table on the next page are reductions in the respective account while positive amounts are increases in the respective account. Based on the information given above and in the table on the next page, which misstatements, if any, are material? In one or two brief sentences, justify why the misstatements you select are material.

Because of the large change in net income, XYZ Auditors benchmarked materiality on total assets instead of net income before taxes. XYZ Auditors have determined that overall materiality is .5% of total assets. From their calculation, overall materiality is $1,666,667 and performance materiality is 60% of overall materiality, or $1,000,000. Note that amounts in parentheses on the table on the next page are reductions in the respective account while positive amounts are increases in the respective account. Based on the information given above and in the table on the next page, which misstatements, if any, are material? In one or two brief sentences, justify why the misstatements you select are material.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started